Back

Karishma

Growing • 1y

Forget about Tax benefits If they make proper use of the taxes, It would save a lot of lives......

Replies (1)

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

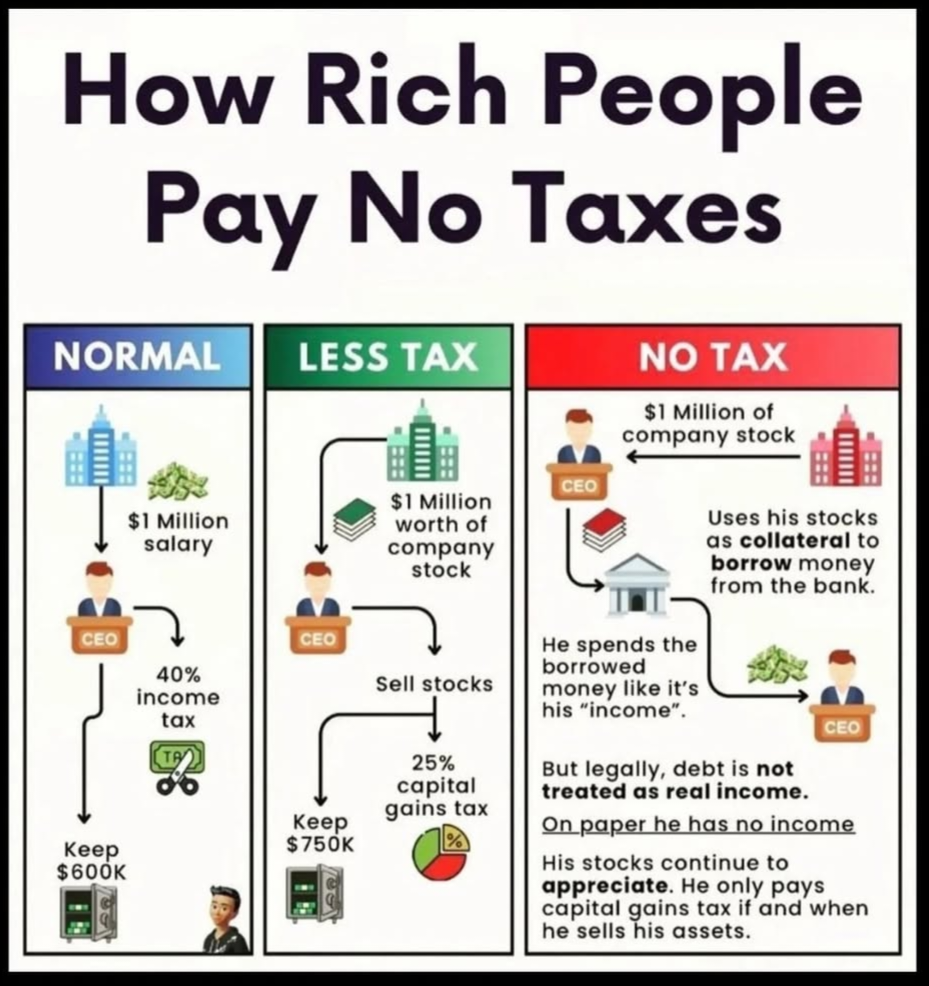

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

CA Jasmeet Singh

In God We Trust, The... • 10m

Tax season got you sweating? 😅 Here’s your survival kit: ✅ Organize receipts monthly (use apps like Expensify!). ✅ Track deductible expenses (yes, that home office counts!). ✅ Hire a CA who speaks ‘tax’ fluently—😎 DM me for a FREE tax checklist to

See More

CA Dipika Pathak

Partner at D P S A &... • 1y

Here’s a real- lesson from July 2024: Many salaried employees, while filing their ITR, realized too late that they had missed out on crucial tax planning and investment opportunities because the financial year had already closed. Don’t let this hap

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)