Back

Aditya Arora

•

Faad Network • 5m

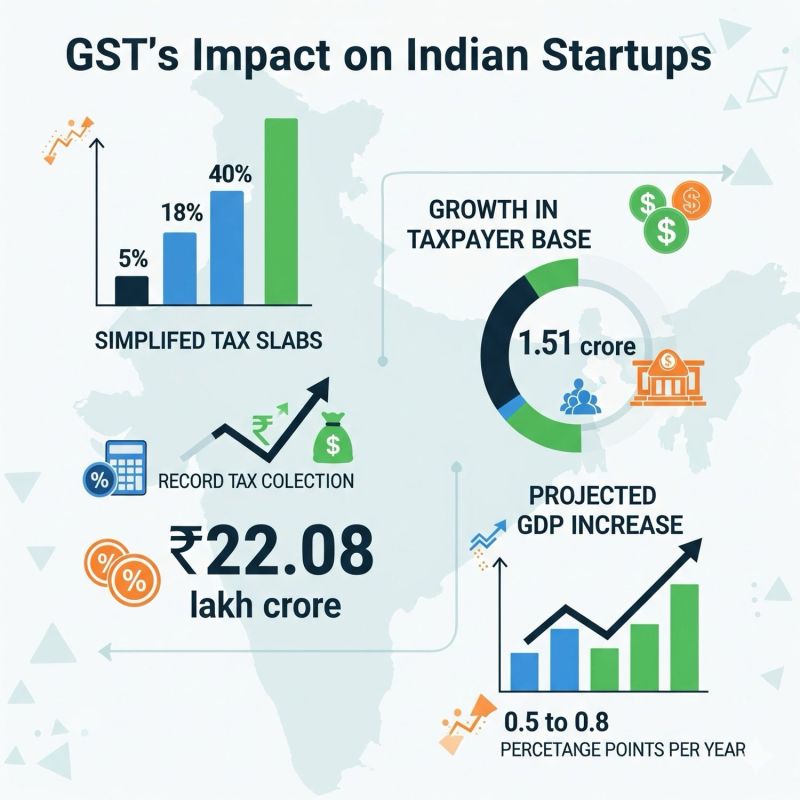

Why are the latest GST reforms being rightly called the Next Gen GST reforms for Startups and MSMEs? Here's why. ⬇️ In 2017, the government rolled multiple taxes (excise, VAT, service tax, entry tax, etc.) on differentiated products into "One Nation, One Tax." GST was born, but the problem remained unsolved. 🤔 Multiple states levied their own taxes, compliance was still a burden, and we had the draconian cascading effect (tax on tax). But now the game changes. 👇🏻 With simplified GST slabs of 5%, 18%, and 40%, and a record ₹22.08 lakh crore collected in 2024–25 (a 9.4% year-on-year increase), India is primed for unprecedented startup expansion. 🙌 Startups and MSMEs get a boost in terms of a) automatic registration within three weeks, b) Inverted duty fixation, and c) Faster refunds and liquidity. ✅ Compliance and paperwork get limited, working capital gets relaxed, and startups can finally (finally) breathe the fresh air. 😅 Agritech companies receive a lower GST on tractors, while healthtech companies are exempt from GST on medical devices and insurance. ⛑️ Additionally, renewables get taxed at just 5% on solar and wind energy equipment. 💨 No wonder the GST taxpayer base has grown from 66.5 lakh entities in 2017 to 1.51 crore by 2025. Viksit Bharat is the new MOTTO. 🇮🇳 hashtag#NextGenGST

Replies (6)

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreRishabh Jain

Start loving figures... • 1y

Is India Taxing Too Much Fun? (POPCORN TAX) India’s tax system has gone global thanks to the popcorn taxation buzz. While we’ve made strides with reforms like GST and corporate tax cuts, quirky rules and compliance hurdles can sometimes leave foreig

See More

AASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)