Back

Shiva Prasad

Passionate Software ... • 1y

Hi Guys, I want to know few things about below mentioned points 1. Will we invest in startup(Starting from 2,000 rupees) and become a share holder if you like it? 2. What are the benefits we get, if we invest in Startups? 3. Any tax exemption for. Salaried Employee, if they invest in Startups from their salary? Since we get tax exemption for money invested in Mutual funds.

Replies (1)

More like this

Recommendations from Medial

Shiva Prasad

Passionate Software ... • 1y

Hi Guys, We are having many platforms to invest in Mutual funds and Stock Market. Similarly how many platforms we have for investing in Startups? Please share any platform you know that helps startups in getting funded as well where we can invest i

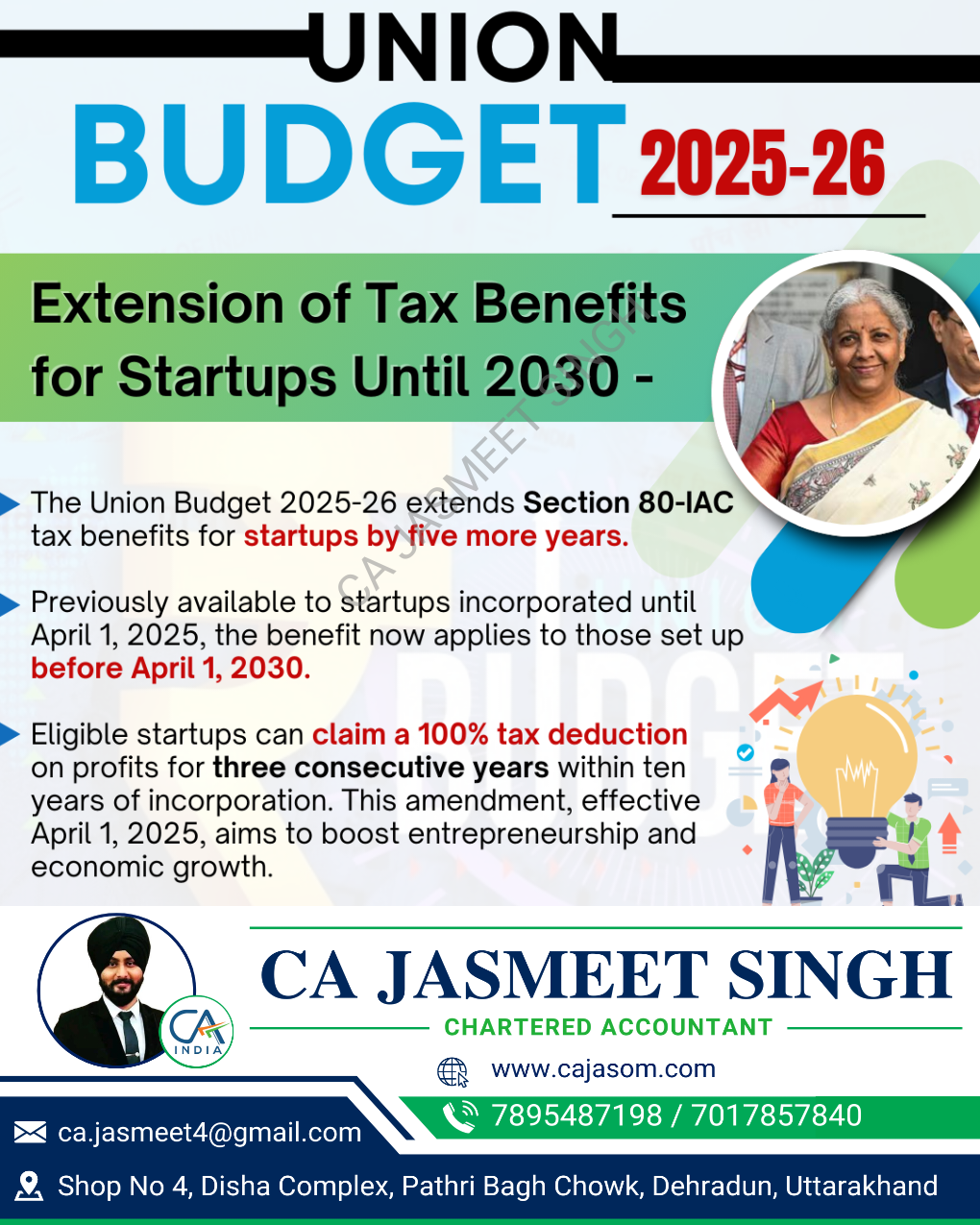

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

