Back

Poosarla Sai Karthik

Tech guy with a busi... • 7m

Trump has brought back a bold claim, he wants to eliminate America’s $36 trillion debt entirely. Central to this is a global tariff plan. He proposes a 10 percent tax on all imports, with higher rates for countries like China. The idea is to boost local manufacturing and raise massive revenue. But tariffs usually raise prices for American consumers and invite retaliation. What sounds like foreign revenue often becomes a domestic cost. He also wants to expand the 2017 tax cuts by making tips, overtime, and Social Security income tax free. While popular, this reduces government income without a clear way to make up the loss. Cutting taxes while trying to erase debt without deep spending cuts or rapid growth is unlikely to work. Another piece is creating a US sovereign wealth fund. He suggests selling public lands, mineral rights, or gold reserves to fund it. This could generate one time cash but it’s not a sustainable solution. You can only sell national assets once and doing so brings legal and environmental pushback. On the borrowing front, Trump’s team prefers issuing short term debt, hoping to refinance it later at lower interest rates. This is risky. If rates stay high or go higher, refinancing costs rise and so does pressure on the debt. Lastly, he wants to send tariff revenue back to citizens through rebates. While politically appealing, it defeats the point. You cannot use money to cut debt and give it away at the same time. From a distance, the plan sounds patriotic and aggressive. But zoom out and the numbers do not add up. Independent analysts say this could add another 1.6 to 7.8 trillion in debt over a decade. Even in the best case, it slows debt growth, it does not eliminate it.

More like this

Recommendations from Medial

Rishabh Jain

Start loving figures... • 1y

Is India Taxing Too Much Fun? (POPCORN TAX) India’s tax system has gone global thanks to the popcorn taxation buzz. While we’ve made strides with reforms like GST and corporate tax cuts, quirky rules and compliance hurdles can sometimes leave foreig

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

Have you read the book "Rich Dad, Poor Dad" written by "Robert Kiyosaki" . he is a genius. He admitted to having more than $1.2 billion in debt 🤯. you might have watched his yt Shorts claiming that. He views this debt as a strategic move and a par

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

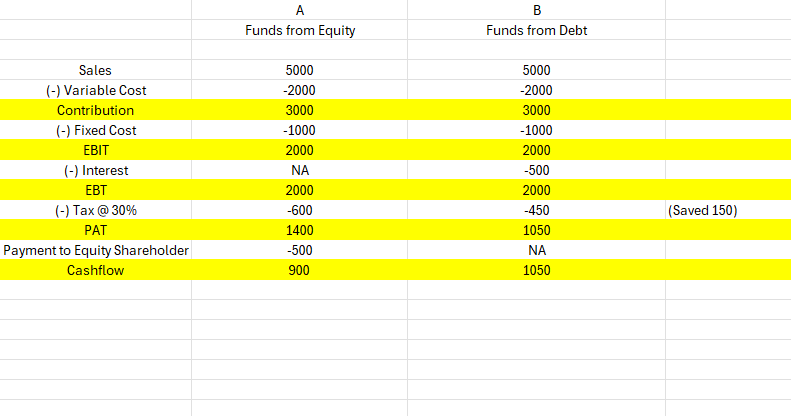

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Akshat kumar Jain

Front end developmen... • 1y

Indian household debt has skyrocketed, reaching Rs 120 trillion in March 2024, a 56% increase since June 2021. This has pushed the debt-to-GDP ratio to 42.9%, raising concerns about consumer spending. With housing loans comprising 30% and vehicle

See MoreSanskar

Keen Learner and Exp... • 1y

There exists a market whose value is estimated to range between 20% to 30% of India's GDP. Yes, I am talking about the Black market (it refers to illegal trade and transactions that occur mainly to Avoid taxes or to trade illegal goods.) But do you

See MoreB Yashwanth

Customer success ent... • 1y

Just invest 10 sec in below 👇 calculator to calculate your tax as per new regime 2025 Tax Calculator comparison as per budget 2025! https://tax.pythontrader.in/ Calculate ur tax as per new proposed slab rates .. just enter your income in this ..

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)