Back

Jayant Mundhra

•

Dexter Capital Advisors • 1y

Yes, all people in India pay taxes. But, ones who pay INCOME TAXES technically work 3-6 months for the Govt 🙏🙏 Thus, like it or not, they are special, even if the system doesn’t say so. And if we can’t provide the first world experience, the least that can be offered to these honest taxpayers is recognition of their EXTRA contributions as the sponsors of the Govt and Indian economy. Thus, had I been PM Modi and Nirmala Tai, I would have announced SPECIAL BENEFITS without any hit to the tax collections 🙏🙏 Here is a list of low/no cost efforts, which would make anyone rich with privileges! .. 1> No processing fees for passports, business and marriage registrations, driving licenses, and other government documentation 2> Priority queues & counters at Govt offices, ensuring faster processing times & reduced wait periods 3> Early access to Govt’s investment schemes & public sector bonds with slightly higher interest rates 4> Priority access to webinars, conferences, lectures & knowledge-sharing sessions by Govt experts 5> Invitations to Govt-hosted events like cultural festivals, art exhibitions or sports matches 6> Priority consideration for tax dispute resolution and faster processing of tax refunds 7> Priority services during elections, including shorter wait times at polling stations 8> Favourable interest rates on business, home & vehicle loans and FDs from PSBs 9> Annual awards and public recognition for the highest contributing taxpayers 10> Fast-tracked claims processing from Govt-owned insurance companies 11> Annual recognition awards for consistent and high-value taxpayers 12> Discounts on entry to national parks, museums, and heritage sites 13> Discounts on tolls through expressways and national highways 14> Preferential quota allocation in every PSU IPO or FPO issue 15> Priority passage gateways on metro rail networks .. And I know, some would say that this will divide India, create differences among people and more. -> Well, job reservations divided us. Different laws for different religions divided us -> Hindu/Muslim, Jat/Yadav, Bihari/Kannadiga, Brahmin/Shudra - That divided us India has already been divided by a thousand such moves over the years. One more won’t hurt 🙏🙏 But, it would go a long mile in acknowledging the special few who toil and send to the Govt whatever they earn anywhere between 3-6 months every single year. Plus, by turning the badge of a taxpayer into an honour and privilege, this will also boost the tax payer base. ..

Replies (5)

