Back

Anirudh Gupta

CA Aspirant|Content ... • 10m

🤯Understanding Capital Gains – Don’t Miss This! Let’s take an example: Mr. A owns a building along with a large piece of land. He enters into a Joint Development Agreement (JDA) with a builder. 😄What is a Joint Development Agreement (JDA)? In a JDA, the landowner gives land to a builder without transferring ownership. The builder takes care of construction, legal approvals, marketing, and selling the flats. In return, the landowner gets a share of the flats or money from the sales. This benefits both parties – the landowner doesn’t spend on construction, and the builder doesn’t spend on buying land. Now, back to Mr. A’s case Mr. A demolished the building and then transferred the land to the builder. The builder developed the property and gave Mr. A his share of flats as per the agreement. Sale consideration: ₹5 crore Cost of acquisition (COA): ₹2 crore Capital gains: ₹3 crore Mr. A purchased a new house for ₹1.3 crore, thinking he could claim an exemption under Section 54. However, he cannot. Why? Understanding Section 54 and Section 54F Section 54 (For Residential Property Sellers) You can claim capital gains exemption if: ✅ The sold asset is a residential house (long-term asset). ✅ You buy another residential house in India within 1 year before or 2 years after selling the old house. (Or construct within 3 years). ✅ If capital gains exceed ₹2 crore, you can claim the exemption for only one residential house. 📍Quantum of exemption: If cost of acquisition>Long term capital gains,then entire long term capital gains is exempt. If cost of acquisition < Long term capital gains, to the extent of cost of acquisition is exempt. Section 54F (For Land or Other Assets) You can claim capital gains exemption if: ✅ The sold asset is anything other than a residential house (e.g., land). ✅ You buy one residential house in India within 1 year before or 2 years after selling the asset. (Or construct within 3 years). ✅ You should not own more than one residential house on the date of transfer. 📍Quantum of exemption If cost of new residential house ≥ Net sale consideration of original asset, entire capital gains is exempt. If cost of new residential house < Net sale consideration of original asset, only proportionate capital gains is exempt i.e. LTCG× (Amount invested in new house/ Net sale consideration) 😭Where Mr. A Went Wrong? By demolishing the building before transferring, Mr. A only transferred land therefore section 54 F is attracted which gives only proportionate exemption based on how much he invested in the new house. If Mr. A had not demolished the building and transferred it as a residential property, he could have claimed full exemption under Section 54! For more interesting posts follow Anirudh Gupta

Replies (4)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 11m

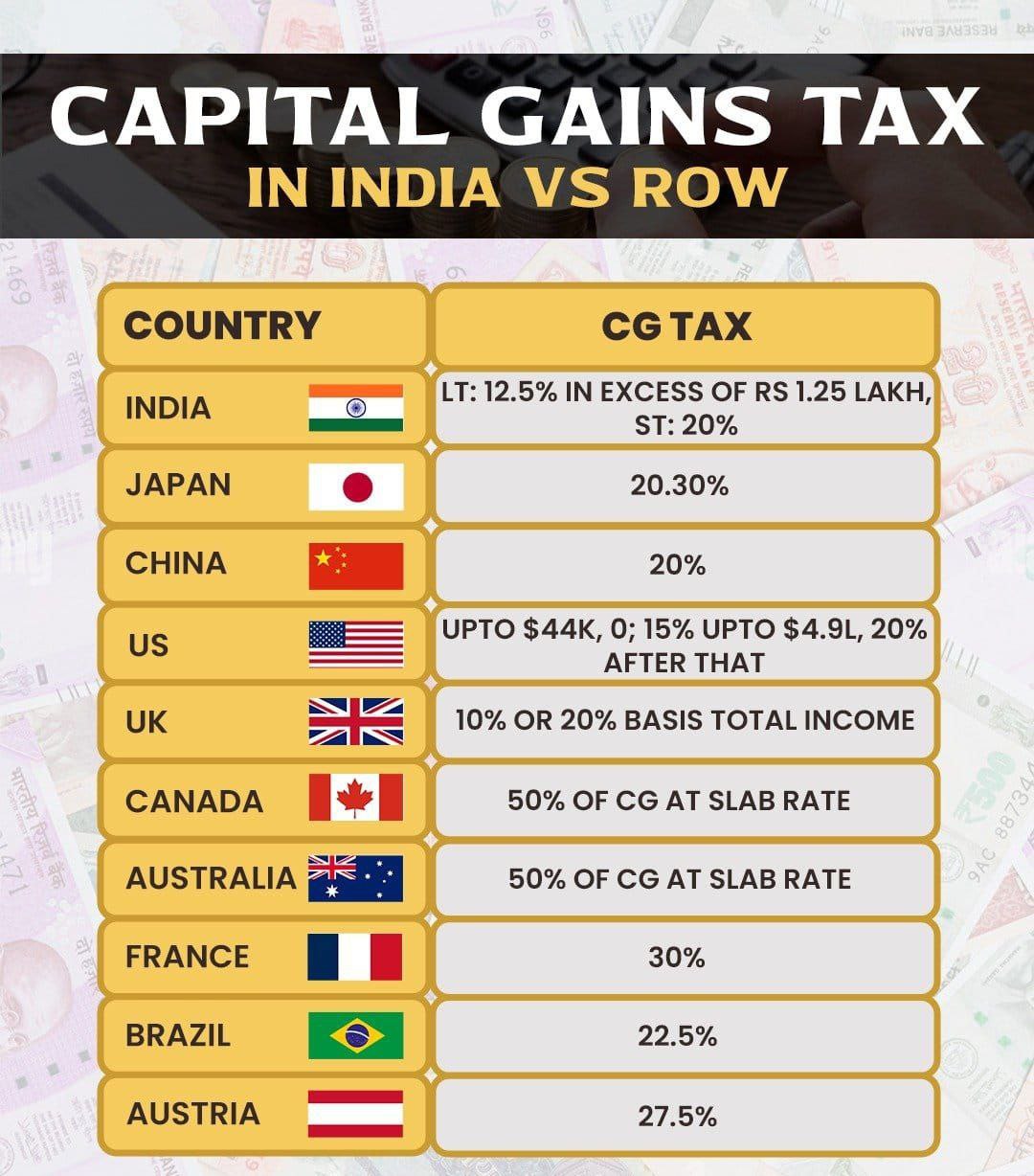

When comparing capital gains tax across different countries, India's main competitors are China and Brazil. Interestingly, both China and Brazil impose higher capital gains taxes than India. However, it's important to note that India also levies a Se

See More

Gireendra

The world runs on hu... • 1y

Name :- second space Problem :- people need to build their own house in cities like bangalore but they can't find the land, if they find the land cost is huge and etc... Sol...:- our team talks to already existing house owners to build another

See MoreAbdulla Raza

Electrician contract... • 1y

Here are some property dealer business ideas you can consider: 1. Real Estate Brokerage Act as an intermediary between buyers and sellers, earning commissions on successful deals. You can specialize in: Residential properties (flats, villas, plots

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)