Back

Rohan Saha

Founder - Burn Inves... • 12m

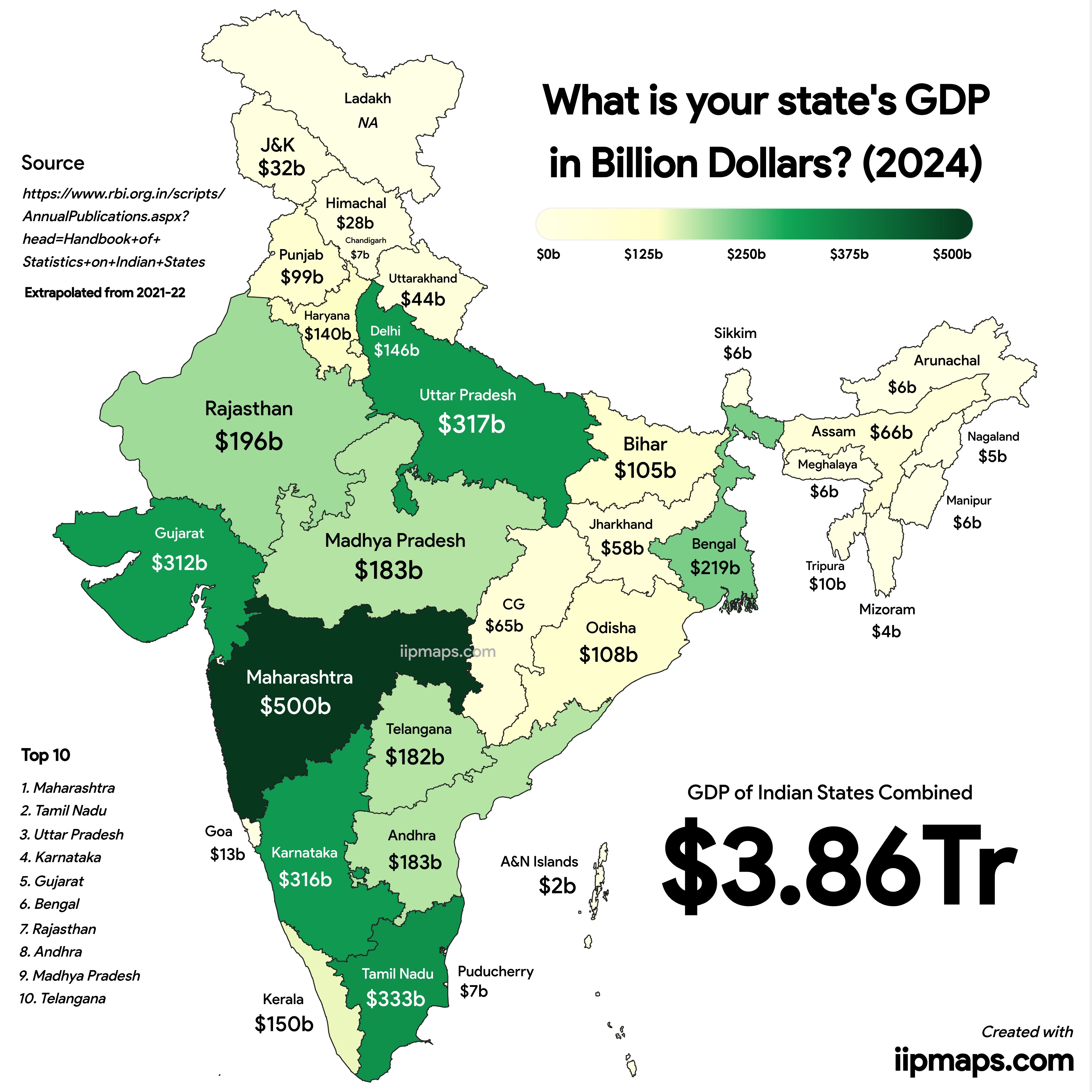

UBS has advised shorting the Indian rupee for now, which means FIIs may remain outside the Indian market for some time. Indian GDP growth is not looking impressive; at one point, China achieved over 10% GDP growth, while we have only managed to reach a maximum of 9.7%. Furthermore, the upcoming budget is a significant concern with only 10 trading sessions left before it is announced. If LTCG (Long Term Capital Gains) and STGC (Short Term Capital Gains) taxes are increased, the Indian market might fall further. At that time, valuations won't matter; post-tax profit will be crucial. The hope is for some tax deductions, not the opposite. Currently, the Indian economy is entirely dependent on the Finance Minister.

