Back

Sanskar

Keen Learner and Exp... • 1y

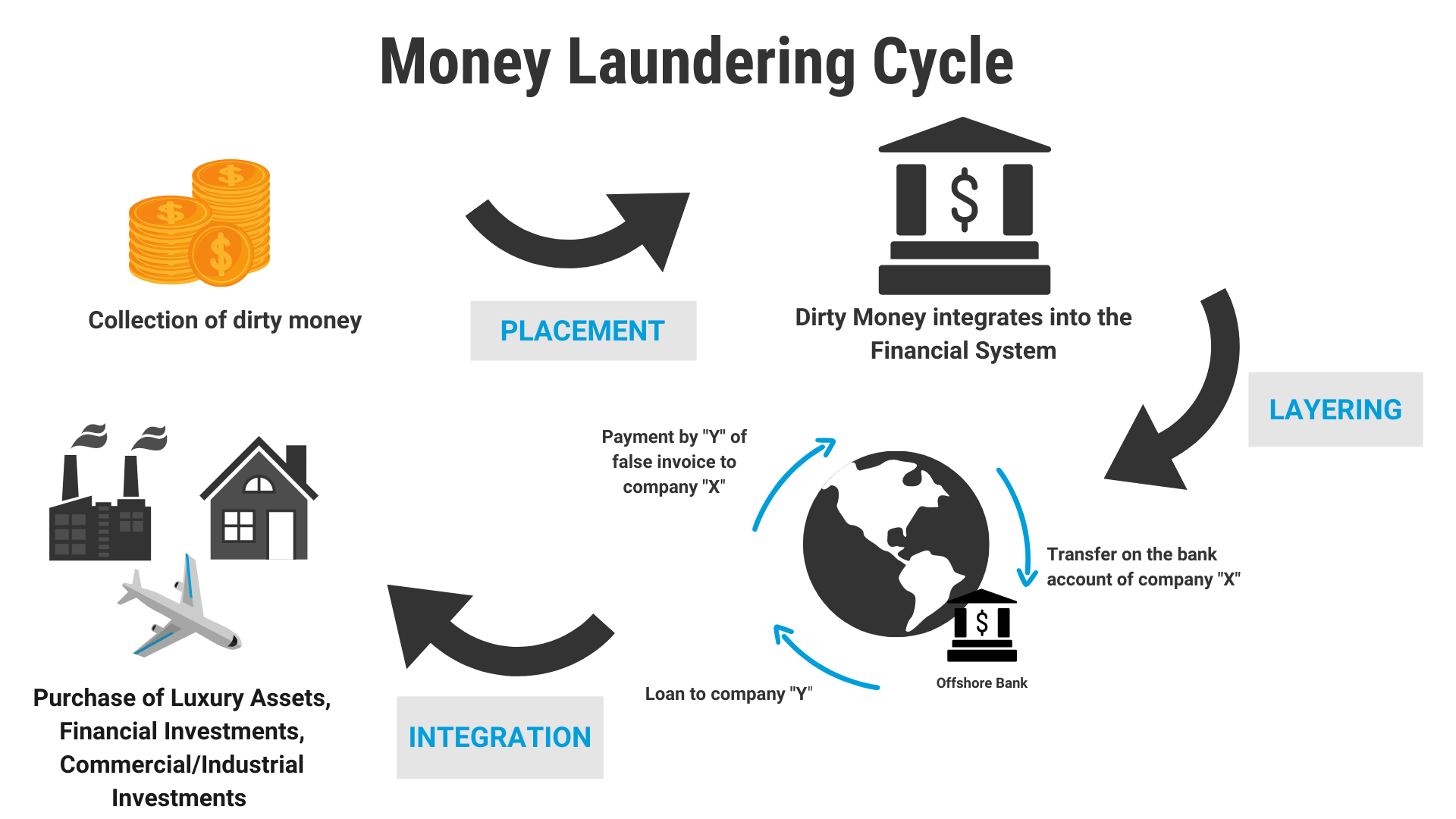

In 2016, a German journalist Bastian Obermayer has published 11.5M documents online. These documents contained details about financial tax evasion and money laundering of the VIPs and VVIPs. This list contained the names of 11 world leaders, politician and film stars. From Amitabh Bachchan to Nawaz Sharif to Vladimir Putin all were included in this list. These papers were called Panama papers. These papers belonged to a law firm situated in Panama named Mossack Fonseca. The ultra rich uses this firm for tax evasion, hiding their money, money laundering and making their black money white. Mossack Fonseca alone control almost half the companies in Panama these were of course fake companies. Countries like Panama, Cyprus and Cayman Island are know as tax heavens as they don't share the data of companies operating in their land. Business man here opens fake companies and invest their money in them convert their black money white, save tons of taxes and do money laundering with ease.

