Back

Chaman Kanth

Mechanical Engineer • 1y

Reply

3

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 11m

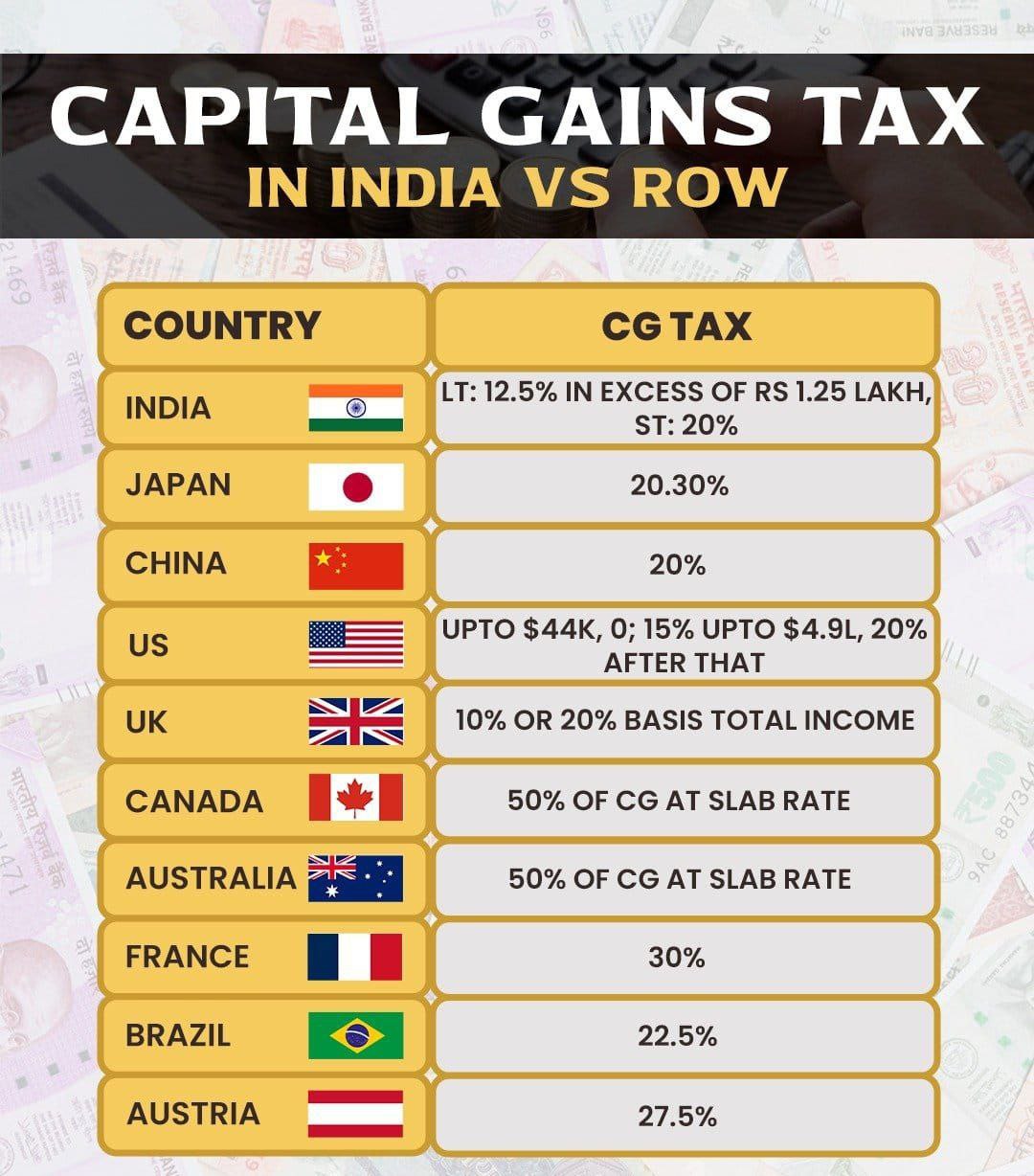

When comparing capital gains tax across different countries, India's main competitors are China and Brazil. Interestingly, both China and Brazil impose higher capital gains taxes than India. However, it's important to note that India also levies a Se