Replies (3)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 10m

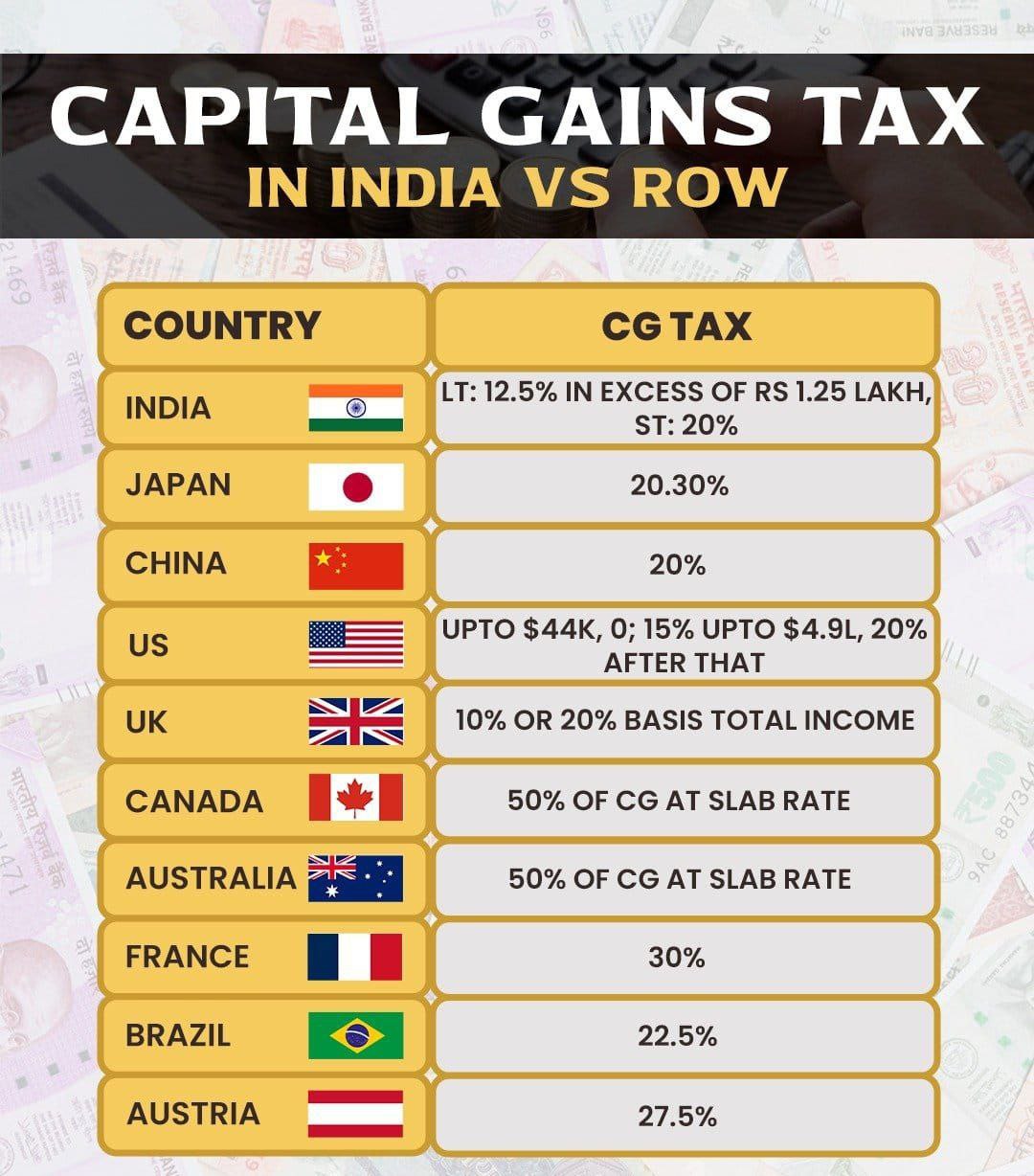

When comparing capital gains tax across different countries, India's main competitors are China and Brazil. Interestingly, both China and Brazil impose higher capital gains taxes than India. However, it's important to note that India also levies a Se

