Back

Nid Best Solutions

Start Here,Lead Ahea... • 1y

why startups are not applying for "TAX EXEMPTION" under 80IAC?? Tell us your reasons

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 7m

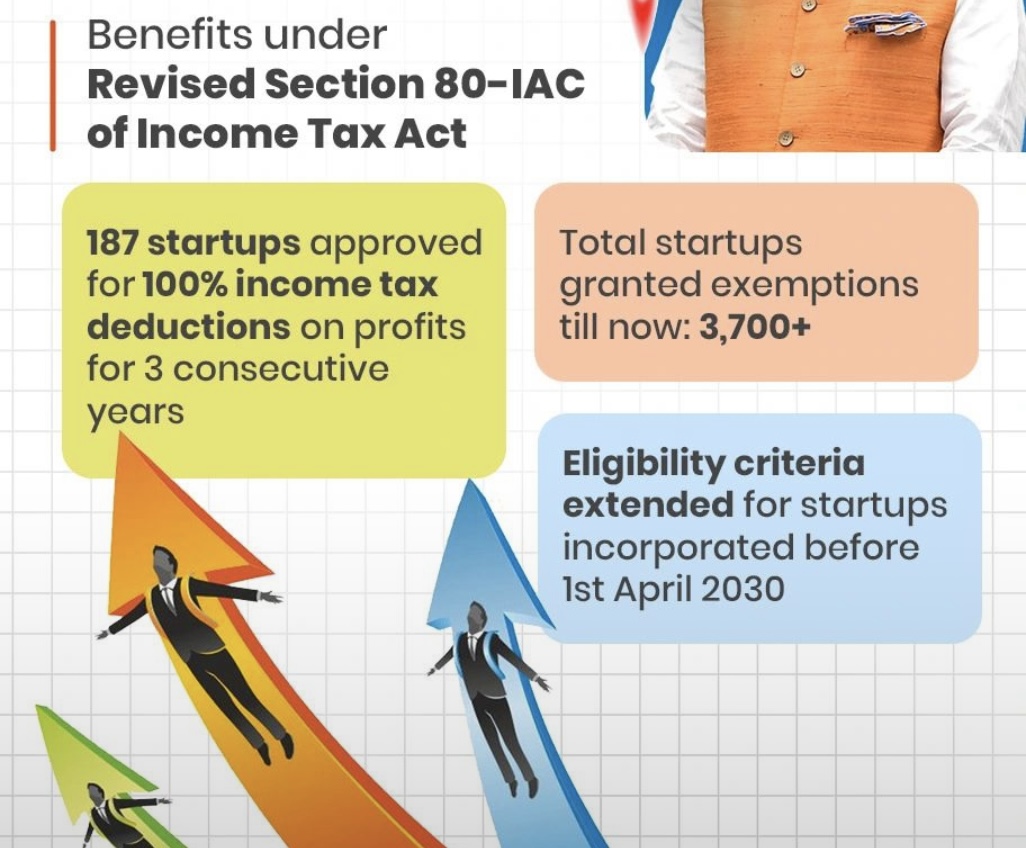

Startup Recognition in India ' (under DPIIT – Department for Promotion of Industry and Internal Trade) 🎁 . Benefits After DPIIT Recognition: Tax exemption for 3 years under section 80IAC. Exemption from Angel Tax under section 56(2)(viib). Easie

