Back

Kishan Kabra

Founder & CEO • 1y

What's the reason behind of OYO valuation crash? They were struggling to get approval from SEBI for IPO back in 2021, Finally got a approval but they withdrew their application and looking to raise from private investors at $2.3 Billion which was $9 Billion at the time of filling IPO. 75% decline in the valuation. FY23 losses- ₹1287 crore Debt - ₹1620 crore (approx)

Replies (17)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 1y

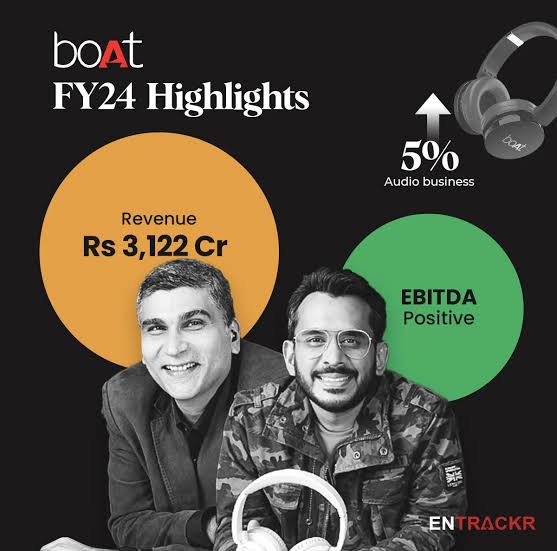

The Year of Indian Startups' IPOs Series : 1. Groww -> • Groww is planning an IPO to raise approximately ₹6,000 crore, aiming for a valuation between $6 billion and $8 billion. • In FY24, Groww reported ₹3,145 crore in revenue from operations, do

See More

Vikas Acharya

Building Reviv | Ent... • 10m

Meesho plans $1 billion IPO at $10 billion valuation Meta-backed e-commerce company Meesho is planning to list on stock exchanges around Diwali this year, aiming to raise around $1 billion in an initial public offering (IPO) at a valuation of $10 bi

See More

Account Deleted

Hey I am on Medial • 10m

Meesho Is Planning For $10 Billion IPO! • Meesho is planning to file its IPO papers in the second half of 2025, with a potential listing in 2026. • The company is planning to raise $1 billion at a $10 billion valuation and appointed Morgan Stanley,

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)