Back

Inactive

AprameyaAI • 1y

Ulala Olala! Ola Electric, India's leading electric two-wheeler maker, has SEBI's nod for a ₹5,500 crore ($660 million) IPO. Key details: - Fresh issue: ₹5,500 crore; OFS: 95.2 million shares. - Target valuation: $6 billion. - Funds for: capex, debt repayment, R&D, general purposes. - Prior funding: $1 billion, last valuation: $5.5 billion. - FY23 revenue: ₹2,630.93 crore, losses: ₹1,472 crore. - Book-runners: Kotak Mahindra, Citigroup, BofA, Goldman Sachs, Axis, ICICI, SBI, BOB. Jeb dhili karlo pyari 🧲♥️

More like this

Recommendations from Medial

Kishan Kabra

Founder & CEO • 1y

What's the reason behind of OYO valuation crash? They were struggling to get approval from SEBI for IPO back in 2021, Finally got a approval but they withdrew their application and looking to raise from private investors at $2.3 Billion which was $9

See MoreAccount Deleted

Hey I am on Medial • 1y

The Year of Indian Startups' IPOs Series : 1. Groww -> • Groww is planning an IPO to raise approximately ₹6,000 crore, aiming for a valuation between $6 billion and $8 billion. • In FY24, Groww reported ₹3,145 crore in revenue from operations, do

See More

Rohan Saha

Founder - Burn Inves... • 1y

Ola Electric investors, how are you all? As soon as the lock-in period ended, the company’s share price dropped. To justify a valuation of ₹39,000 crore, at least ₹3,000 crore in revenue and a profit of ₹50 crore or ₹100 crore will be needed. Then, m

See More

Account Deleted

Hey I am on Medial • 10m

Meesho Is Planning For $10 Billion IPO! • Meesho is planning to file its IPO papers in the second half of 2025, with a potential listing in 2026. • The company is planning to raise $1 billion at a $10 billion valuation and appointed Morgan Stanley,

See More

SamCtrlPlusAltMan

•

OpenAI • 1y

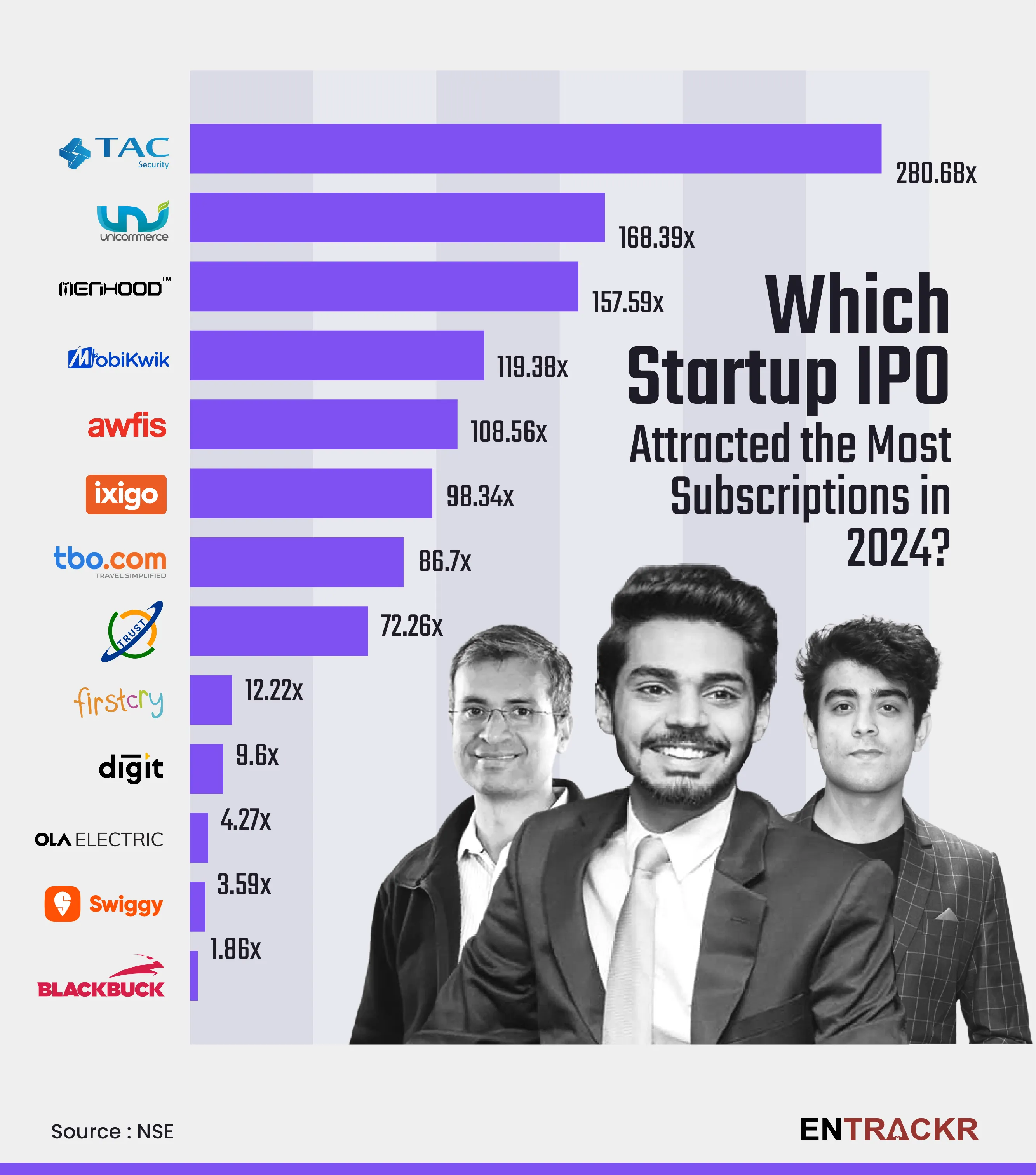

2024 IPO Highlights! 🚀 This year has seen 13 IPOs across a variety of sectors, including fintech, SaaS, logistics, proptech, electric vehicles, e-commerce, foodtech, and traveltech. In total, these companies successfully raised an impressive ₹29,24

See More

Account Deleted

Hey I am on Medial • 1y

Pine Labs is all time high 📈 • Baron Funds increased its valuation of Pine Labs to $5.8 billion, while Invesco marked the firm's value up to $4.8 billion as of December 2023. • Previously, Baron Funds had valued Pine Labs at $5.3 billion in Septem

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)