Back

CA Jasmeet Singh

In God We Trust, The... • 11m

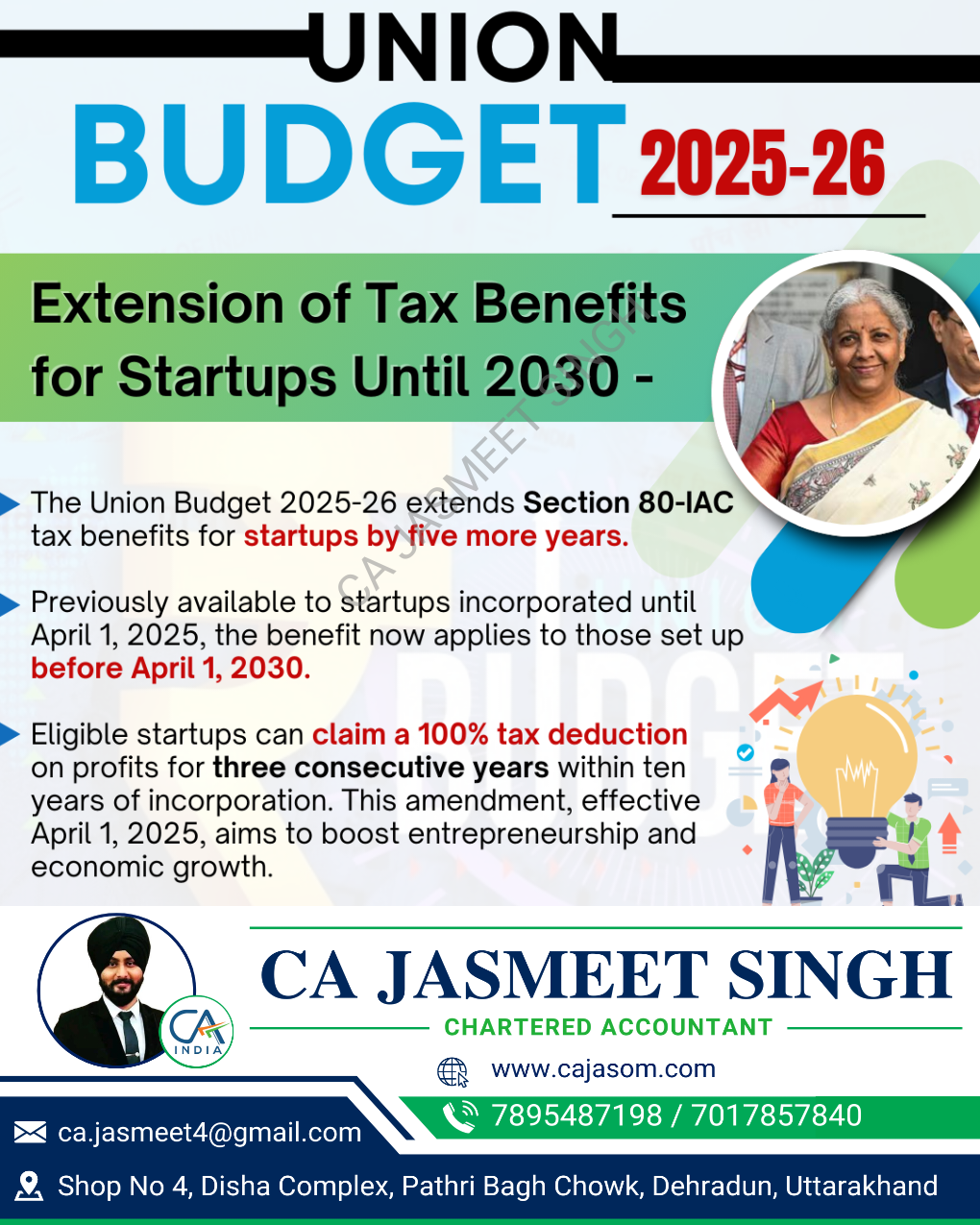

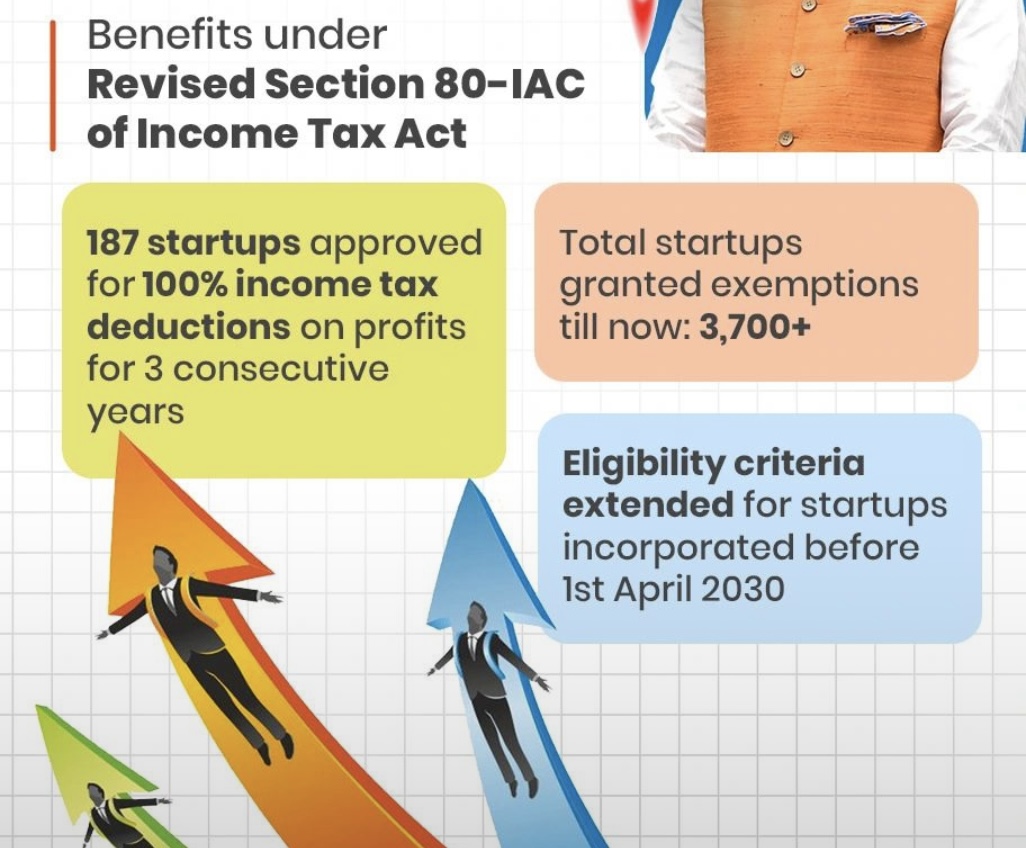

🚀 Section 80-IAC: Tax Exemption for Startups! 💡 If you're a startup recognized by DPIIT, you can claim a 100% tax deduction on profits for 3 consecutive years out of the first 10 years! 🎉 📌 Eligibility: ✅ Incorporated as a Private Ltd. Co. or LLP ✅ Turnover < ₹100 Cr in any previous year ✅ Engaged in innovation, development, or improvement of products/processes/services 🌟 Apply to DPIIT & enjoy tax savings! 💰 #StartupIndia 🚀 #TaxSavingTips #80IAC

Replies (14)

More like this

Recommendations from Medial

CA Chandan Shahi

Startups | Tax | Acc... • 11m

Big Relief for Start-Ups! 🚀 The Finance Act 2025 brings great news for aspiring entrepreneurs! The tax exemption under Section 80-IAC—which allows eligible start-ups to claim a 100% deduction on profits for three consecutive years within their firs

