Back

More like this

Recommendations from Medial

Neelakanth Chavan

Analytics and Data s... • 1y

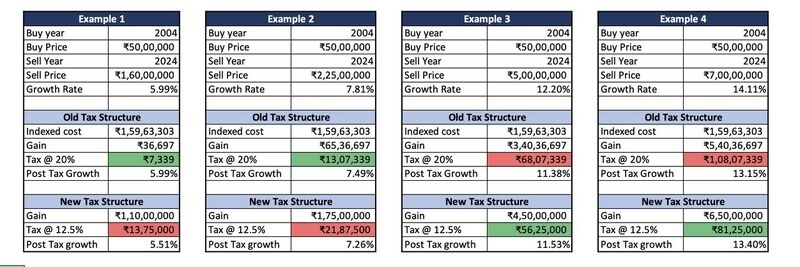

What are the taxation rules in india on investments in stocks. As per my knowledge, gains on stocks more than 1 lakh are taxed at 10% for long term gains(>1year) & 15% for short term gains(<1year). How can someone escape from this. One method that

See MoreAccount Deleted

Hey I am on Medial • 10m

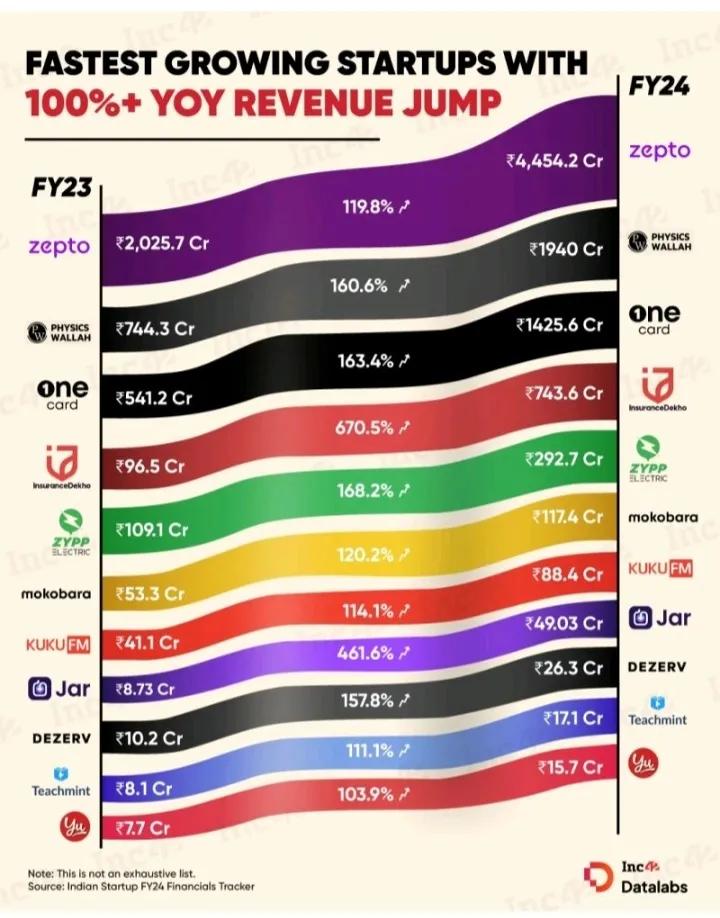

Did you know ❓️❓️ In FY'24, more than two dozen startups with revenues of over Rs 500 Cr posted improved financial performance . Startups like Purplle, Porter, Lenskart and PhonePe achieved growth and better margins while others focused on reducing

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

You still have to pay taxes if your income is below 12Lakhs.💀 Let’s talk about a crucial detail in the recent Indian Union Budget that many people are overlooking. If you’re already aware, great! But if not, this is essential to know—otherwise, you

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)