Back

vishakha Jangir

•

Set2Score • 8m

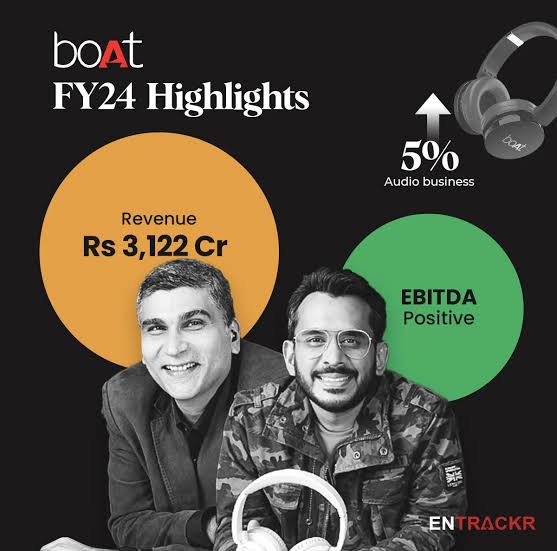

𝗕𝗼𝗮𝘁 𝗰𝗼𝗺𝗽𝗮𝗻𝘆 𝗳𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗮𝗻𝗮𝗹𝘆𝘀𝗶𝘀: 📍Financial Performance Overview. : Revenue: ₹3,122 crore in FY24, a 5% decline from ₹3,285 crore in FY23. Net Loss: Reduced by 47% to ₹53.5 crore in FY24 from ₹101 crore in FY23. EBITDA: Turned positive with ₹14 crore profit in FY24, compared to a ₹50 crore loss in FY23. Cash Flow: Operating cash flow improved to ₹3,999 million in FY24 from negative ₹76.82 million in FY23. 📍Revenue Breakdown by Segment (FY23) : Audio Products: 70% (₹2,350 crore) Wearables: 27% (₹902 crore) Others: 3% (₹109 crore) 📍Business Model & Strategy : Product Focus: Affordable, stylish audio and wearable devices targeting young consumers. Sales Channels: Primarily online via e-commerce platforms and boAt's website, supplemented by offline retail partnerships. Marketing: Leveraging influencer collaborations and social media to build brand appeal among millennials and Gen Z. 📍Strategic Outlook : Profitability: Positive EBITDA indicates improved operational efficiency. Market Position: Continues to lead in India's audio and wearable segments. Expansion Plans: Aiming for a valuation of over $1.5 billion in its upcoming IPO in FY25 Follow vishakha Jangir for more such insights.

More like this

Recommendations from Medial

Ashish Singh

Finding my self 😶�... • 1y

🤯Founders with Highest salary in India. --⭐Supam Maheshwari (FirstCry) received an annual salary of ₹103.8 crore in FY24. This marks a significant decrease from his ₹200.7 crore salary in FY23. --⭐Nithin Kamath (Zerodha) Co-founder of the broker

See More

Ashish Singh

Finding my self 😶�... • 1y

🫡This is business . Drishti IAS Institute achieved revenue of over ₹400 crore in FY24, with profits reaching ₹90 crore🤯. The company's revenue has grown significantly over the past four years: -- ₹40 crore in FY21, -- ₹119 crore in FY22, --

See More

Account Deleted

Hey I am on Medial • 1y

The Year of Indian Startups' IPOs Series : 1. Groww -> • Groww is planning an IPO to raise approximately ₹6,000 crore, aiming for a valuation between $6 billion and $8 billion. • In FY24, Groww reported ₹3,145 crore in revenue from operations, do

See More

Rohan Saha

Founder - Burn Inves... • 8m

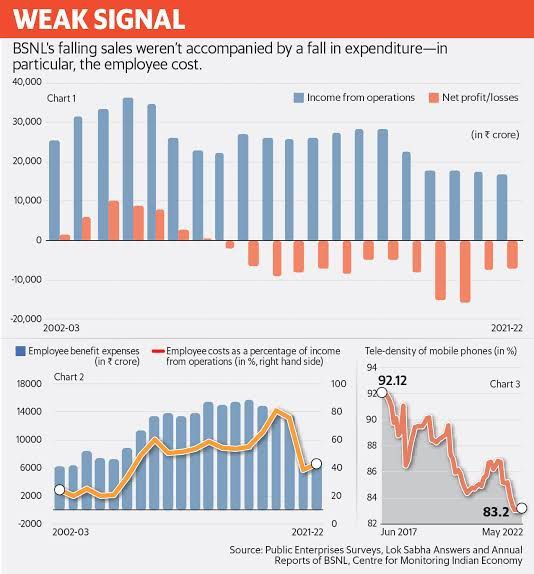

After years of financial strain, BSNL reported a net profit of ₹262 crore in Q3FY25 marking its first profitable quarter since 2007. This comes after a loss of ₹849 crore in Q4FY24. Despite this milestone, the company posted an overall loss of ₹2,24

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)