Back

Anonymous

Hey I am on Medial • 1y

Do you guys think moving to dubai to save taxes (or any other tax haven country) is a good move? I mean it surely has its pro's but there are con's as well. Share your views!

Replies (6)

More like this

Recommendations from Medial

Aakash kashyap

Building JalSeva and... • 1y

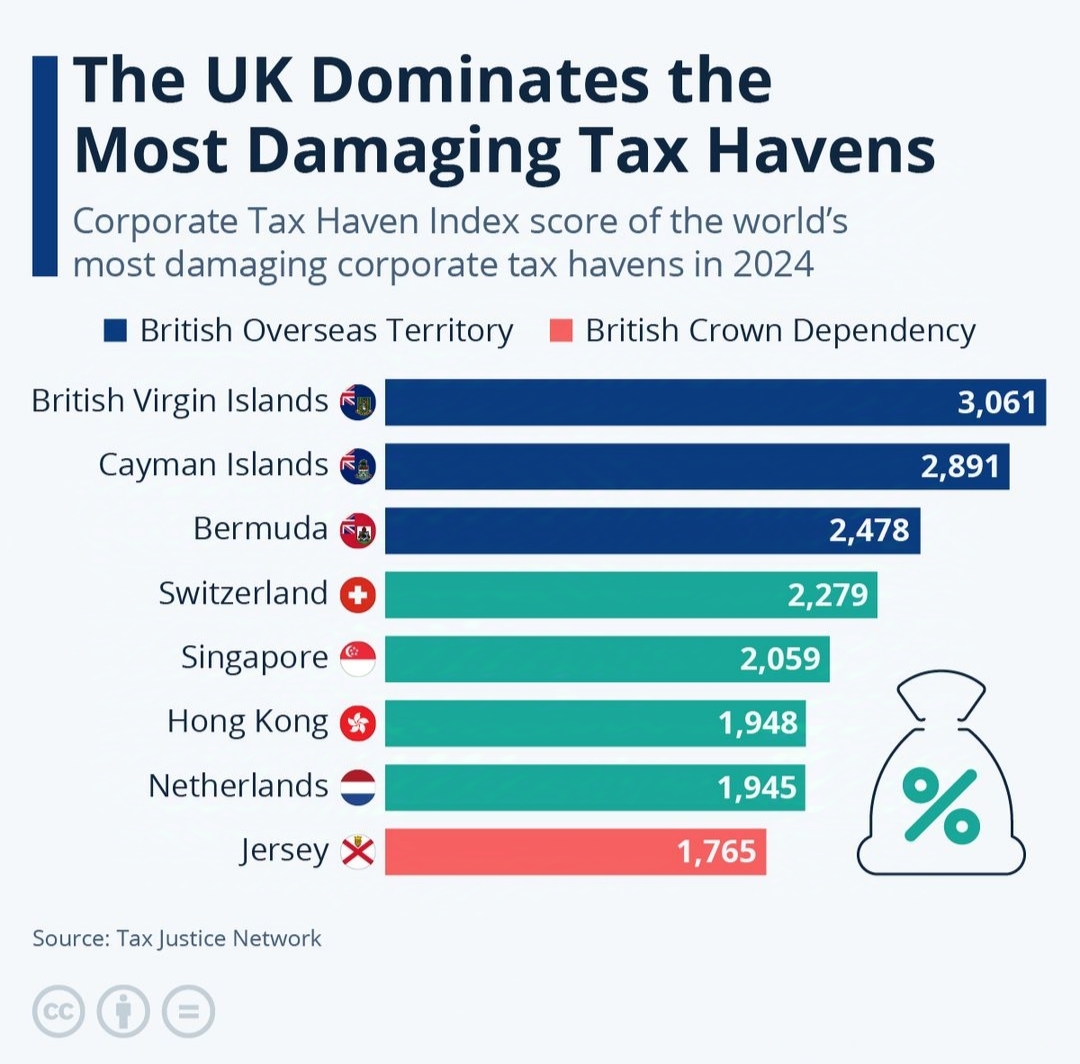

The UK's Overseas Territories Lead the Charge in Global Tax Havens – British Influence Dominates the Corporate Tax Haven Landscape in 2024 🤯 (A tax haven is a country or jurisdiction that offers low or no taxes, minimal financial transparency, an

See More

Mayank Kumar

Strategy & Product @... • 1y

What do you think the take on this should be? What should the government do to keep this from happening? This year almost 5300 millionaires are ready to leave India to countries like UAE. Do you think India lacks in providing for its citizens? Few

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

CA Dipika Pathak

Partner at D P S A &... • 1y

Here’s a real- lesson from July 2024: Many salaried employees, while filing their ITR, realized too late that they had missed out on crucial tax planning and investment opportunities because the financial year had already closed. Don’t let this hap

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)