Back

Account Deleted

Hey I am on Medial • 1y

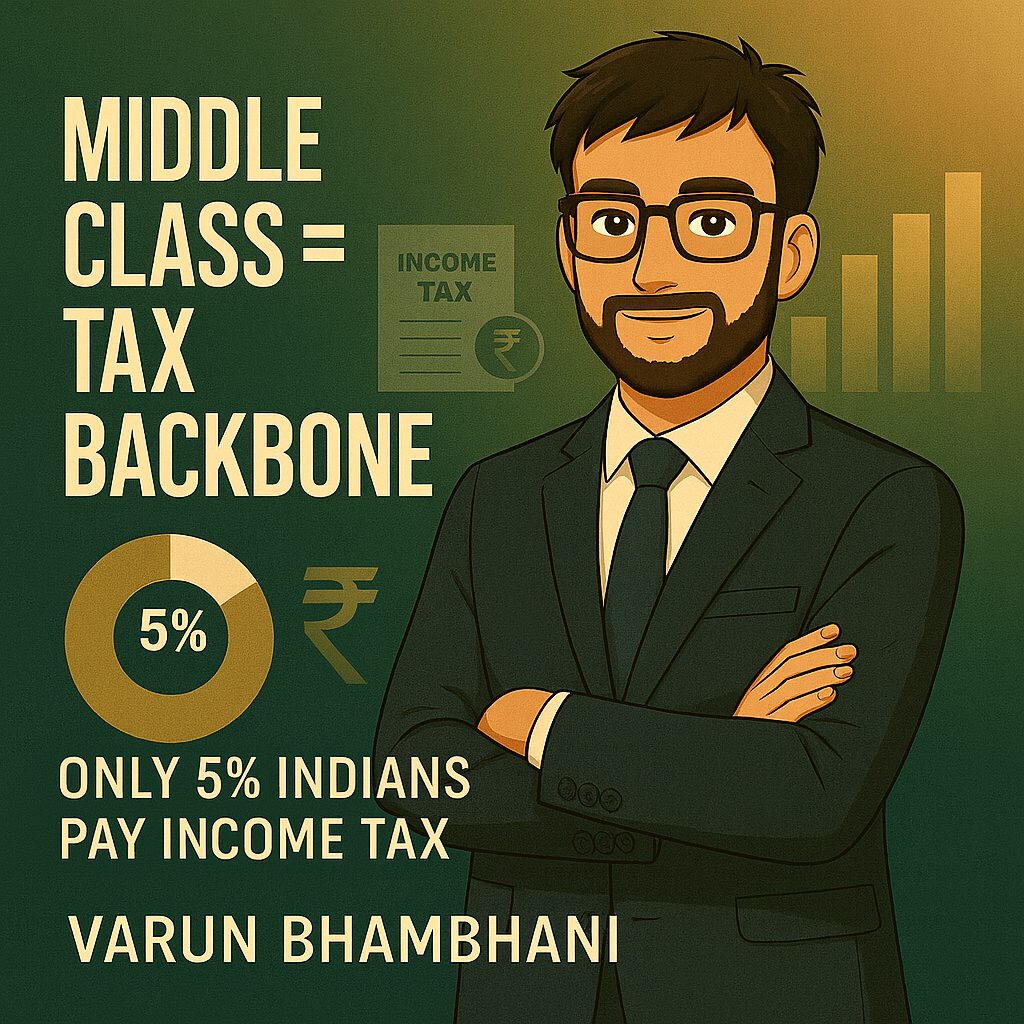

In India, taxes like income tax are really high, but the public services don't seem to match. My suggestion: If someone pays ₹5 crore in tax, the govt should tell them, 'Instead of paying us, invest that money in your local area—build roads, schools, hospitals, or support a charity that solves community problems.' The spending and results should be transparent, and the public can track it online. This way, taxes contribute directly to development, and taxpayers get the appreciation they deserve. #TaxForDevelopment #BetterIndia

Replies (9)

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)