Back

Applyly

Hey I am on Medial • 1y

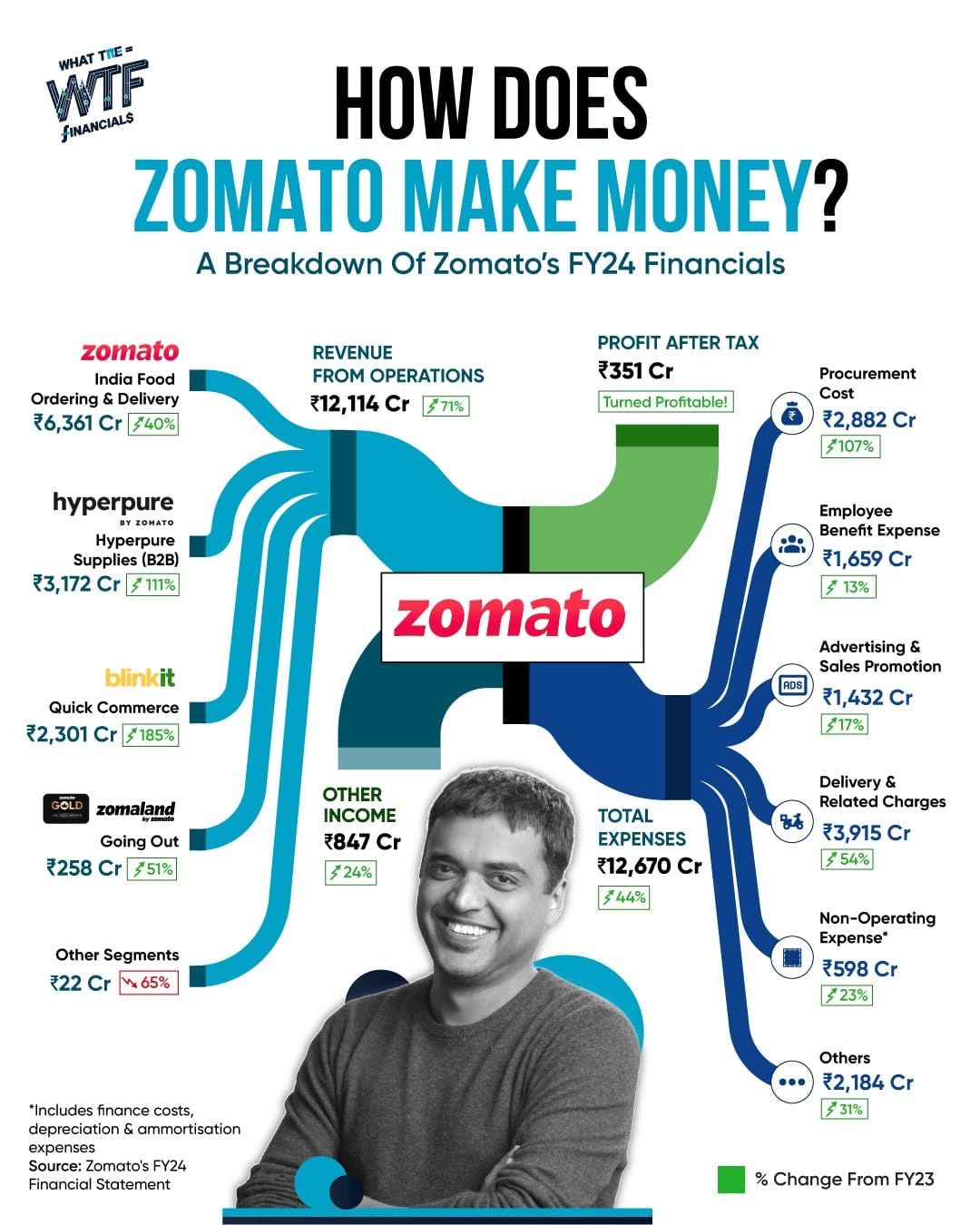

Zomato Hit With Rs. 800 Crore Tax Demand by GST Authorities By Applyly December 13, 2024 Zomato faces a Rs. 803.4 crore tax demand from GST authorities. The demand covers 29 October 2019 to 31 March 2022. It includes Rs. 401 crore in tax and equal interest and penalties. This Zomato Tax demand raises questions about compliance and could significantly impact the company’s finances. However, Zomato asserts a strong legal position and intends to contest the order, citing support from external legal and tax advisors. The Details of Zomato Tax Demand Zomato received the GST order on 12 December 2024, dated 12 November 2024. This Zomato Tax demand, totalling Rs. 802 crore, is linked to alleged non-compliance during the three years. Zomato has clarified that it strongly contests the claim. In a note to exchanges, Zomato stated: “We believe that we have a strong case on merits which is backed by opinions from our extemal legal and tax advisors. The Company will be filing an appeal against the order before the appropriate authority.” The company plans to file an appeal against the order with the appropriate authorities. The Ongoing GST Dispute This is not the first instance of a Zomato Tax demand. In 2023, they came across the problem of ₹400 crore tax demand. This was in relation to demand for the payment of GST on delivery fees which was as of 2017. Zomato and other delivery platforms, like Swiggy, differ from tax authorities on GST applicability. The authorities argue that food delivery is a service, attracting 18% GST. Conversely, Zomato believes it acts as a platform, hiring gig workers for deliveries. They contend that delivery fees are paid to gig workers, who are exempt from GST if their annual income is below Rs. 20 lakh. This discrepancy has created confusion over whether GST liability falls on platforms like Zomato or individual delivery personnel. Potential Financial Impact on Zomato The latest demand of Rs. 802 crore could put a lot of pressure on Zomato’s financial health. It is above 60 percent of the company’s net profit for FY24. If the demand is upheld, Zomato could experience a decline in profitability, which shapes a threat to its future stock movement. As a result, investors are likely to be cautious until there is certainty over the appeal process. They generate a sense of uncertainty and may in the short-term exert pressure on Zomato’s stock value.

More like this

Recommendations from Medial

Shreyas Ramdasi

Mechanical Engineer • 1y

Zomato hikes platform fee for users; pauses these deliveries Zomato hikes platform fee for users; pauses these deliveries Zomato increased platform fee to Rs 5/order in major cities, aiming to enhance earnings. Swiggy charges Rs 5, with some users f

See MoreJayant Mundhra

•

Dexter Capital Advisors • 9m

And I won against Zomato! A big victory today, as Zomato has finally revealed its Net Order Values 🙏🙏 People who have been reading my work over the last 26 months know how I have written so many viral posts to build awareness on how Zomato has bee

See More

Account Deleted

Hey I am on Medial • 9m

Deepinder Goyal’s Zomato has introduced a 'long distance service fee' for orders placed from restaurants located beyond 4 km, the Economic Times has reported. As per the new pricing structure, customers will be charged Rs 15 by the online food deli

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)