Back

More like this

Recommendations from Medial

Rishabh Jain

Start loving figures... • 1y

Is India Taxing Too Much Fun? (POPCORN TAX) India’s tax system has gone global thanks to the popcorn taxation buzz. While we’ve made strides with reforms like GST and corporate tax cuts, quirky rules and compliance hurdles can sometimes leave foreig

See More

subhash kumar

Hey I am on Medial • 1y

This is my brth's channel (also on insta), recently set up. He wants to set a business around fitness. Especially in the elite group. Going to move in Bengaluru in the coming months. Anyone who wants to create something big around it together kindly

See More

Samraat

I am a tech enthusia... • 1y

You envision creating a next-generation platform for entrepreneurs that fosters innovation, competition, and collaboration while promoting long-term growth and philanthropy. The platform will provide tools, resources, and a supportive ecosystem tailo

See MoreAakash kashyap

Building JalSeva and... • 1y

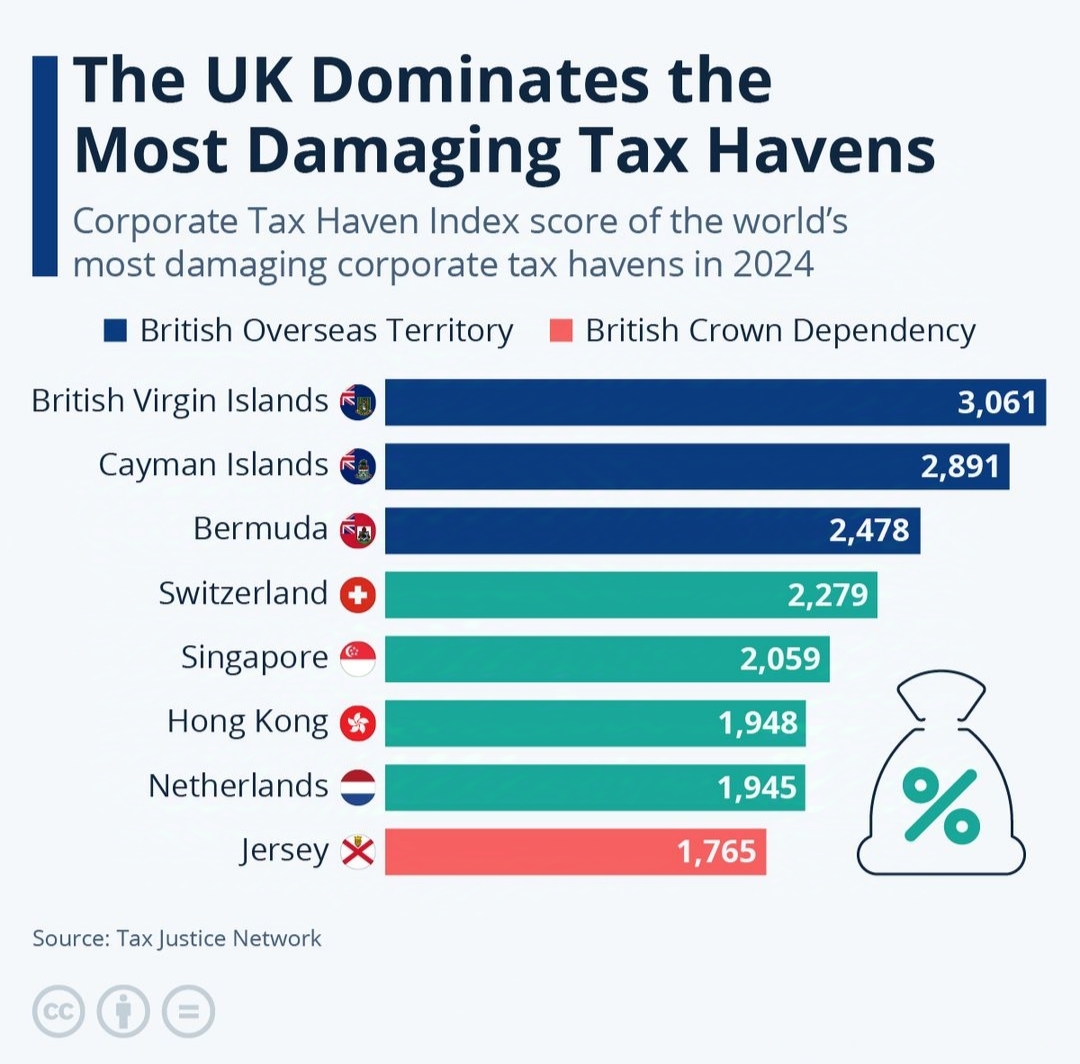

The UK's Overseas Territories Lead the Charge in Global Tax Havens – British Influence Dominates the Corporate Tax Haven Landscape in 2024 🤯 (A tax haven is a country or jurisdiction that offers low or no taxes, minimal financial transparency, an

See More

CA Kakul Gupta

Chartered Accountant... • 1y

Breaking Chains, Building Clarity! 💡🏛️ Just write about the New Income Tax Bill 2025, and it feels like history in the making! 📖✨ Finance Minister Nirmala Sitharaman has introduced a bill that promises to simplify, modernize, and revolutionize In

See MoreThe Outlier

Hey I am on Medial • 11m

₹1 Cr salary? You take home ₹65L after taxes. ₹1 Cr business profit? You keep ₹80L after deductions. ₹1 Cr in stock growth? ₹₹87.65L remains after 12.5% tax. The system wasn’t designed for workers. It was built for owners. Still chasing promotions

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)