Back

Vipul Bansal

Parter@Finshark Advi... • 1y

Simplifying Taxes on Stock Trading: FY 2024-25 🧾📊 Taxes on stock trading can feel daunting, but a clear understanding helps you keep more of your gains! Here's an easy-to-follow guide: 📈 Long-Term Trading - ⏳ Holding Period: Over 12 months - 💰 Tax Rate: 12.5% (after ₹1.25 lakh exemption) - 🔄 Capital Loss: Offset against long-term gains, carry forward up to 8 years 📉 Short-Term Trading - ⏳ Holding Period: Less than 12 months (more than a day) - 💰 Tax Rate: Flat 20% (irrespective of your slab) - 🔄 Capital Loss: Offset against short/long-term gains, carry forward up to 8 years 💹 Intraday Trading - ⏳ Holding Period: Same-day buy & sell - 📜 Treatment: Speculative business income - 💰 Tax Rate: As per your applicable slab - 🔄 Speculative Loss: Offset only against speculative income, carry forward up to 4 years 🏦 Dividends & Derivatives - 💰 Taxed: At your applicable slab rate CA Vipul Bansal 7017759459 #TaxPlanning #SmartInvesting

Replies (2)

More like this

Recommendations from Medial

Suman solopreneur

Exploring peace of m... • 1y

naval ravikant Hard Work > Judgement: The most money is produced by wise decisions. Leverage Multiplies: Even minor skill gaps can result in significant gains. Reputation Gains: Credibility and trust draw in opportunities. Think Long-Term:

See More

Thakur Ambuj Singh

Entrepreneur & Creat... • 11m

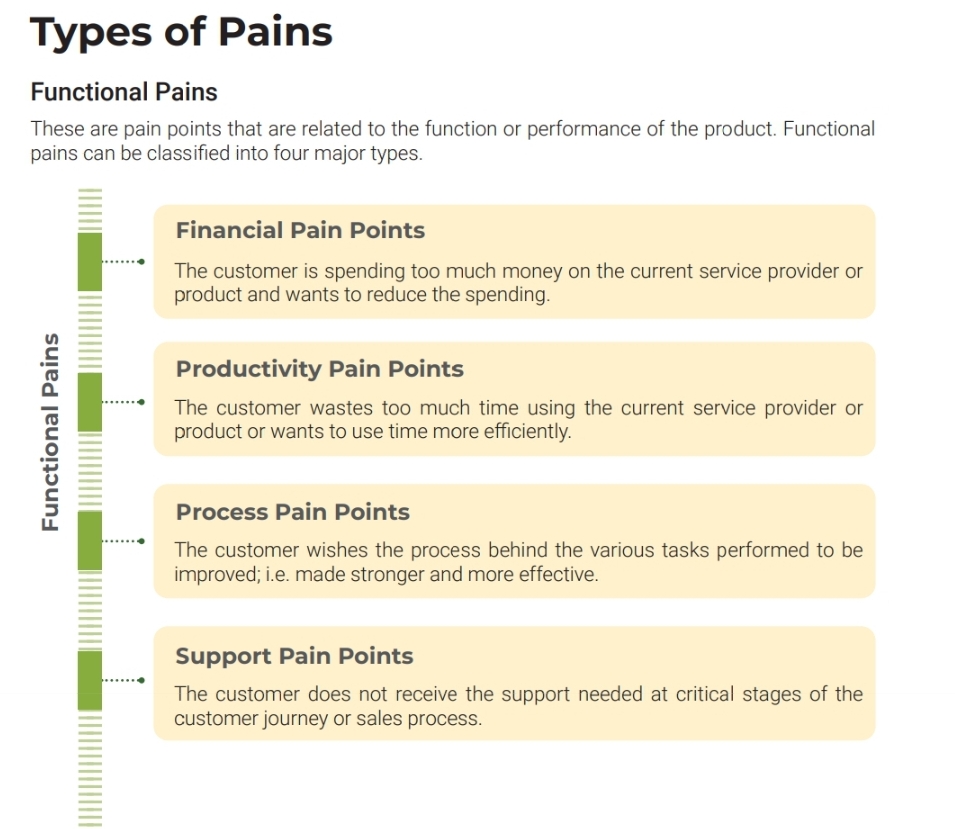

⚠️ Types of Functional Pains in Customer Experience Customers face different challenges when using a product or service: 💰 Financial Pain – Too expensive, seeking cost reduction. ⏳ Productivity Pain – Wasting too much time, needing efficiency. 🔄

