Back

Replies (1)

More like this

Recommendations from Medial

Dr.monisha Singhgray

Hey I am on Medial • 1y

Gray Educational Social and Environmental society up India is a registered . The society is working for Educational system specially for girls and womens and women's empowerment women's hand made items. social works and all others. this society atta

See More

Abdul Samad Pathan

Business Enthusiasti... • 1y

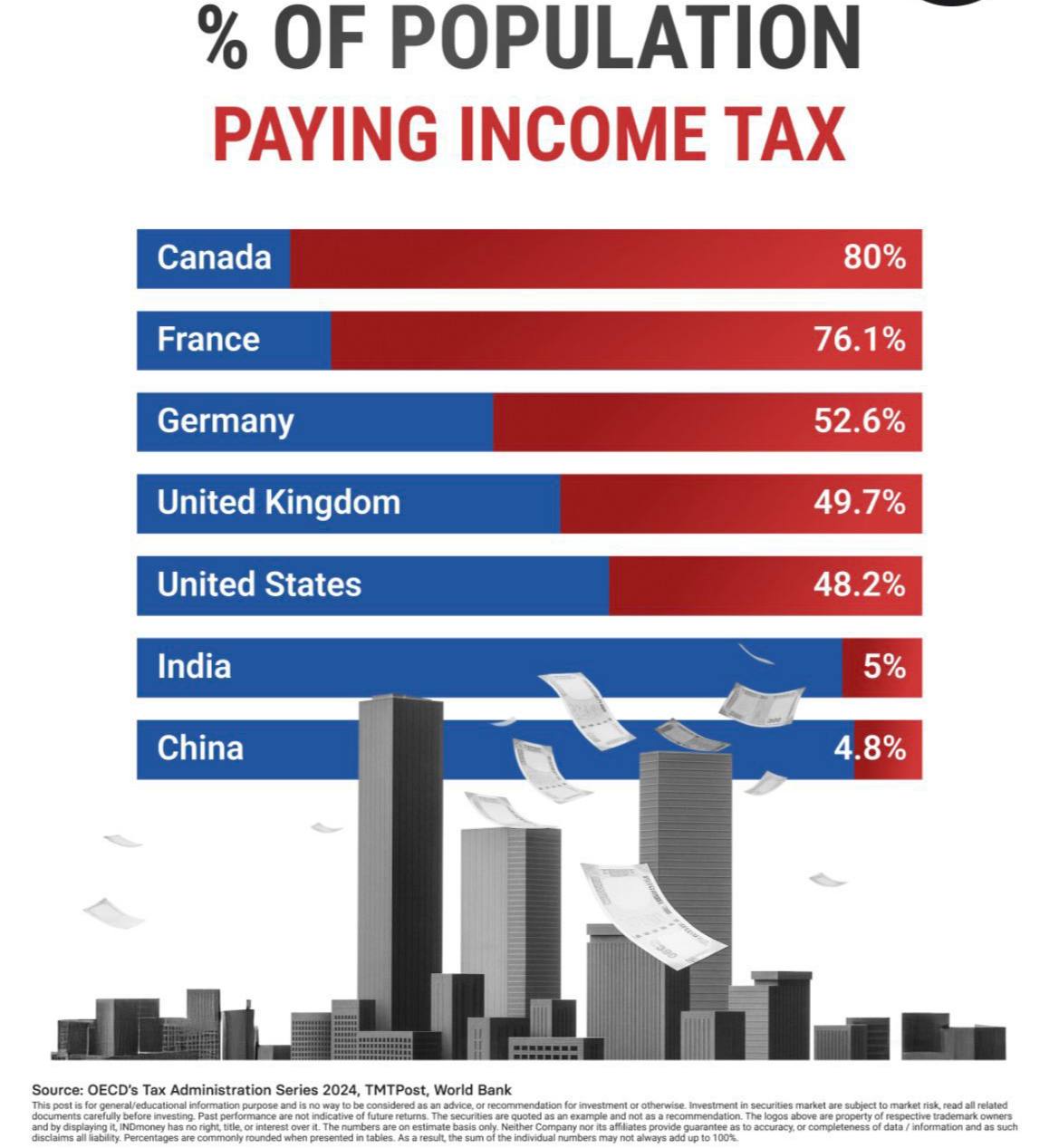

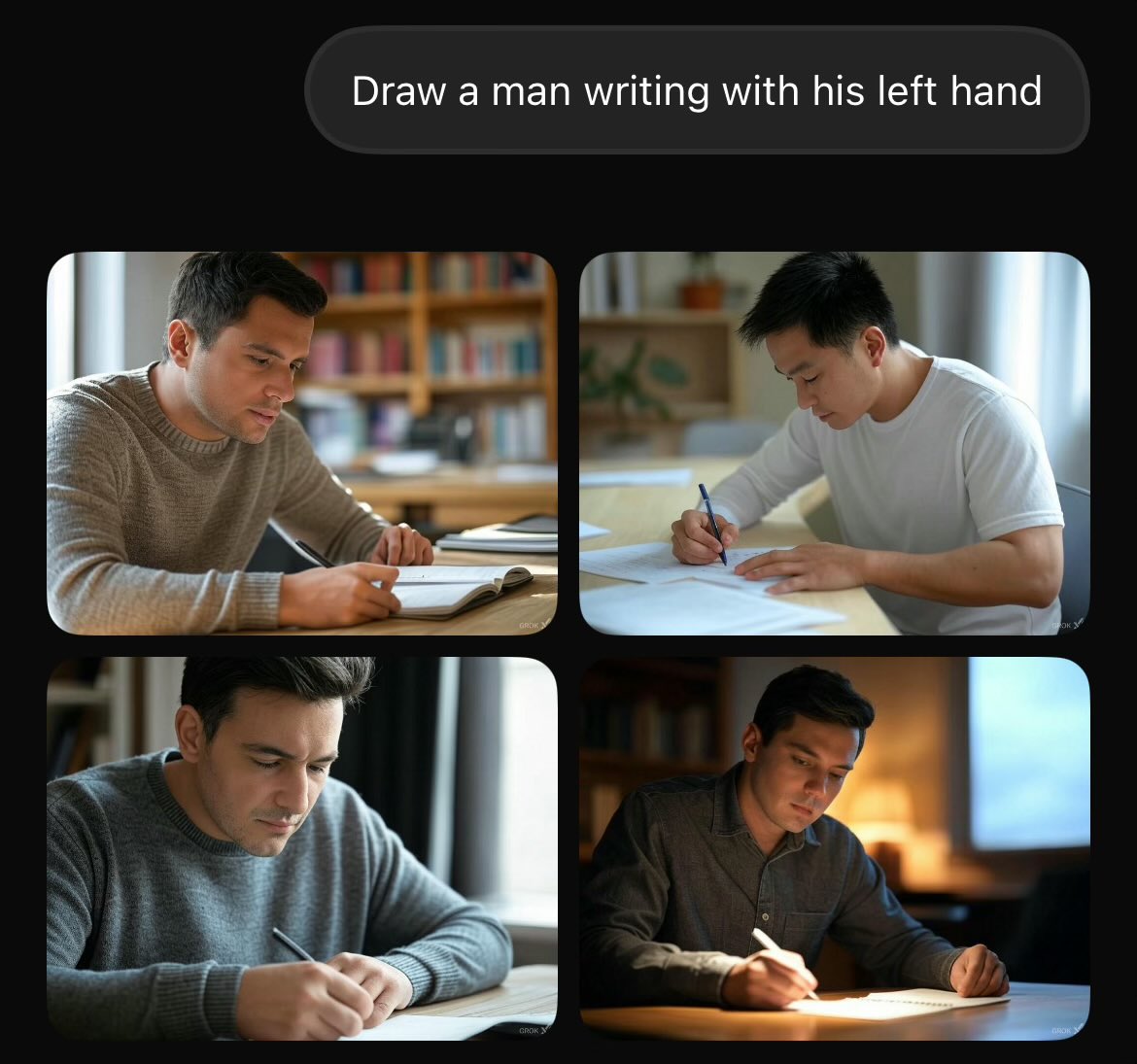

Startups in India promise to disrupt markets, but often get disrupted by endless paperwork, taxes, and compliance hurdles. It feels like innovating with one hand tied behind your back. What’s the most frustrating obstacle you’ve faced while building

See More

Anonymous

Hey I am on Medial • 1y

No matter how much we strive to reach the top 1%, let's not forget the importance of working towards improving the lives of the most vulnerable in our society. Ideas that benefit farmers and residents of tier 2 and 3 cities are always more valuable,

See More

Anonymous

•

Boston Consulting Group • 1y

Collaborative governance for trustworthy AI The US and EU are strengthening cooperation on AI safety and governance to ensure responsible development of this transformative technology. Key focus areas include aligning regulatory approaches, advancin

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)