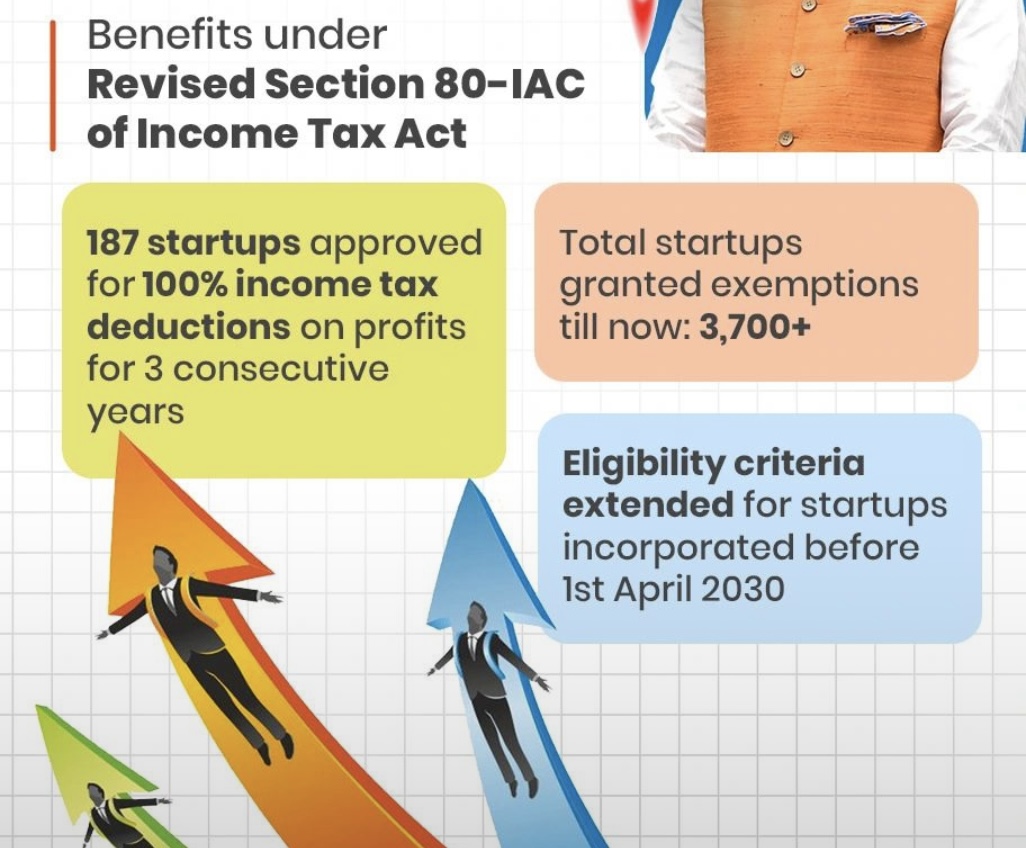

🚀 Section 80-IAC: Tax Exemption for Startups! 💡 If you're a startup recognized by DPIIT, you can claim a 100% tax deduction on profits for 3 consecutive years out of the first 10 years! 🎉 📌 Eligibility: ✅ Incorporated as a Private Ltd. Co. or L

See More

calculus

Your Bottom Line Our... • 8m

📢 Income Tax Filing Awareness – Don’t Miss the Deadline! ✔️ Filing your Income Tax Return (ITR) is mandatory if your annual income exceeds the exemption limit. ✔️ It helps you avoid penalties, claim refunds, and build a strong financial record. ✔️

See MoreSandip Kaur

Hey I am on Medial • 1y

Essential Tax Tips Every Indian Startup Shld Know- Navigating taxes can be tricky for startups, but mastering them is crucial for growth. Here’s what every Indian entrepreneur shld keep in mind: •Startup India Exemptions: If your startup is recognize

