Back

CA Jasmeet Singh

In God We Trust, The... • 11m

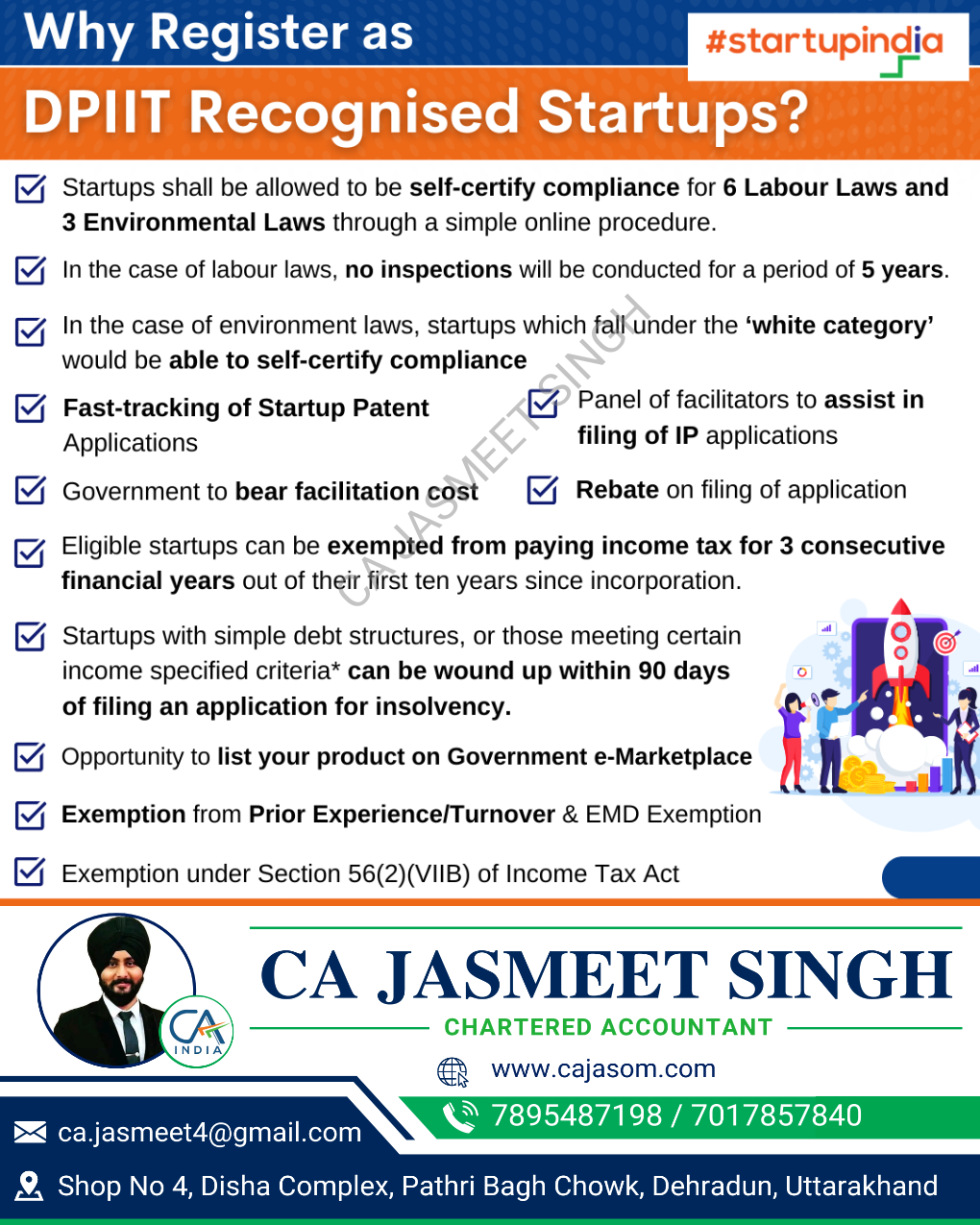

🚀 DPIIT Registration for Startups 101 🔍 What is it? DPIIT Registration is the Indian government's official recognition for startups under the Startup India initiative, launched in 2016 to boost innovation and entrepreneurship! 🇮🇳 ✨ Why Register? 💰 Financial Perks - 💸 Tax Benefits: 3-year income tax exemption - 📝 Patent Filing: Large fee reduction - 💼 Funding Access: Priority for govt funds & ₹10,000 crore Fund of Funds ⚖️ Regulatory Wins - ✅ Self-Certification: Easier compliance for labor & environmental laws - 🏎️ Fast-Track Patents: Priority examination - 📊 Procurement Edge: Relaxed criteria for govt tenders 🌟 Networking Boost - 🤝 Connect: With investors, mentors & incubators - 🔬 Research Access: Partnerships with academia - 🎯 Events: Priority in startup competitions 📋 Eligibility Checklist - ⏰ Age: ≤ 10 years since incorporation - 🏢 Entity: Private Ltd, Partnership, or LLP - 💵 Turnover: ≤ ₹100 crore annually - 💡 Innovation: Working on innovative products/services 🔄 How to Apply 1. 💻 Register on [startup.gov.in](https://startup.gov.in) 2. 📄 Submit required documents 3. 🎉 Receive recognition certificate 🚀 Ready to transform your startup journey? Get DPIIT-registered today! 🌈

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 7m

Startup Recognition in India ' (under DPIIT – Department for Promotion of Industry and Internal Trade) 🎁 . Benefits After DPIIT Recognition: Tax exemption for 3 years under section 80IAC. Exemption from Angel Tax under section 56(2)(viib). Easie

See MoreSahil Bagwan

•

MDFC Financiers Private Limited • 9m

Tuesday Tutorial #1> Register your startup with Startup India 1. Incorporate Your Business: Your startup needs to be registered as one of the following legal entities: •Private Limited Company •Limited Liability Partnership (LLP) •Partnership

See MoreJayant Mundhra

•

Dexter Capital Advisors • 1y

Yes, all people in India pay taxes. But, ones who pay INCOME TAXES technically work 3-6 months for the Govt 🙏🙏 Thus, like it or not, they are special, even if the system doesn’t say so. And if we can’t provide the first world experience, the leas

See More

Prem Siddhapura

Unicorn is coming so... • 1y

**Tax Revenue Hits Record Highs** 📈 The government’s net direct tax collection, post-refunds, surged 15.4% to ₹12.3 lakh crore between April and November 10, 2024. Gross collections also saw a robust 21.2% increase, reaching ₹15.02 lakh crore. 💰

See MoreAshutosh Mishra

Chartered Accountant • 1y

Direct Tax collections for FY 2024-25 as of 17 September, 2024 Net Collections, YOY comparison Corporate Tax : ₹4.53 lakh crore, up 10.5% Personal Income Tax : ₹5.15 lakh crore, up 18.8% STT : ₹26,154 crore, up 96% Other Taxes : ₹1,812 crore, up

See MoreAnonymous

Hey I am on Medial • 1y

i have appointed a known website to register my company i paid them hefty amount now they are asking more money under the name of company dsn, startup certificate, & startup india approval,dpiit recognition , website, tax exemption , marketing cloud

See MoreRavi Kumar Mishra

Hum hai Aapke Busine... • 8m

ITR 23-24 24-25 25-26 Compution,Balancesheet with Ca Certified 1. GST Registration 2. GST return Filing 3. MSME Registration 4. Tds FILLING 5. Company, NGO & Partnership Reg. 6. Importer Exporter Code 7. ISO Non-Iaf/IAF Registration 8. Start up

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)