More like this

Recommendations from Medial

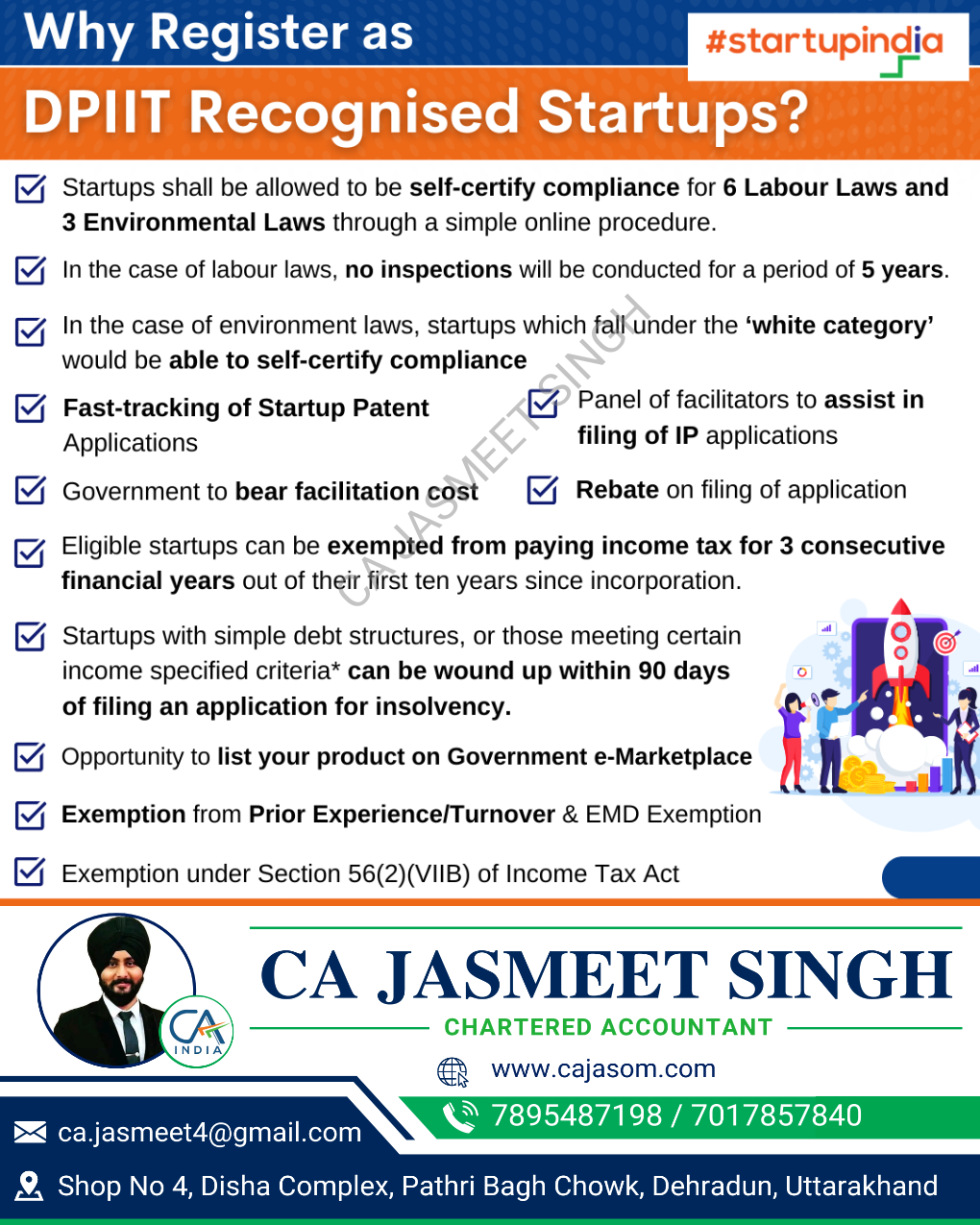

CA Jasmeet Singh

In God We Trust, The... • 11m

🚀 DPIIT Registration for Startups 101 🔍 What is it? DPIIT Registration is the Indian government's official recognition for startups under the Startup India initiative, launched in 2016 to boost innovation and entrepreneurship! 🇮🇳 ✨ Why Register

See More

Account Deleted

Hey I am on Medial • 1y

In India, taxes like income tax are really high, but the public services don't seem to match. My suggestion: If someone pays ₹5 crore in tax, the govt should tell them, 'Instead of paying us, invest that money in your local area—build roads, schools,

See MoreJayant Mundhra

•

Dexter Capital Advisors • 1y

I get that Chinese EV makers have received a lot of subsidies from the Govt there 🙏🙏 But, I don’t get why people think that Indian Govt is not raining money on Indian players. .. In February, Tata Motors CFO P Balaji publicly stated that in FY25

See More

Account Deleted

Hey I am on Medial • 7m

Startup Recognition in India ' (under DPIIT – Department for Promotion of Industry and Internal Trade) 🎁 . Benefits After DPIIT Recognition: Tax exemption for 3 years under section 80IAC. Exemption from Angel Tax under section 56(2)(viib). Easie

See MoreMehul Fanawala

•

The Clueless Company • 1y

When the income tax return filing date is near, the income tax department goes into full marketing mode to remind taxpayers to file on time. Guess what? Even they have targets and quotas like our marketing and sales teams! 🎯 Imagine the tax offic

See More

Sameer Patel

Work and keep learni... • 1y

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See MoreAccount Deleted

Hey I am on Medial • 1y

🤖 Named Entity Recognition (NER) plays a crucial role in Natural Language Processing by helping machines understand and categorize key information from text. Discover its significance and applications in our latest article! Read more: http://news.e

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)