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 11m

You still have to pay taxes if your income is below 12Lakhs.💀 Let’s talk about a crucial detail in the recent Indian Union Budget that many people are overlooking. If you’re already aware, great! But if not, this is essential to know—otherwise, you

See More

CA Kakul Gupta

Chartered Accountant... • 9m

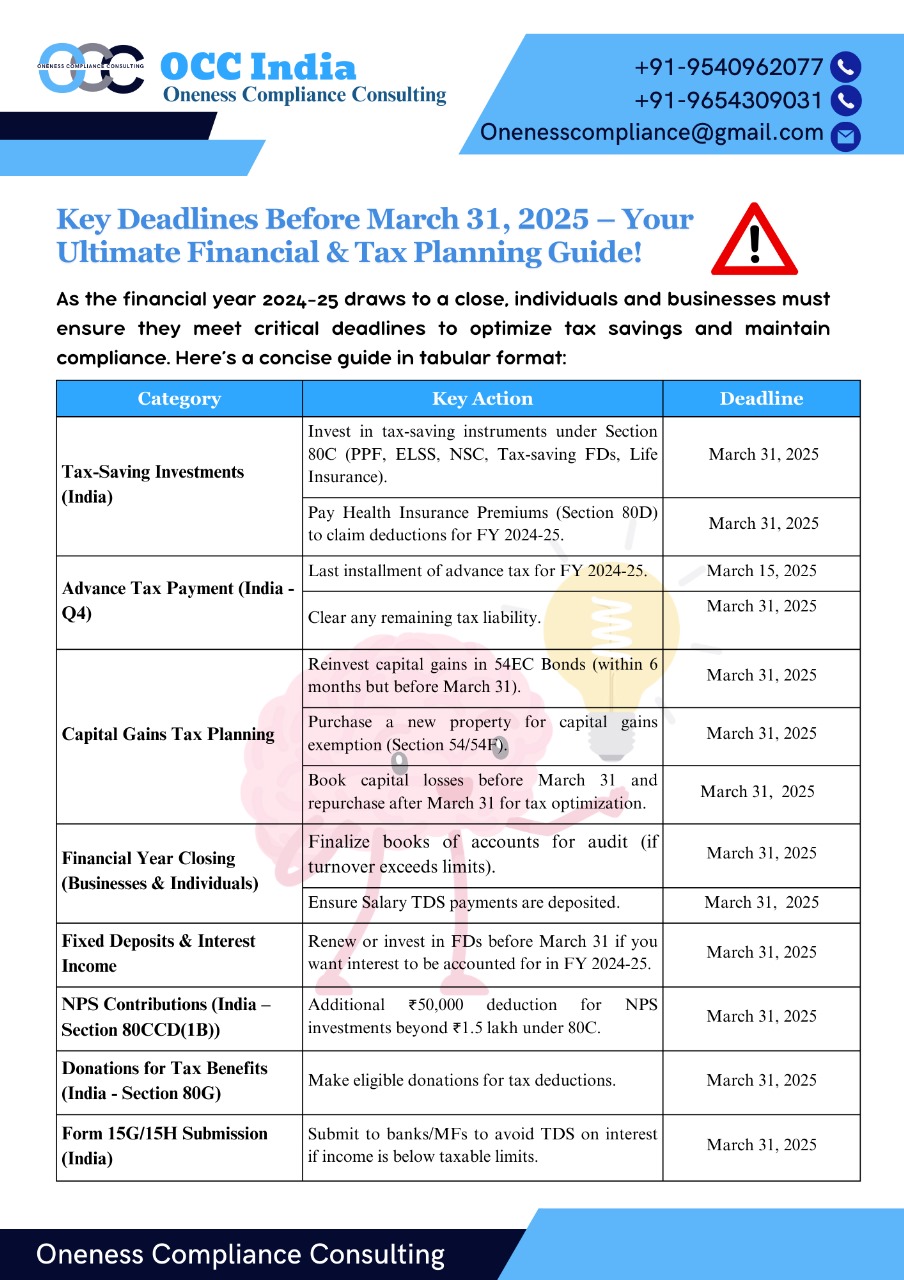

Summary of action points Before March 31, 2025 ✔ Review tax-saving investments. ✔ Pay pending taxes/advance tax. ✔ Submit investment proofs to employer (if salaried). ✔ Plan capital gains/losses for tax efficiency. ✔ Update financial records for the

See More

Download the medial app to read full posts, comements and news.