Back

Anonymous

Hey I am on Medial • 1y

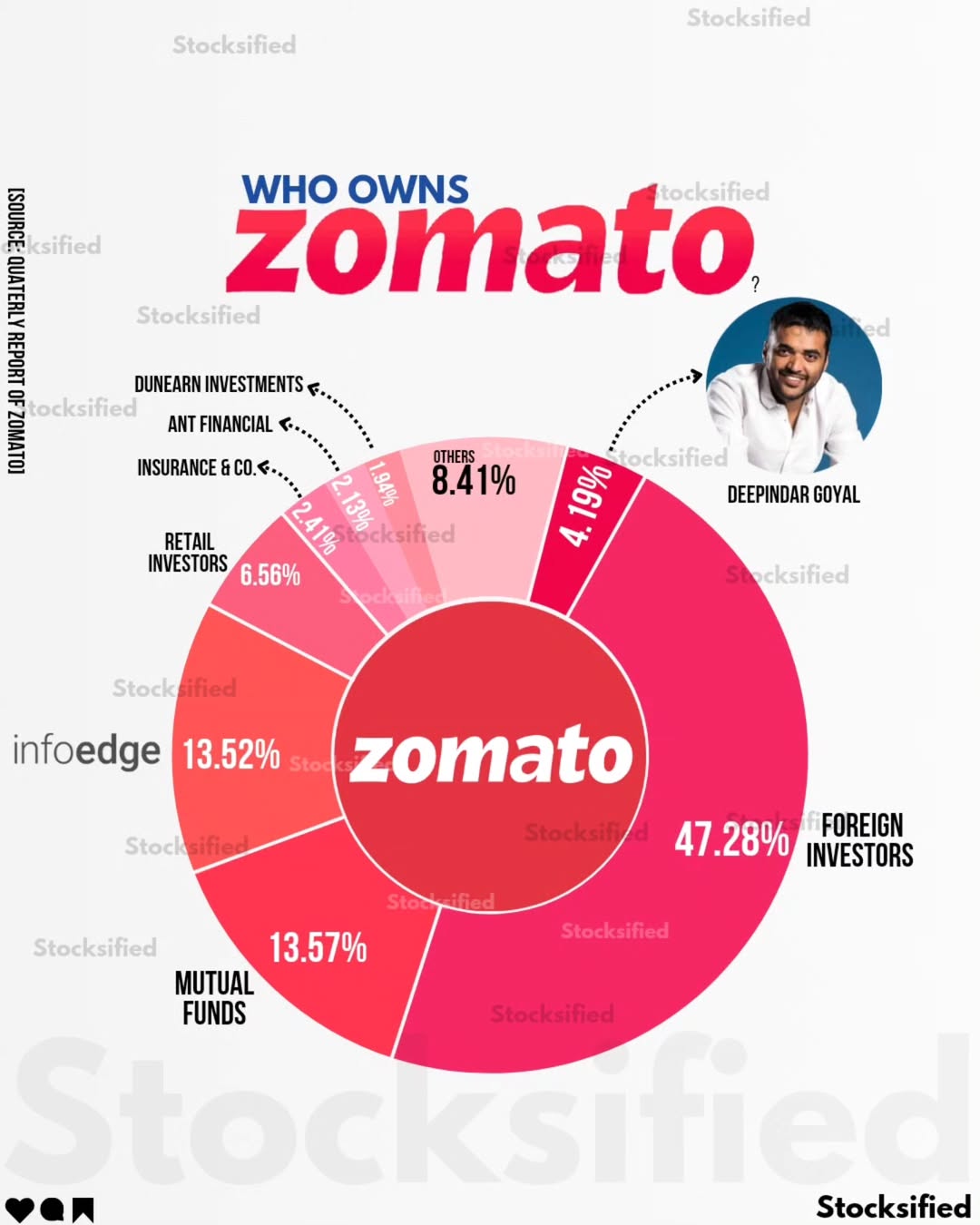

Deepinder Goyal-led food delivery giant Zomato has abandoned plans to enter the non-banking financial company (NBFC) sector. The company's subsidiary, Zomato Financial Services Limited (ZFSL), has decided to voluntarily withdraw its application to operate as a non-banking financial company (NBFC). "We do not wish to pursue the lending/credit business anymore," Zomato said.

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

Aye Finance Secures INR 110 Cr in Debt Ahead of IPO Delhi, India- IPO-bound lending tech startup Aye Finance has successfully secured INR 110 Cr (approximately $12.8 Mn) in debt from a group of investors, including Northern Arc, ASK Financial Holdin

See More

Account Deleted

Hey I am on Medial • 2y

Do you think that Zomato Will Become $100 Billion Company By 2030 As Deepinder Goyal Said that?! Their full focus on Blinkit and Hyperpure Business? According to me , Zomato Will become $100 Billion Dollars Company by because Mostly people buy onli

See More

Finonoma

Markets, Startups & ... • 9m

📈 Zerodha Capital Achieves ₹12.5 Cr Profit in FY25 Zerodha Capital, the non-banking financial company (NBFC) subsidiary of leading stockbroker Zerodha, has reported a net profit of ₹12.5 crore for the fiscal year ending March 2025. This represents

See More

vijay gondliya

Hey I am on Medial • 1y

we have diamond and jewelry business we see with time gold loan and banking system is good to make money we want to start nidhi company for gold loan or nbfc for business expansion anybody come and investment with us 100 % profitable business patel

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)