Back

Anonymous for now

Curious drives, pass... • 1y

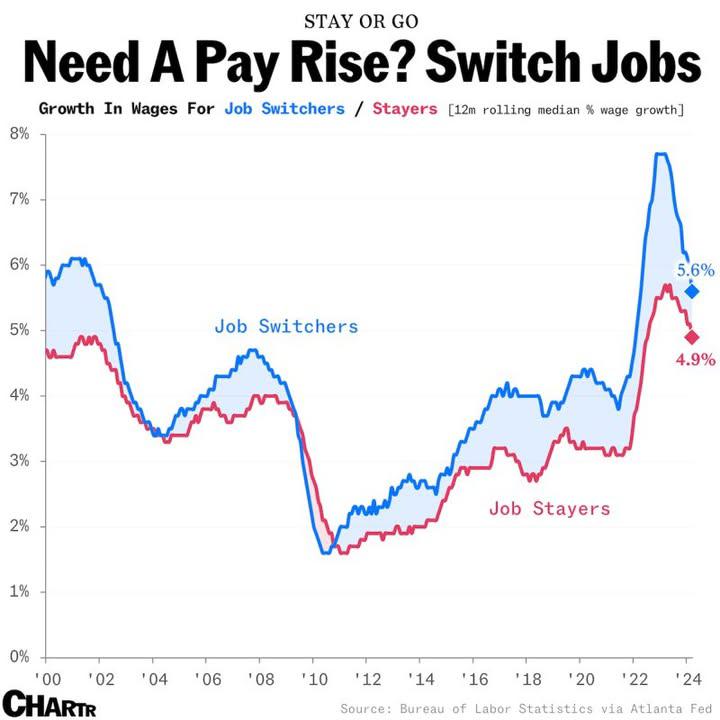

Hey, I am a CA inter aspirant working at a NBFC for a year now. My question is should I continue in the NBFC as an accounting who's trying to raise private equity or switch and try to get into investment banking.

1 Reply

2

Replies (1)

More like this

Recommendations from Medial

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)