Back

Harsh Dwivedi

•

Medial • 6m

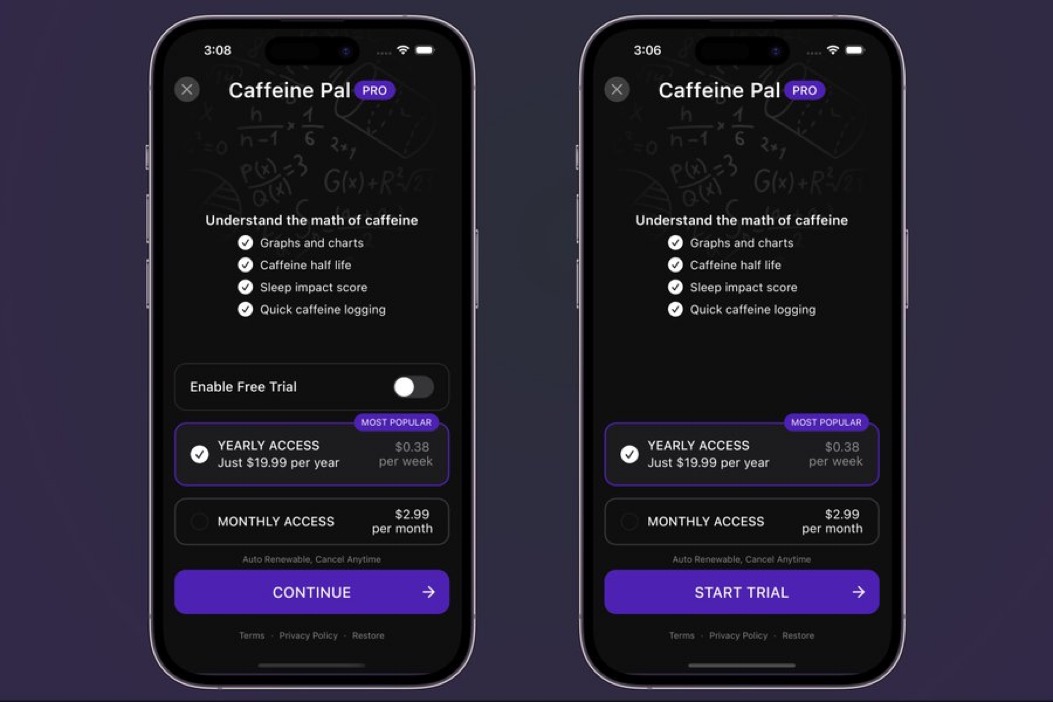

free trial on yearly subs is such a hack. ₹1 upfront → then ₹999 or more (annual) after 3 days. might be perfect if: - retention sucks but CAC is high - you want LTV upfront to recycle into ads - refund % < payback speed - optics don’t matter, only cashflow does have seen this in a lot of apps recently.

Replies (5)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 9m

Mastering Unit Economics Unit economics isn’t just a metric—it’s your startup’s financial DNA. It reveals whether each customer adds value or drains cash. Here’s how to build your unit economics from scratch: 1. Define Your Economic Unit What drives

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

Unlock the secrets of startup success with our comprehensive guide on Decoding Unit Economics! In this video, we break down the critical components that can determine the fate of your early-stage venture. Learn how to define your unit, calculate Cust

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

Decoding Unit Economics for Early-Stage Startups Unit economics is your startup’s compass. It tells you if scaling will make you rich—or broke. Here’s how to decode it, step by step: 1. Define a Unit: This could be a customer, order, or subscriptio