See More

VIJAY PANJWANI

Learning is a key to... • 19d

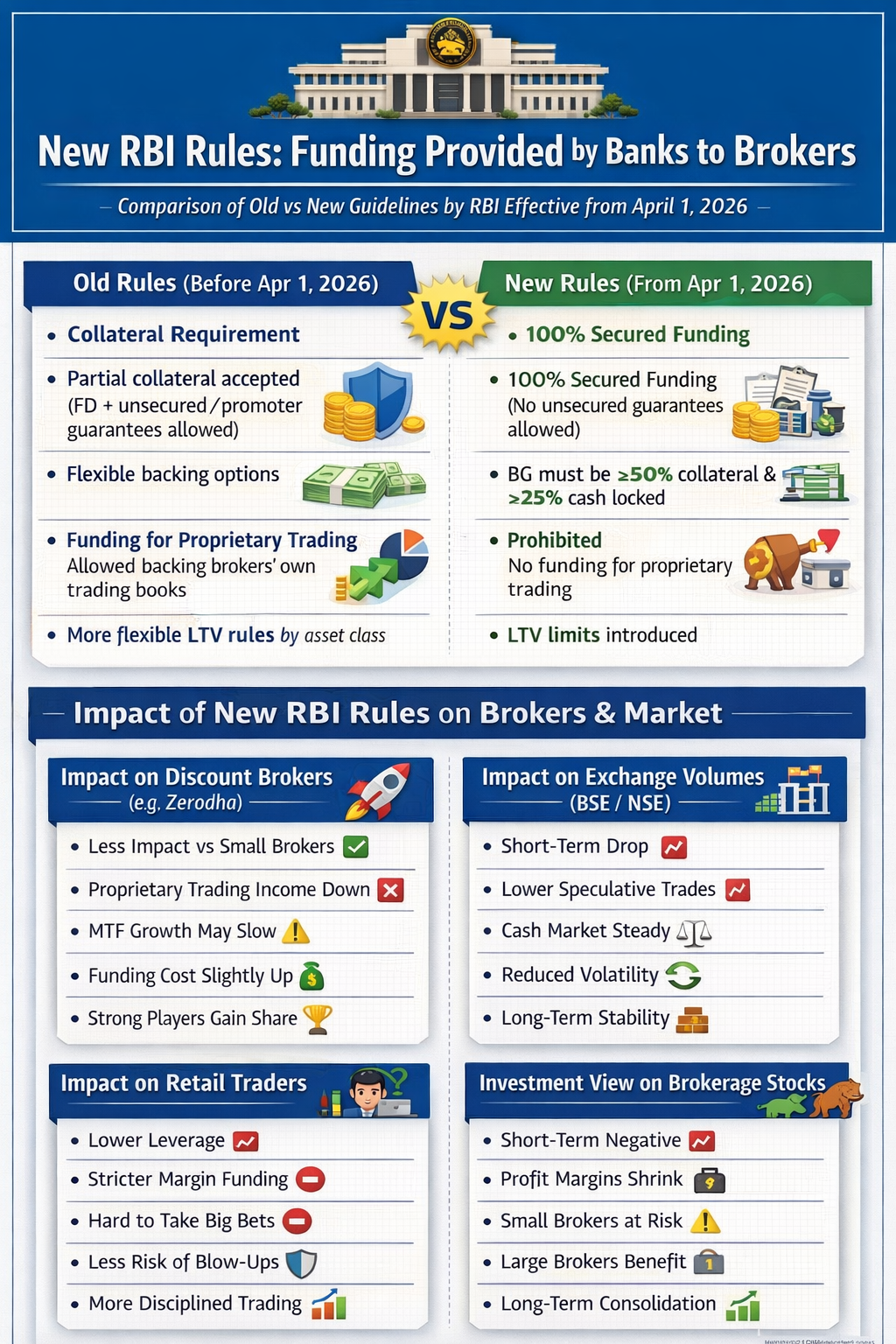

New RBI Rules for Brokers – Big Change for Markets! The Reserve Bank of India (RBI) has tightened rules on bank funding to brokers (effective April 1, 2026). 🔹 Old Rules: • Partial collateral allowed (FD + promoter guarantee) • Proprietary trading

See More

VIJAY PANJWANI

Learning is a key to... • 3m

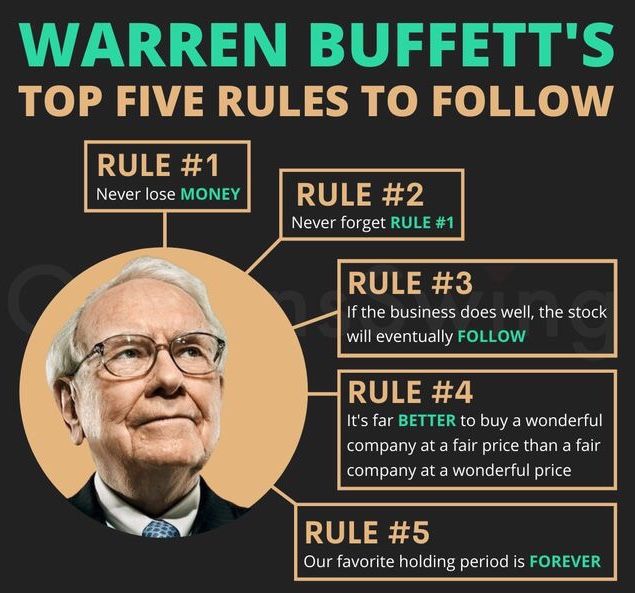

💼 WARREN BUFFETT’S GOLDEN RULES OF INVESTING 💰 If you truly want to build long-term wealth, learn from the world’s greatest investor himself 👇 📌 Rule #1: Never lose money 📌 Rule #2: Never forget Rule #1 📌 Rule #3: If the business grows, the s

See More

Ashutosh Upadhyay

Never played e5 agai... • 1y

Hello traders/investors, I invested in Wipro at a mean price of 550 and currently the stock is trading somewhere around 450.At that point of time I had no idea about stop losses and it was considered to be a good share for a long term but since then

See MoreVIJAY PANJWANI

Learning is a key to... • 2m

POWER OF BONUS SHARES 🔥 Imagine investing just ₹1,900 in 1993… and letting time + patience + bonus shares do the magic 💥 📈 INFOSYS IPO (1993): ₹95/share ➡️ 20 Shares ➡️ Multiple bonus issues ➡️ Today: 10,240 Shares ➡️ Value: ₹2+ CRORE 🤯 💡 Thi

See More

Rohan Saha

Founder - Burn Inves... • 1y

UBS has advised shorting the Indian rupee for now, which means FIIs may remain outside the Indian market for some time. Indian GDP growth is not looking impressive; at one point, China achieved over 10% GDP growth, while we have only managed to reach

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)