Back

Account Deleted

Hey I am on Medial • 7m

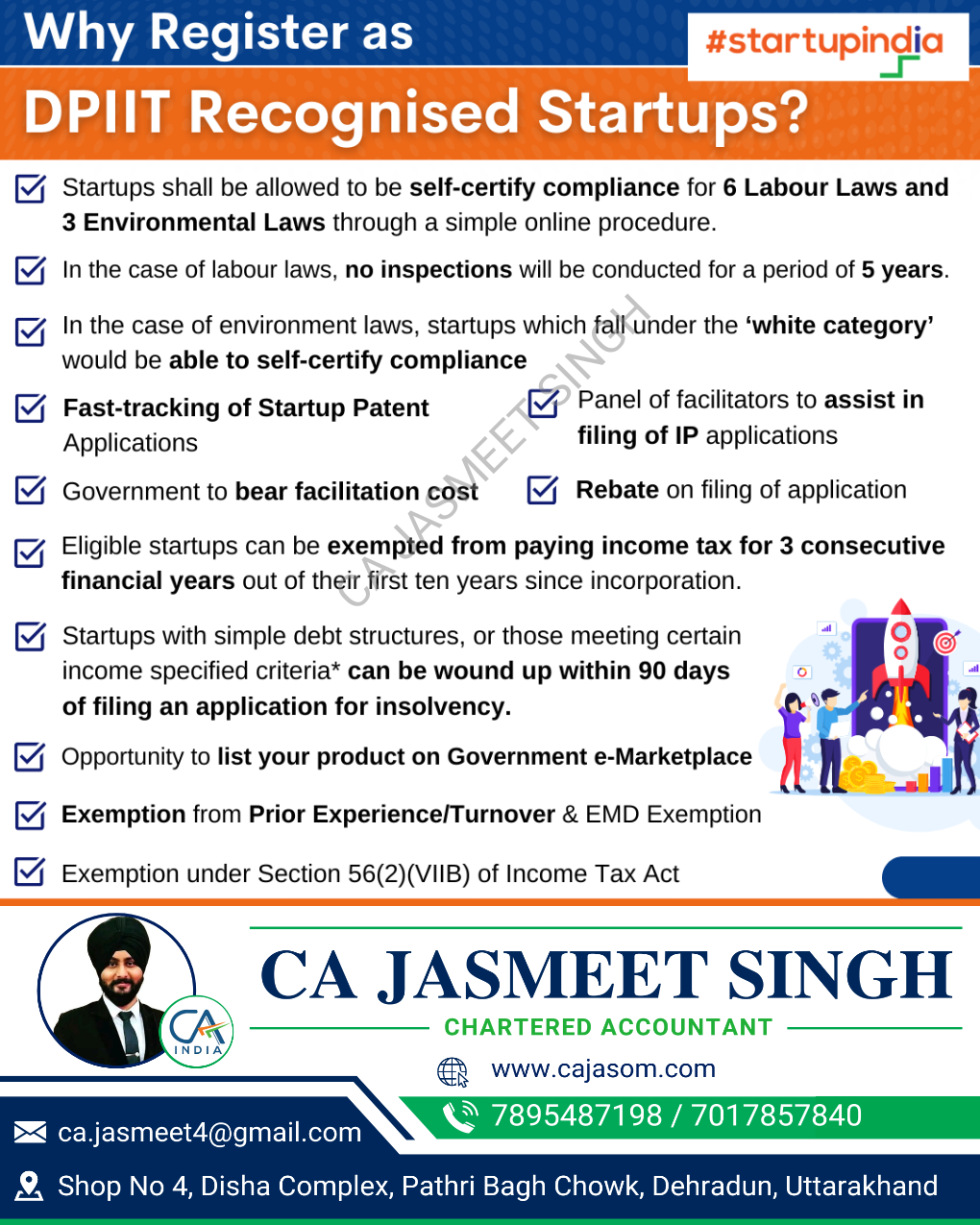

Startup Recognition in India ' (under DPIIT – Department for Promotion of Industry and Internal Trade) 🎁 . Benefits After DPIIT Recognition: Tax exemption for 3 years under section 80IAC. Exemption from Angel Tax under section 56(2)(viib). Easier access to government tenders (without prior experience). Fast-track patent filing and IPR support. Access to ₹10,000 crore Startup Fund of Funds (via VCs). Self-certification for 6 labor laws and 3 environmental laws. Easier exit process (fast-track under IBC). Participation in international startup events and Indian govt startup missions.

