Back

Inactive

AprameyaAI • 1y

Direct Investment from Foreign Vs Portfolio Investment ➩ FDI: Long-term growth through infrastructure and jobs. ➩ FPI: Quick capital inflows but volatile. ➩ FDI: Strengthens economic foundations. ➩ FPI: Boosts market liquidity but can be fickle. ➩ FDI: Promotes technological advancement and skill development. ➩ FPI: Enhances stock market performance temporarily. ➩ FDI: Encourages sustainable industry growth. ➩ FPI: Can lead to short-term gains but lacks stability. ➩ FDI: Attracts stable, committed investors. ➩ FPI: Appeals to speculative capital; less reliable. You on FDI or FPI Side ? ~ Follow for more

Replies (1)

More like this

Recommendations from Medial

Rajesh Shukla

Hey I am on Medial • 4m

Designed to uplift sugarcane farmers and millers, Sugar Funding offers easy access to loans, subsidies, and growth capital. By supporting modernization, energy diversification, and financial stability, it drives sustainable growth, rural prosperity,

See MoreVamshi Yadav

•

SucSEED Ventures • 10m

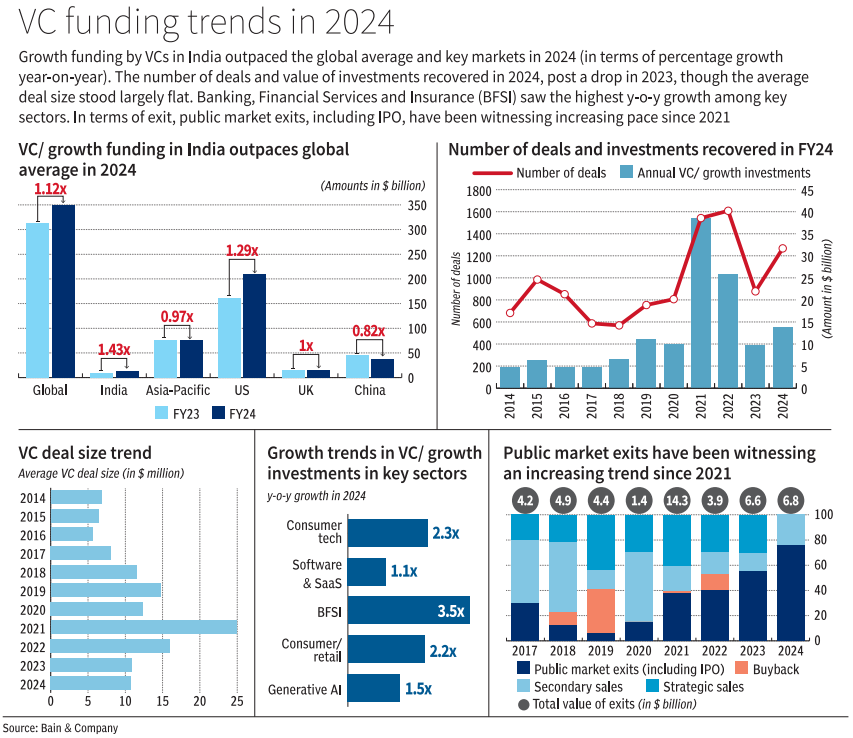

India led global VC growth in 2024, outpacing major markets with 1.43x growth. Investments gained momentum with BFSI (3.5x growth), Consumer Tech (2.3x), and Generative AI (1.5x) attracting the most capital. Public market exits have been rising since

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)