See MoreCA Kakul Gupta

Chartered Accountant... • 11m

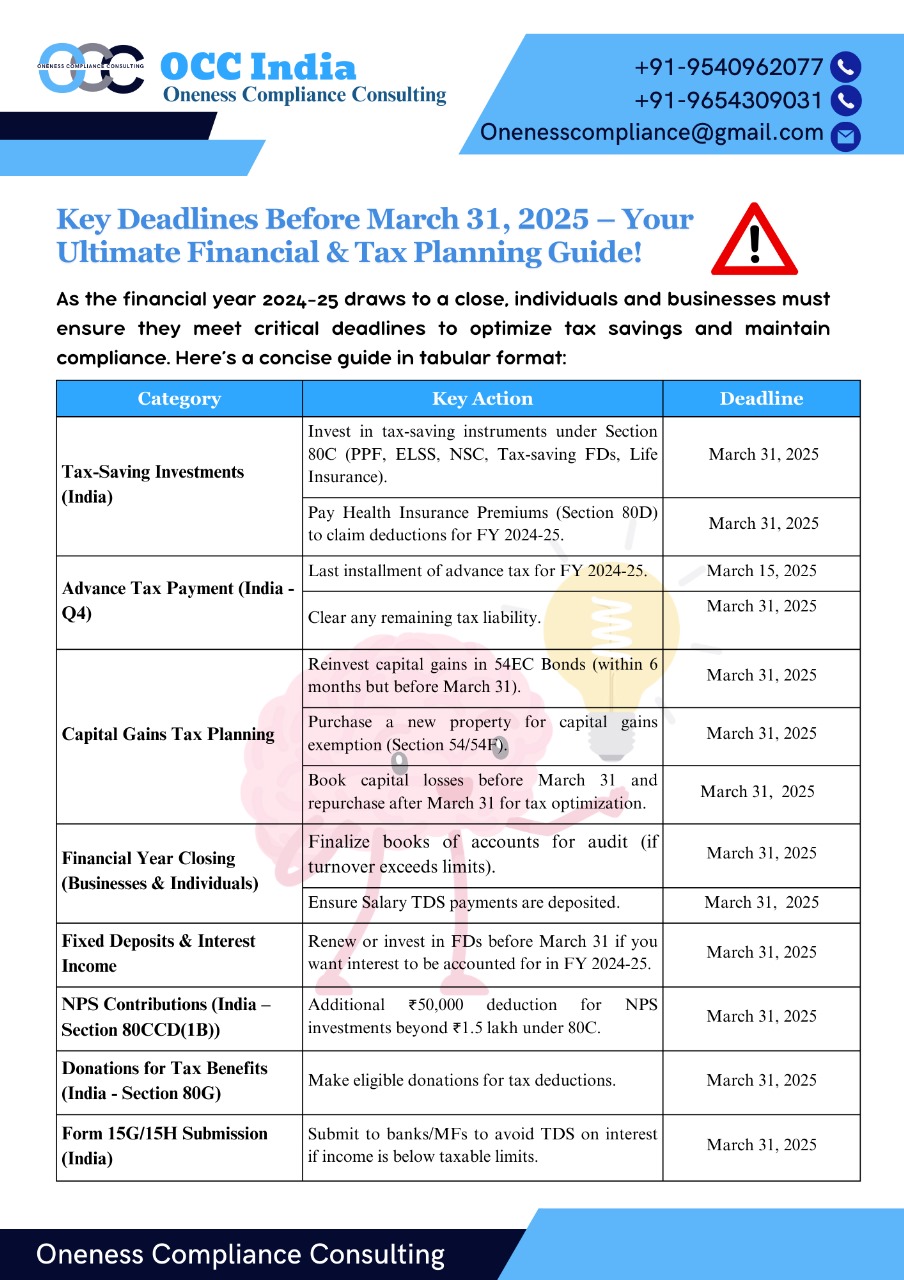

Summary of action points Before March 31, 2025 ✔ Review tax-saving investments. ✔ Pay pending taxes/advance tax. ✔ Submit investment proofs to employer (if salaried). ✔ Plan capital gains/losses for tax efficiency. ✔ Update financial records for the

See More

PVSN RAJU

Start Small Dream Bi... • 1y

We are a fintech startup based out of Bangalore launching our mobile app in Feb-2025. We are on mission to make Finance & Investments Affordable, Accessible and Efficient. In our research we have seen that only income earners mostly male members in

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)