Back

CA Dipika Pathak

Partner at D P S A &... • 1y

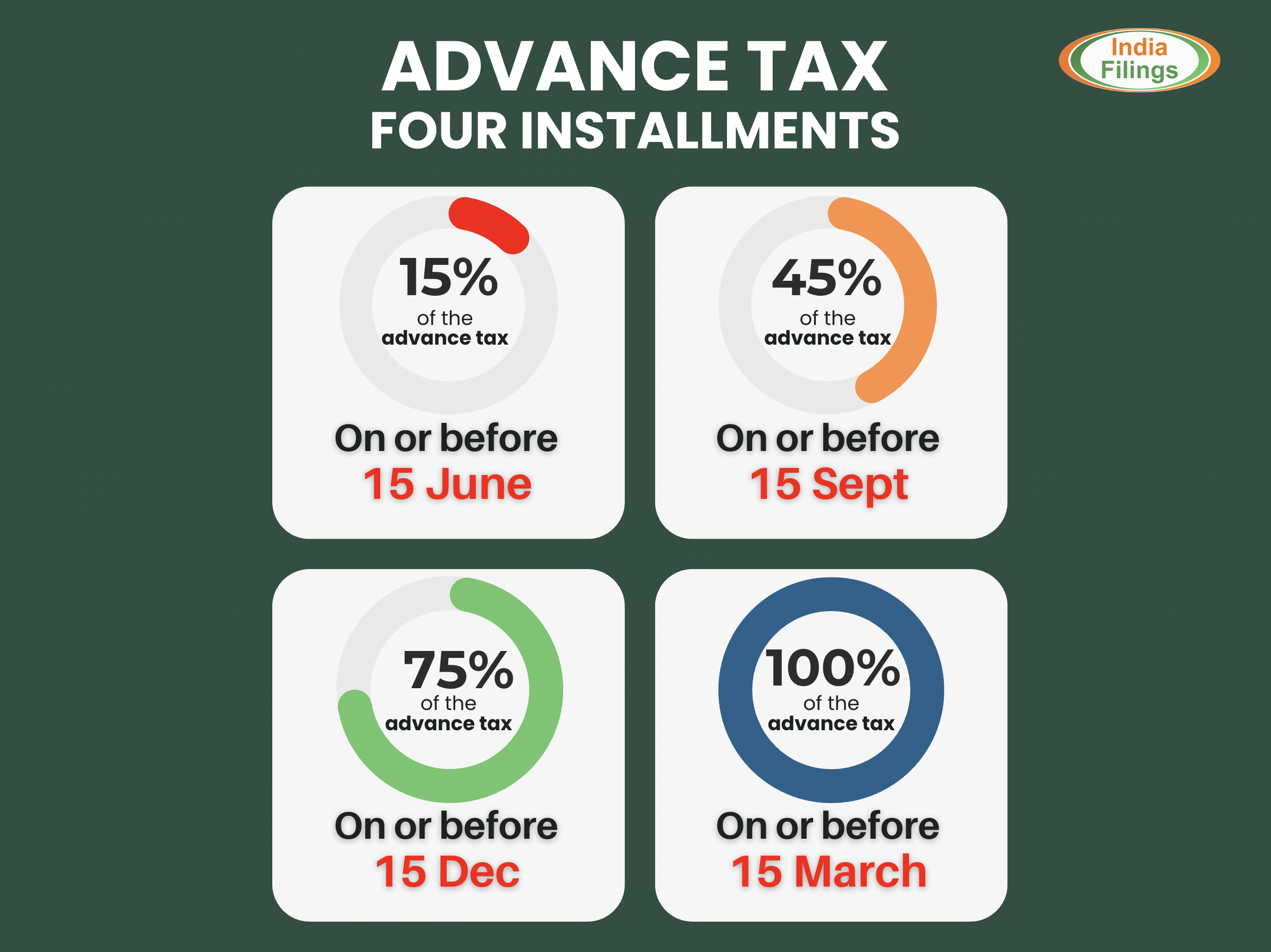

Here’s a real- lesson from July 2024: Many salaried employees, while filing their ITR, realized too late that they had missed out on crucial tax planning and investment opportunities because the financial year had already closed. Don’t let this happen to you! Always plan your taxes in advance based on your salary components. If you're in the 30% tax bracket, proactive tax planning is a must. And if you’re unsure how to go about it, seek professional help. Be smart—save more by planning your taxes wisely! Tax planning is not a crime but tax evasion is

More like this

Recommendations from Medial

calculus

Your Bottom Line Our... • 9m

📢 Income Tax Filing Awareness – Don’t Miss the Deadline! ✔️ Filing your Income Tax Return (ITR) is mandatory if your annual income exceeds the exemption limit. ✔️ It helps you avoid penalties, claim refunds, and build a strong financial record. ✔️

See MoreRabbul Hussain

Pursuing CMA. Talks... • 8m

Income Tax Update for AY 2025-26 Attention Taxpayers! Income Tax Department ne announce kiya hai ki Excel Utilities for ITR-2 and ITR-3 ab officially live hain! Yeh utilities Assessment Year 2025-26 ke liye hai, aur aap inhe portal se download ka

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)