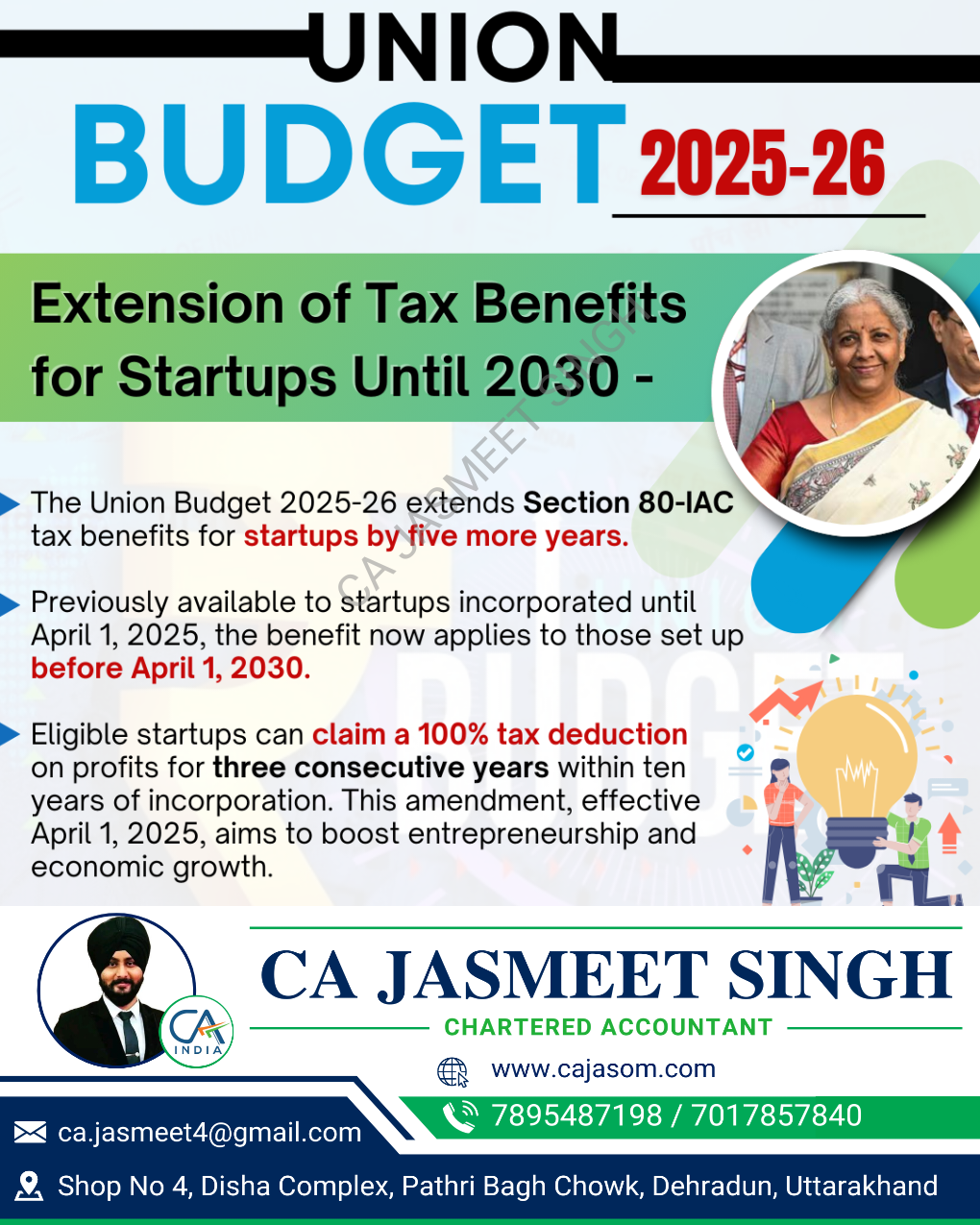

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

🚀 Section 80-IAC: Tax Exemption for Startups! 💡 If you're a startup recognized by DPIIT, you can claim a 100% tax deduction on profits for 3 consecutive years out of the first 10 years! 🎉 📌 Eligibility: ✅ Incorporated as a Private Ltd. Co. or L

See More

Shiva Prasad

Passionate Software ... • 1y

Hi Guys, I want to know few things about below mentioned points 1. Will we invest in startup(Starting from 2,000 rupees) and become a share holder if you like it? 2. What are the benefits we get, if we invest in Startups? 3. Any tax exemption

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)