Back

Account Deleted

Hey I am on Medial • 11m

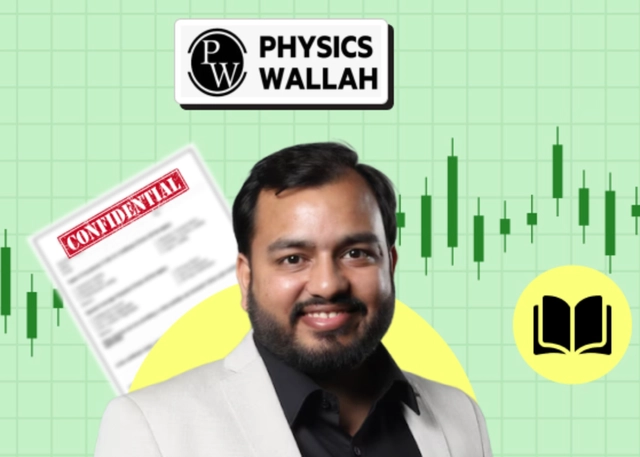

𝗣𝗵𝘆𝘀𝗶𝗰𝘀𝗪𝗮𝗹𝗹𝗮𝗵 𝗙𝗶𝗹𝗲𝘀 𝗳𝗼𝗿 𝗜𝗣𝗢 𝗖𝗼𝗻𝗳𝗶𝗱𝗲𝗻𝘁𝗶𝗮𝗹𝗹𝘆! • PW (PhysicsWallah) confidentially filed for an IPO with SEBI using the pre-filing route introduced by SEBI in 2021, which helps companies hide financial data and more from competitors. • PW is planning to raise $400-500 million at an approximate valuation of $5 billion, and recently they raised a pre-IPO round in February 2025 at $3.7 billion. • PW hired various investment banks like JPMorganChase , Goldman Sachs , and Axis Bank Capital to prepare and structure the IPO. • Though PW reported ₹2,015 crores with a loss of ₹1,131 crores in FY24.

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

PW India's Most Valuable Edtech Startup! • PW (PhysicsWallah) has raised a pre-IPO $25 million round led by existing investors like WestBridge Capital at a valuation of $3.7 billion. • In September 2024, PW raised a $210 million Series B round led

See More

Account Deleted

Hey I am on Medial • 5m

***13 companies that recently received SEBI approval for their IPOs, as reported across media outlets: 1) Urban Company 2) Imagine Marketing (parent of boAt) 3) Juniper Green Energy 4) Allchem Lifescience 5) Omnitech Engineering 6) KSH International

See More

Account Deleted

Hey I am on Medial • 1y

Lenskart IPO Also Coming Soon! • Lenskart.com is also planning an IPO to raise between $750 million to $1 billion, with a valuation of $7-8 billion. • In FY24, Lenskart generated ₹5,427 crores in revenue, a 23% increase from the last financial year

See More

Dr Sarun George Sunny

The Way I See It • 3m

SEBI’s New Rule: Mutual Funds Must Say Goodbye to Pre-IPO Deals The Securities and Exchange Board of India (SEBI) has recently stepped in to bring a meaningful change in the way mutual funds invest in the IPO space. From now on, mutual funds can no

See More

Vivek Joshi

Director & CEO @ Exc... • 4m

Invitation for Growth-Focused Ventures & SMEs | Excess Edge Experts Consulting Excess Edge Experts Consulting is actively seeking to partner with mid-market companies that have a clear IPO roadmap within the next 18–24 months. Through our Pre-IPO Cat

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)