See MoreAccount Deleted

Hey I am on Medial • 7m

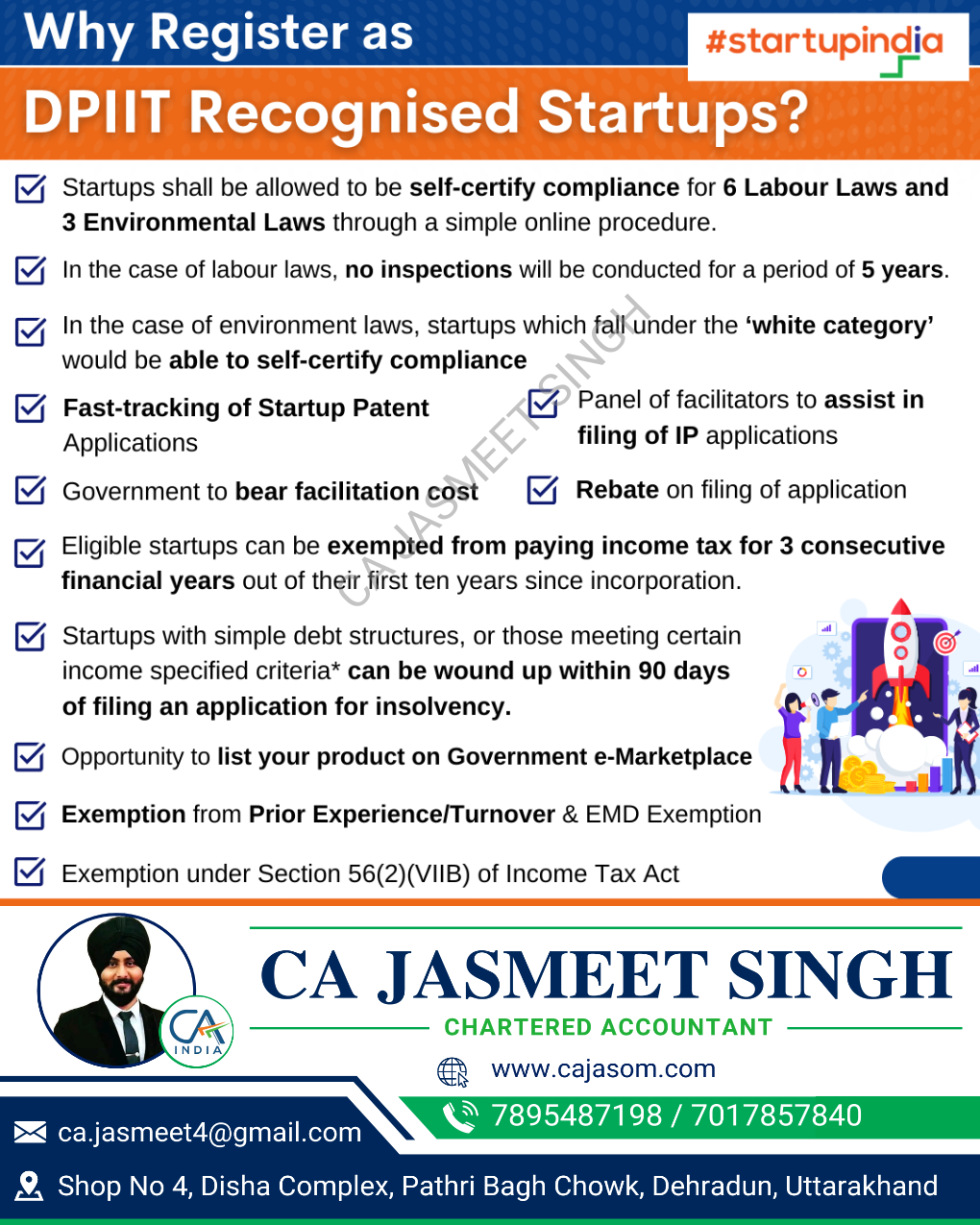

Startup Recognition in India ' (under DPIIT – Department for Promotion of Industry and Internal Trade) 🎁 . Benefits After DPIIT Recognition: Tax exemption for 3 years under section 80IAC. Exemption from Angel Tax under section 56(2)(viib). Easie

See MoreAnonymous

Hey I am on Medial • 1y

i have appointed a known website to register my company i paid them hefty amount now they are asking more money under the name of company dsn, startup certificate, & startup india approval,dpiit recognition , website, tax exemption , marketing cloud

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

🚀 DPIIT Registration for Startups 101 🔍 What is it? DPIIT Registration is the Indian government's official recognition for startups under the Startup India initiative, launched in 2016 to boost innovation and entrepreneurship! 🇮🇳 ✨ Why Register

See More

Sandip Kaur

Hey I am on Medial • 1y

Essential Tax Tips Every Indian Startup Shld Know- Navigating taxes can be tricky for startups, but mastering them is crucial for growth. Here’s what every Indian entrepreneur shld keep in mind: •Startup India Exemptions: If your startup is recognize

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)