See More

Nikhil Raj Singh

Entrepreneur | Build... • 11m

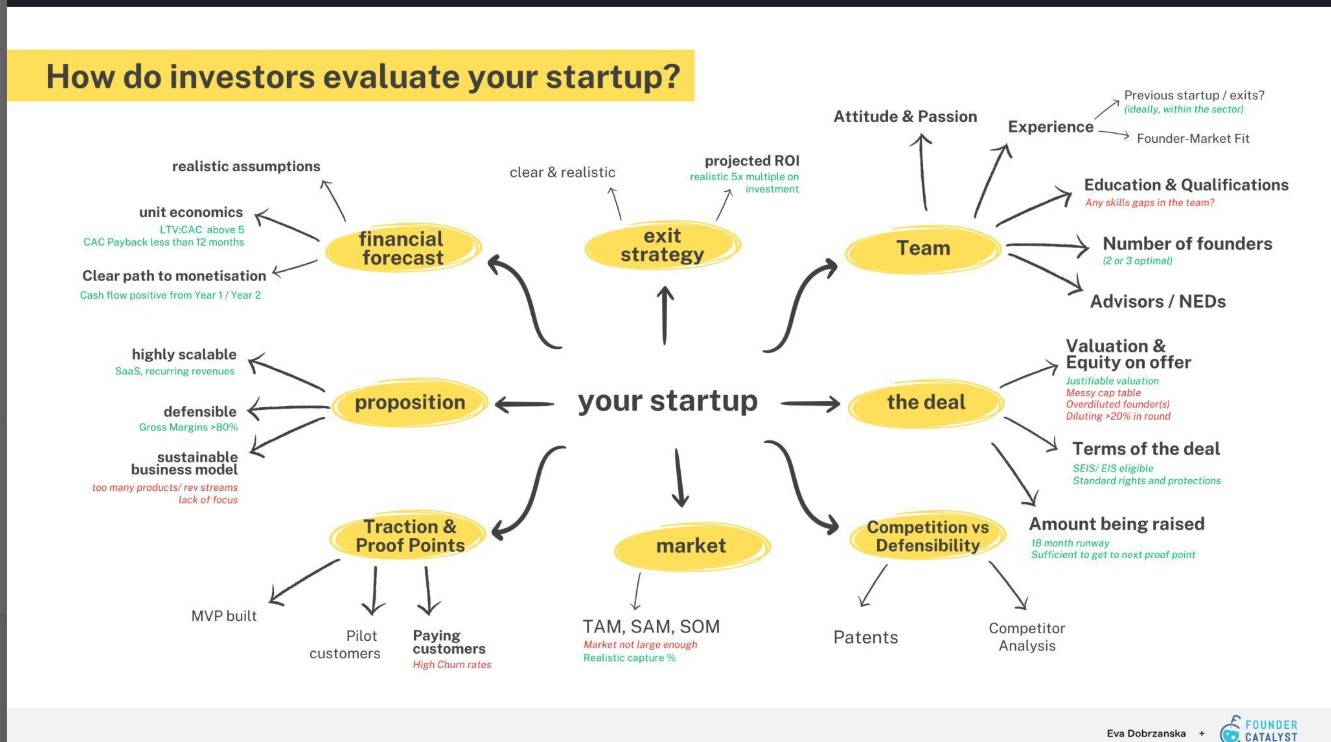

Whenever any Investor evaluates a startup then they focus on these criteria.. 1. A team with relevant experience is super important- their past working experience, educational qualifications, etc. 2. Next is the market opportunity- how big is your

