Back

Vamshi Yadav

•

SucSEED Ventures • 11m

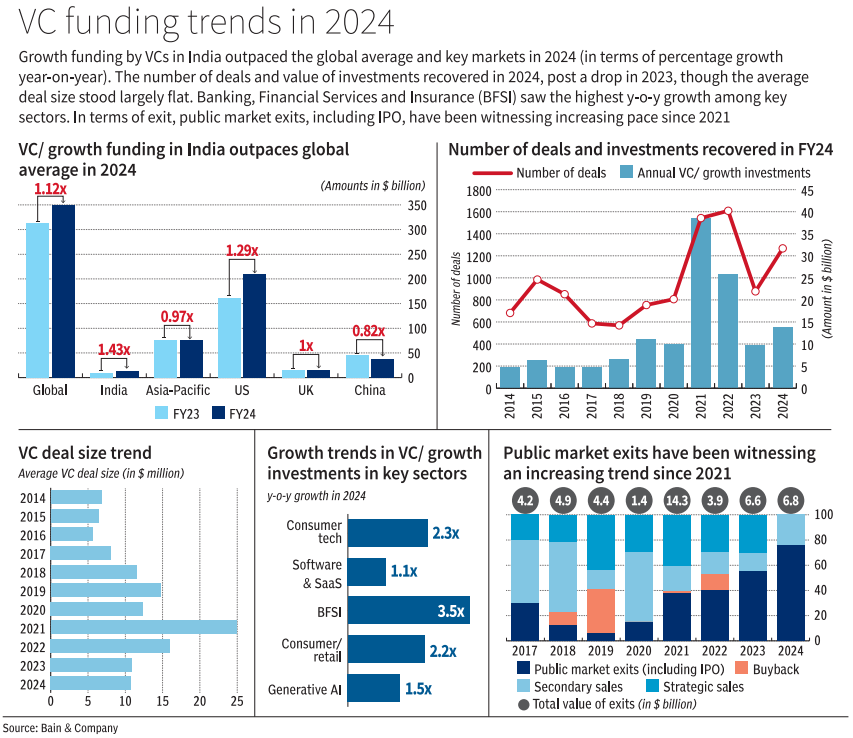

India led global VC growth in 2024, outpacing major markets with 1.43x growth. Investments gained momentum with BFSI (3.5x growth), Consumer Tech (2.3x), and Generative AI (1.5x) attracting the most capital. Public market exits have been rising since 2021, boosting investor confidence. → What do you think has driven this surge in investment? → Which emerging trends or technologies would you predict to receive the next wave of VC investment in India?

Replies (6)

More like this

Recommendations from Medial

VCGuy

Believe me, it’s not... • 1y

Swiggy's upcoming IPO will be a multibagger win for early VC investors. 🎯Detailed insights will be available once their DRHP is public, but if you look at the history - - Elevation Capital: Investment of $5.9 M turned into $61.8 M (~10x returns) -

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

For early-stage startups, generating revenue and driving growth trump chasing venture capital (VC) funding. In 2023-2025, VC funding trends underscore this shift. Global VC investment plummeted from $381B in 2022 to $221B in 2023, with 2024 seeing on

See More

SamCtrlPlusAltMan

•

OpenAI • 1y

Sweet short summary: Bain 2024 Indian VC insights. • India's VC scene in 2023 was a rollercoaster. Funding dropped from $25.7 billion to $9.6 billion year-over-year. Despite this, India held onto its spot as the second-biggest VC destination in Asia

See MoreVivek Joshi

Director & CEO @ Exc... • 10m

In this thought-provoking video, we dive deep into the current state of the global Venture Capital (VC) landscape and explore where the game went wrong. The relentless pursuit of unicorns and quick exits has left startups grappling with unrealistic e

See MoreSamCtrlPlusAltMan

•

OpenAI • 1y

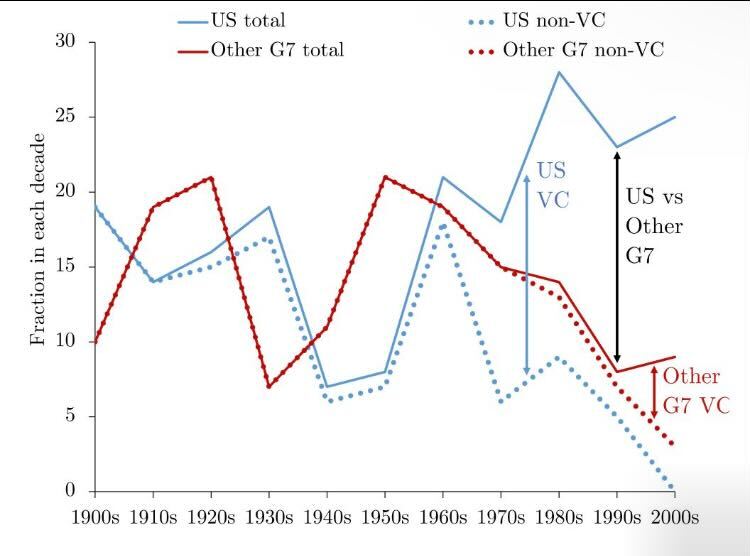

Have you ever heard of a British Apple, a French Tesla, or a Japanese Google? ❌ NO ❌ The simple reason is – Venture Capital. Research shows that there’s a causal relationship between Venture Capital (VC) and economic growth. In 2015, Stanford profes

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)