Back

Vijay Dutt

Be the best • 10m

Looking to explore Pre-IPO Equity, Private Equity, or Alternative Investment Strategies (AIS)? We're building a strong network of strategic investors, family offices, and HNIs who are keen on high-growth opportunities in the Pre-IPO and Private Equity space. If you're seeking: Access to exclusive Pre-IPO placements Curated Private Equity deals across emerging sectors Structured AIS opportunities tailored to your investment goals …let’s connect and collaborate. We are currently working on exciting, well-diligenced opportunities that align with long-term value creation. Whether you’re a seasoned investor or a family office looking to diversify—this is the right time to engage. Join us for curated investment access. Feel free to DM or connect directly. #PreIPO #PrivateEquity #AlternativeInvestments #HNIs #FamilyOffices #InvestmentOpportunities #CapitalMarkets #WealthCreation #PrivateMarkets

Replies (1)

More like this

Recommendations from Medial

Sanskar Choubey

Create. Convert. Sca... • 1y

What's this Pre-Ipo Buzz?🤔 The pre-IPO market includes companies whose shares aren’t yet listed on stock exchanges. These companies are often on the verge of significant growth or planning an IPO, offering investors a chance to get in early and pot

See MorePoosarla Sai Karthik

Tech guy with a busi... • 10m

It’s always not easy to mislead the public market compared to the private one, simply because public markets are more accessible and heavily scrutinized. Public companies have to follow strict reporting rules, making it harder to hide or manipulate i

See MoreAccount Deleted

Hey I am on Medial • 1y

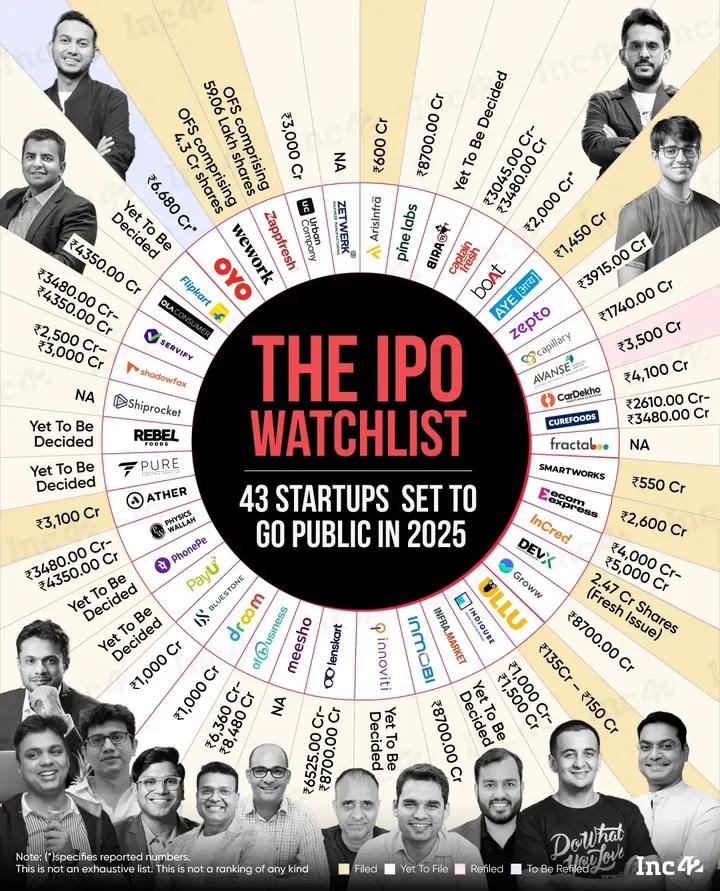

India's IPO Boom: 43 Startups Set to Go Public in 2025! Spanning sectors from fintech to e-commerce, these anticipated listings could reshape the stock market and unlock new investment opportunities. From Zepto to Boat, here’s a look at the most

See More

Vivek Joshi

Director & CEO @ Exc... • 4m

Invitation for Growth-Focused Ventures & SMEs | Excess Edge Experts Consulting Excess Edge Experts Consulting is actively seeking to partner with mid-market companies that have a clear IPO roadmap within the next 18–24 months. Through our Pre-IPO Cat

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)