See More

Karnivesh

Simplifying finance.... • 1m

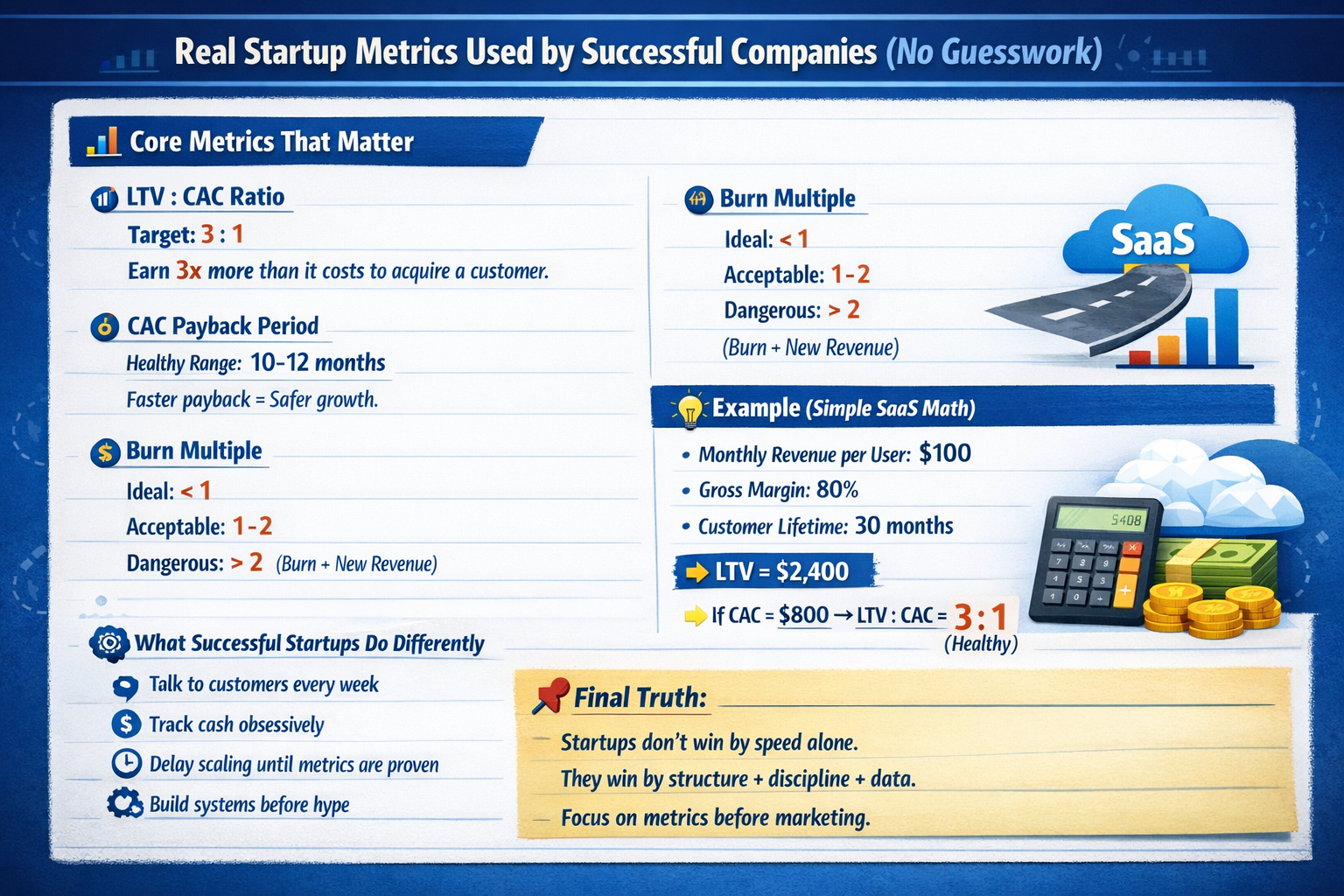

I’ve noticed that many startups celebrate users, orders, and revenue before asking the hardest question: does each unit actually make money? That’s what unit economics reveals. Strip away the hype, and it comes down to whether a business earns more

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

Why Metrics Matter More Than Ideas in VC Funding. 🚀✨️ Be good at your numbers. You’ve got a bold vision and a slick pitch deck. But the moment you step into a VC meeting, the conversation shifts from your idea to your numbers. Why? Because VCs d

See More

build III

we help you build im... • 7m

After raising more than $ 45 million of investor money, here are 5 harsh truths I have learned about fundraising. 1. Investors don’t fund ideas. They fund traction. You might have the smartest solution in the room, but if you don’t have real users,

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)