See More

1 Reply

4

15

CA Kakul Gupta

Chartered Accountant... • 11m

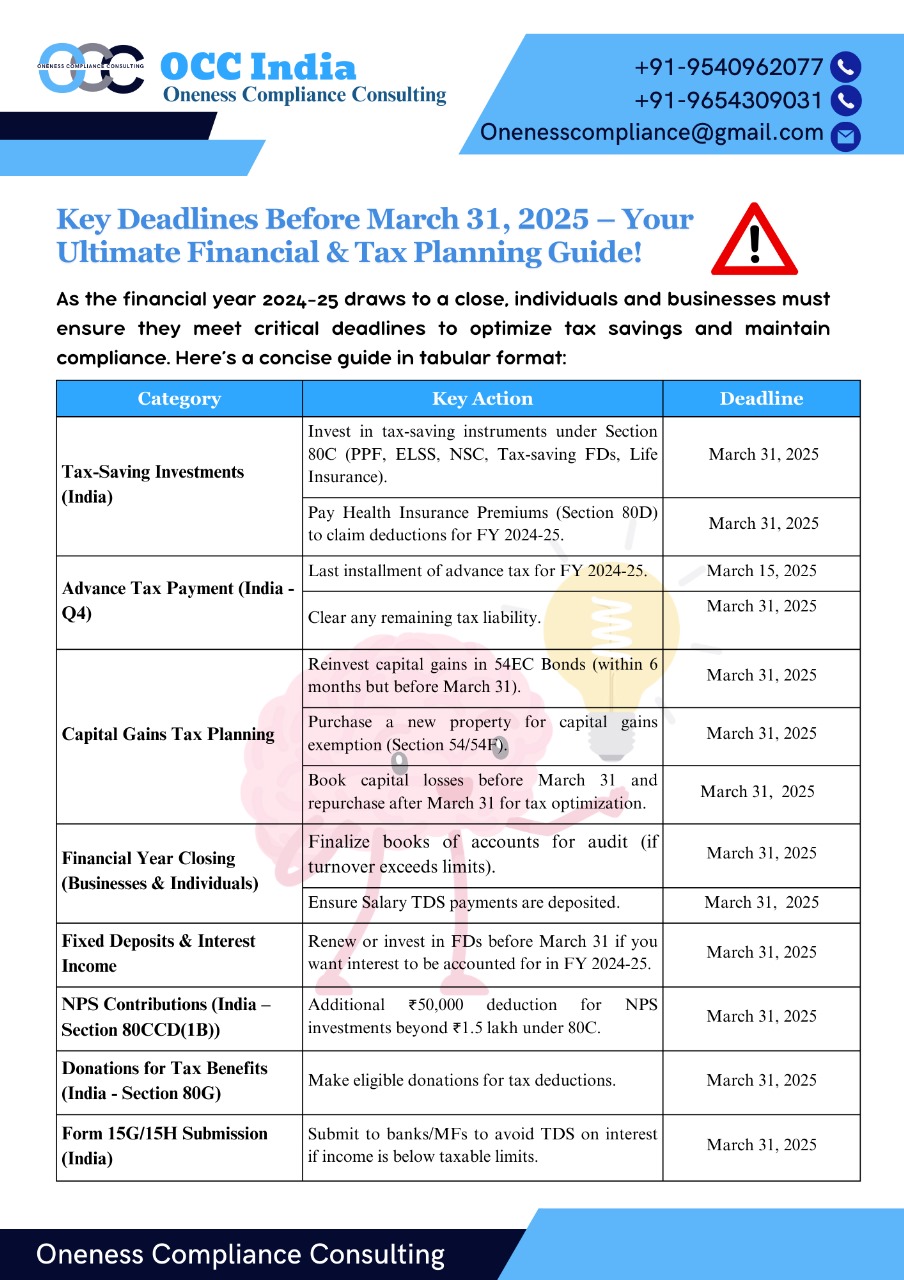

Summary of action points Before March 31, 2025 ✔ Review tax-saving investments. ✔ Pay pending taxes/advance tax. ✔ Submit investment proofs to employer (if salaried). ✔ Plan capital gains/losses for tax efficiency. ✔ Update financial records for the

See More

1 Reply

2

12

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)