Replies (1)

More like this

Recommendations from Medial

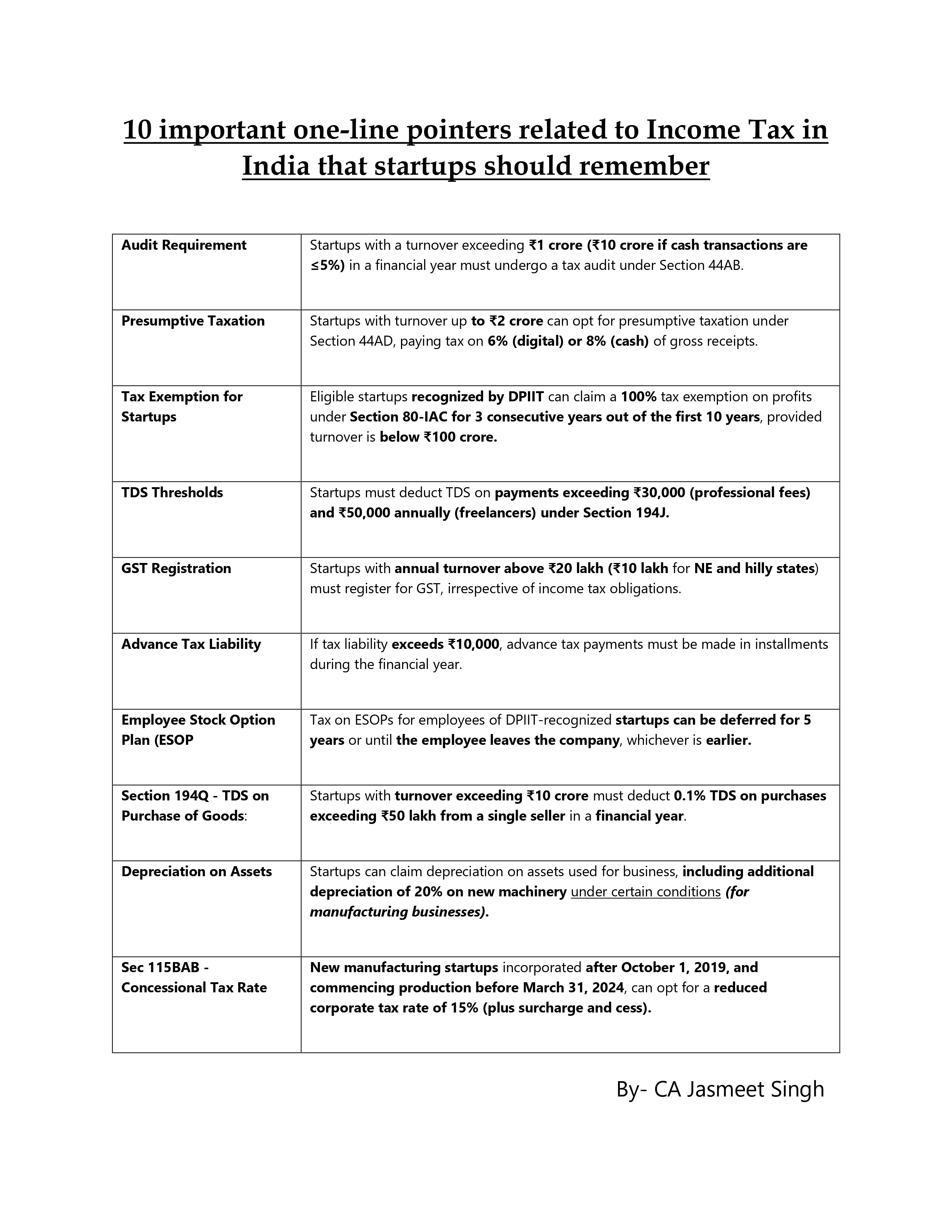

CA Jasmeet Singh

In God We Trust, The... • 11m

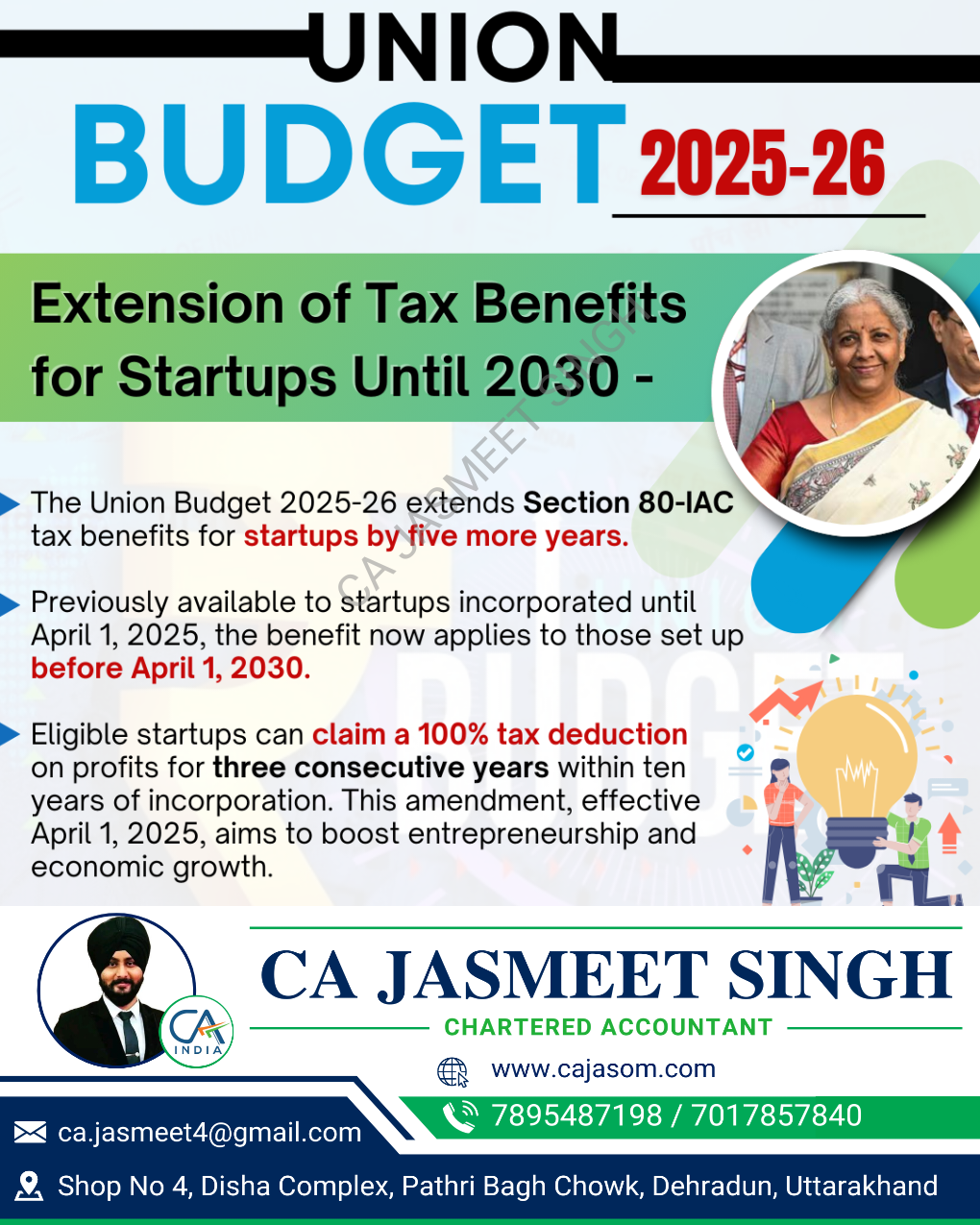

🚀 Section 80-IAC: Tax Exemption for Startups! 💡 If you're a startup recognized by DPIIT, you can claim a 100% tax deduction on profits for 3 consecutive years out of the first 10 years! 🎉 📌 Eligibility: ✅ Incorporated as a Private Ltd. Co. or L

See More

CA Jasmeet Singh

In God We Trust, The... • 11m

🚀 DPIIT Registration for Startups 101 🔍 What is it? DPIIT Registration is the Indian government's official recognition for startups under the Startup India initiative, launched in 2016 to boost innovation and entrepreneurship! 🇮🇳 ✨ Why Register

See More

Anonymous

Hey I am on Medial • 1y

i have appointed a known website to register my company i paid them hefty amount now they are asking more money under the name of company dsn, startup certificate, & startup india approval,dpiit recognition , website, tax exemption , marketing cloud

See MoreSahil Bagwan

•

MDFC Financiers Private Limited • 9m

Tuesday Tutorial #1> Register your startup with Startup India 1. Incorporate Your Business: Your startup needs to be registered as one of the following legal entities: •Private Limited Company •Limited Liability Partnership (LLP) •Partnership

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)