Back

Sanskar

Keen Learner and Exp... • 1y

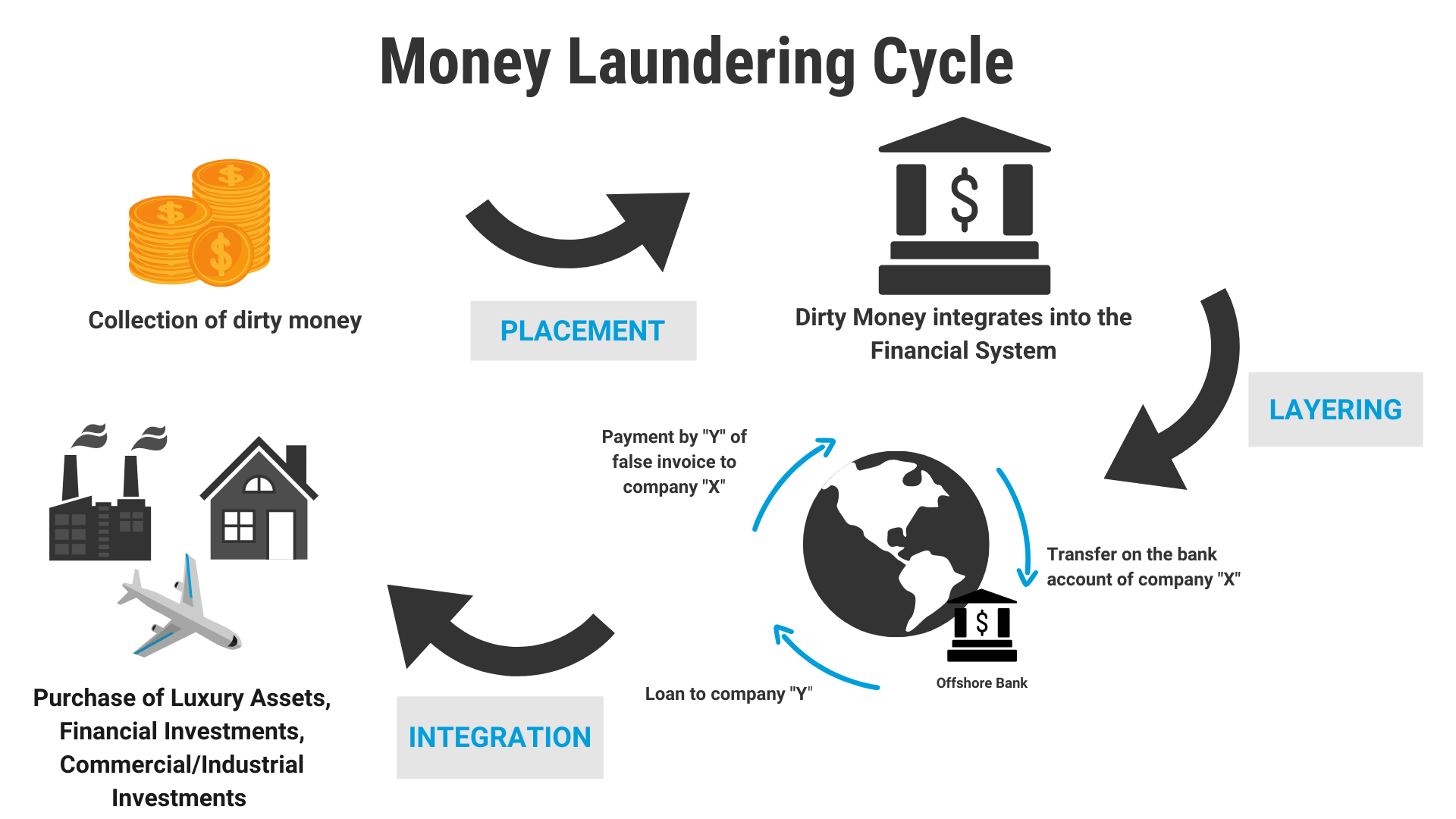

There exists a market whose value is estimated to range between 20% to 30% of India's GDP. Yes, I am talking about the Black market (it refers to illegal trade and transactions that occur mainly to Avoid taxes or to trade illegal goods.) But do you know that High taxes contributes majorly in this black market? High tax rates create strong incentives for individuals and businesses to evade taxes by underreporting income or engaging in off-the-books transactions, leading to the collection of black money. This black money then finds its way into the hands of organized crime syndicates and the underworld. By using which these groups finance illegal activities such as drug dealing, human trafficking, and other criminal Activities. Solutions: 1. Tax rates should be revised every year or two according to the inflation. 2. Tax should act as a responsibility not a burden. (lower tax rates). 3. Money should not be given to those states who cannot use ut responsibly. 4. Reduce in corruption.

Replies (1)

More like this

Recommendations from Medial

Aakash kashyap

Building JalSeva and... • 1y

Do you think Bitcoin will continue to outpace traditional payment systems like Visa and Mastercard in transaction value? What does this mean for the future of finance? 💬 Bitcoin is commonly used on the dark web due to its pseudonymous nature, all

See More

Account Deleted

Hey I am on Medial • 1y

In India, taxes like income tax are really high, but the public services don't seem to match. My suggestion: If someone pays ₹5 crore in tax, the govt should tell them, 'Instead of paying us, invest that money in your local area—build roads, schools,

See MoreSanskar

Keen Learner and Exp... • 1y

In 2016, a German journalist Bastian Obermayer has published 11.5M documents online. These documents contained details about financial tax evasion and money laundering of the VIPs and VVIPs. This list contained the names of 11 world leaders, politic

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreCryptoMYN

Investor and trader • 1y

We are working on an Idea that involves around cryptocurrency in which we can use use our own crypto as payment on our daily day to day transactions. Here in which we also can trade and invest our money in the most advanced and realest technology. So

See MoreSanjay Srivastav. Footwear Designer

Hey I am on Medial • 1y

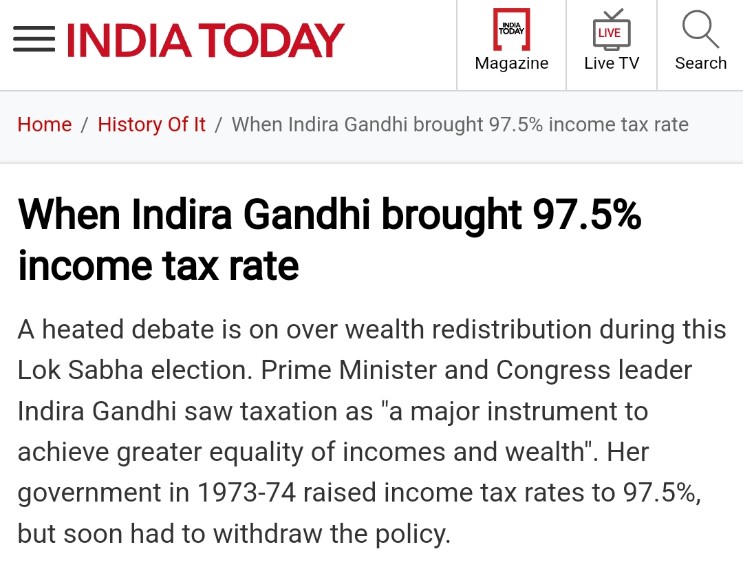

Of course the value of money has changed but it's a great comparison. It does not show Congress taxed the rich btw. Nobody was paying 97.5% tax. They were just paying bribes to Congress to keep money black. That's how they destroyed our economy.

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)