Back

Varun Bhambhani

•

Medial • 1y

How to save tax as a Corporate Employee in India in 2025: My Top 5 Tips! 💡💰 1) Know your exemptions! Yes, certain allowances like HRA (House Rent Allowance) are tax-free under specific conditions. If you're paying rent, don’t forget to claim this benefit! It can save a chunk of money! 2) Invest smartly! Put your money into ELSS (Equity Linked Savings Scheme) or NSC (National Savings Certificate). Not only can these yield returns, but they can also shave off your taxable income. Win-win! 3) Health Insurance Benefits! Don’t sleep on it! The premium you pay for health insurance is eligible for tax deductions. Got a family? Claim deductions for covering them too. It’s a no-brainer! 4) Home Loan Benefits! Paying EMI can feel like a burden, but guess what? You're eligible for tax deductions on both the principal and interest payments. So, every time you pay that EMI, think about those savings! 5) 80C to the rescue! Max out your contributions to PF, NPS, or PPF. You can claim deductions up to Rs. 1.5 lakh. Talk about turning a skint month into a jubilant one! As someone who's been navigating this landscape for over 15 years, I've seen firsthand how these simple strategies can make a massive difference. Saving on taxes can feel daunting, but breaking it down into easier steps has always helped me and my friends meet those financial goals! What other tax-saving tips have you tried that have worked for you? Drop them in the comments! Let’s learn from each other. 👇🏼

Replies (3)

More like this

Recommendations from Medial

Bharat Yadav

Betterment, Harmony ... • 1y

Key Financial Considerations for Medical Professionals 1 . Debt Management: Strategize student loan repayment, credit cards, and personal loans. 2. Retirement Planning: Maximize tax-advantaged accounts (401(k), IRA). 3. Investments: Diversify portfol

See Moretheresa jeevan

Your Curly Haird mal... • 12m

🚨 Tax Saving Alert: Only 2 Months Left! 🚨 Hi there! 👋 Here’s a quick guide to help you maximize your savings: 🔹 80C - Save up to ₹1.5L PPF, ELSS (higher returns), NSC, LIC, Tax-Saving FDs (5 yrs). 🔹 80D - Health is Wealth Save ₹25K (self/fami

See More

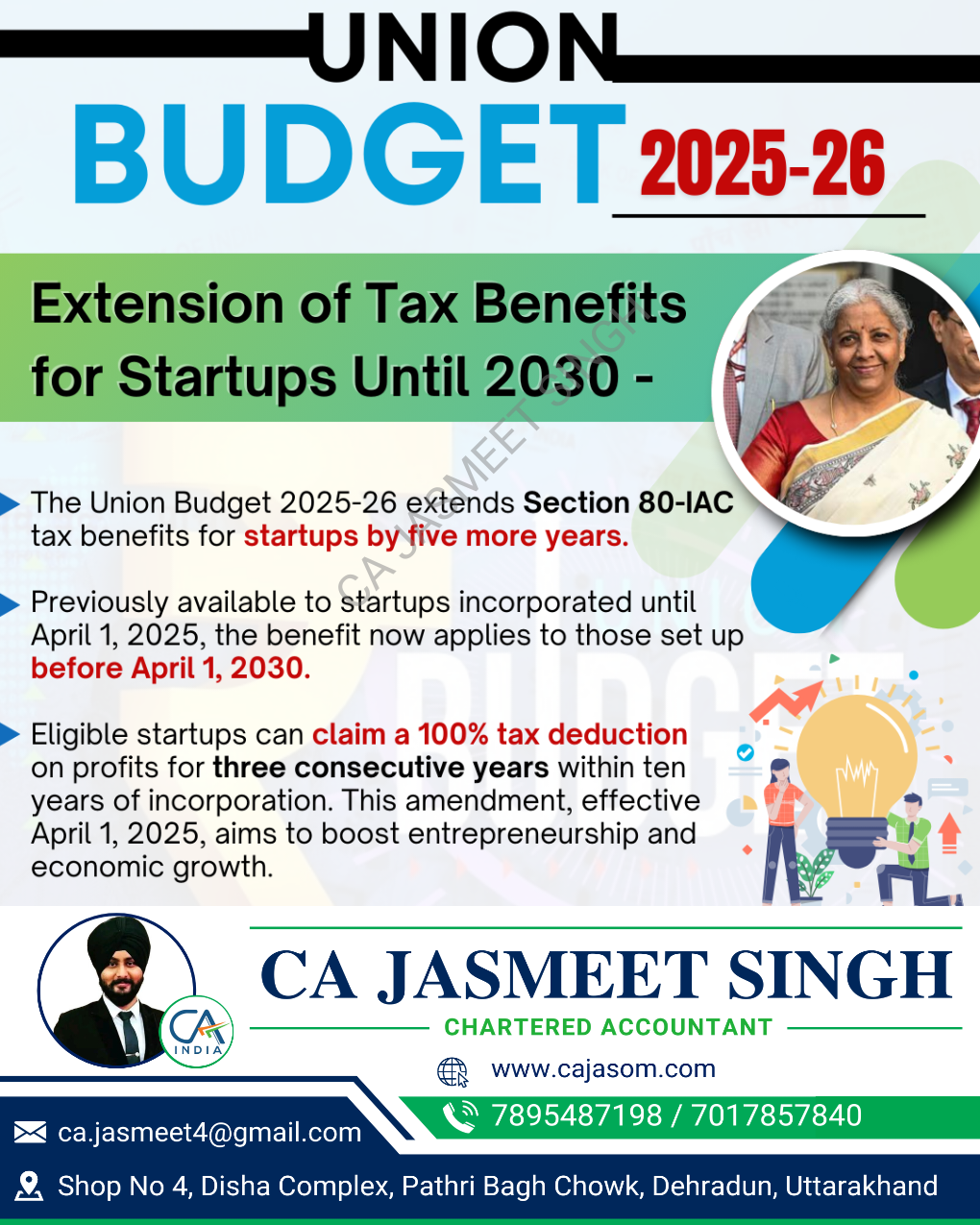

CA Jasmeet Singh

In God We Trust, The... • 10m

🚀 Section 80-IAC: Tax Exemption for Startups! 💡 If you're a startup recognized by DPIIT, you can claim a 100% tax deduction on profits for 3 consecutive years out of the first 10 years! 🎉 📌 Eligibility: ✅ Incorporated as a Private Ltd. Co. or L

See More

Shriharsha Konda

•

Start.io - A Mobile Marketing and Audience Platform • 8m

If you are a freelancer, or are just curious what it holds on the taxation front, Section 44ADA can mean huge tax savings. Here is a detailed breakdown - https://shriharsha.com/salary-to-contract-44ada/ Also bonus - a tool to compare your potentia

See More

Download the medial app to read full posts, comements and news.