Back

Sresh

....... • 9m

Nike's $4 Billion Tax Scam Nike has 2 companies: 1. 🇳🇱Netherlands - sells products, pays employees. 2. 🇧🇲Bermuda - has zero employees, but owns the Swoosh logo. Every time Nike sells a product, the Dutch company pays a royalty fee to Bermuda for using the logo. That means profits get shifted to Bermuda, where Nike pays 0% tax. This hack saved Nike over $4 billion in taxes.

Replies (2)

More like this

Recommendations from Medial

gray man

I'm just a normal gu... • 1y

Nike and Skims are shaking up activewear with their new collab, NikeSkims, launching this spring. The announcement sent Nike's stock up 6.2%, adding $6.7 billion in value. Nike's first-ever partnership with an outside brand is a bold move to reclaim

See More

Hemant Prajapati

•

Techsaga Corporations • 1y

🔍 Nike: A Case Study in Branding and Innovation 🔍 🚀 The Rise of a Global Powerhouse 🔸 Founded in 1964 as Blue Ribbon Sports, later rebranded as Nike. 🔸 Founders Phil Knight and Bill Bowerman aimed to create superior athletic footwear. 💡 Bra

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

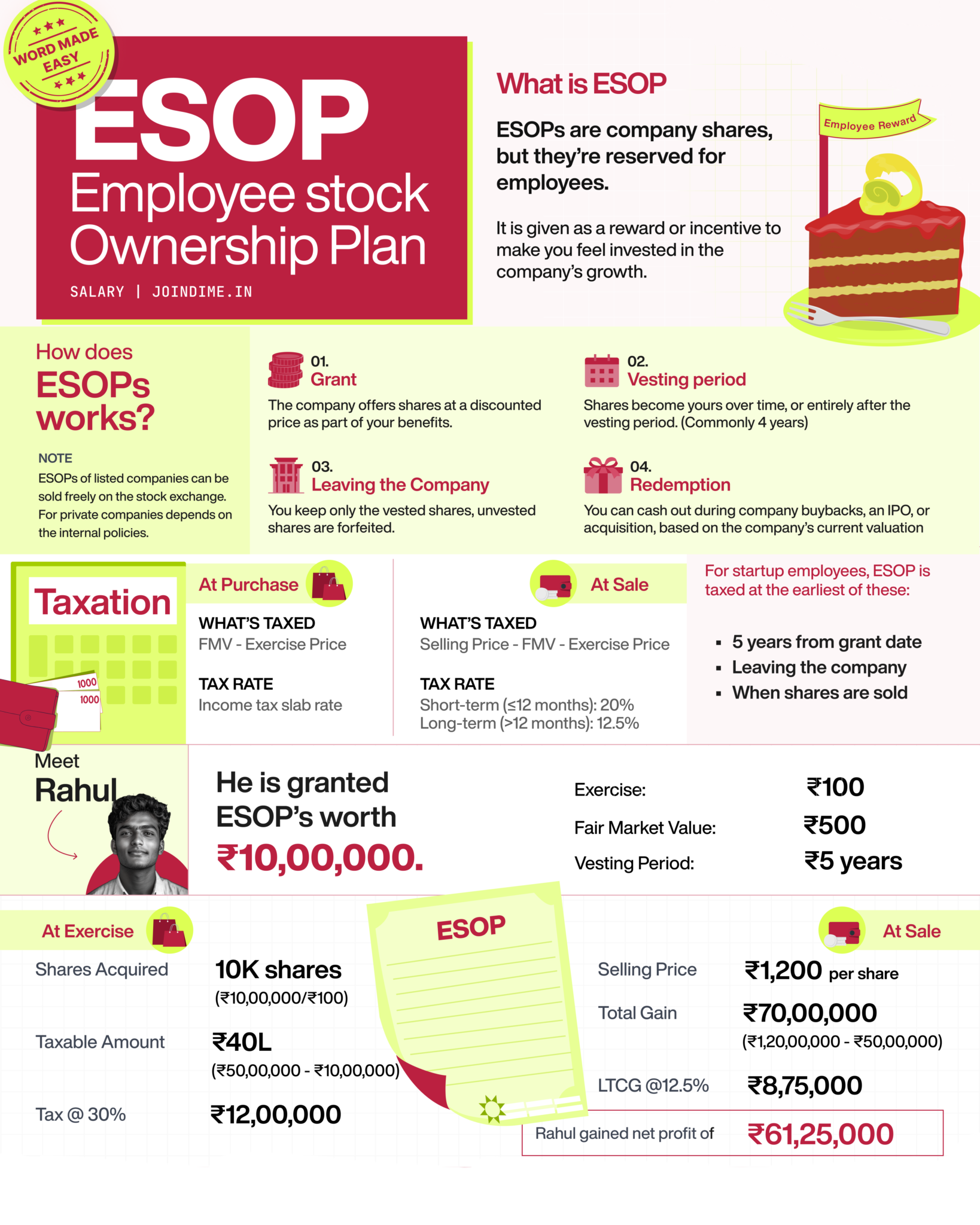

What is an ESOP (Employee Stock Ownership Plan)? ----- Explained. (Employee Perspective) Imagine your company gives you a chance to own a piece of the business. That’s what an ESOP is company shares reserved for employees like you. You don’t get

See More

Sanskar

Keen Learner and Exp... • 1y

Rolex, we all have heard of this premium watch brand based in Geneva, Switzerland. But do you know that despite earning $11.4 billions in revenue and a profit of $1.1 billion it pays absolutely no taxes and is not actually a private company. Well Ro

See More

Vikas Acharya

Building Reviv | Ent... • 1y

Modern banking tech company" ZETA" announced it has secured a $50 million investment from a strategic investor valuing it at $2 billion. However, the SaaS company did not reveal the investor’s name. Zeta became a unicorn in May 2021 after a $250 m

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)