Replies (4)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 10m

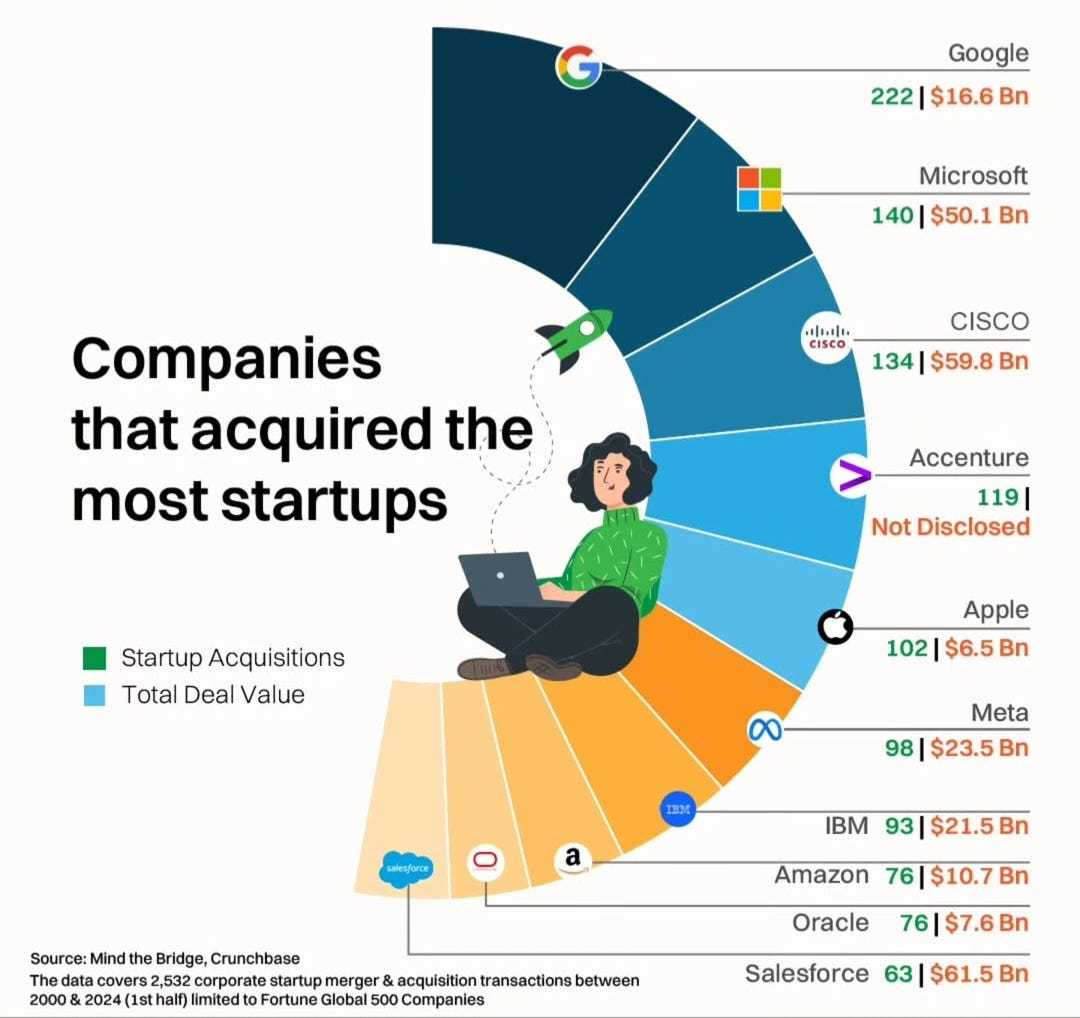

30+ Strategies How Billionaires Avoid Taxes. 🚀 1. Double Irish with a Dutch Sandwich 2. Tax Haven Residency 3. Offshore Shell Companies 4. Trust Funds 5. Carried Interest Loophole 6. Capital Gains Tax Rate 7. Intellectual Property Rights Shifts 8.

See MoreSanjeev Antal

OG Founder & CEO - P... • 1y

🚨 GST Council Introduces 'Track and Trace' Mechanism 🚨 The GST Council has approved a 'track and trace' system to combat tax evasion in specific industries. Cigarettes and pan masala are expected to be the initial focus of this initiative. Key H

See MoreCA Dipika Pathak

Partner at D P S A &... • 1y

Here’s a real- lesson from July 2024: Many salaried employees, while filing their ITR, realized too late that they had missed out on crucial tax planning and investment opportunities because the financial year had already closed. Don’t let this hap

See More

Anonymous

Hey I am on Medial • 1y

How these sharks can invest so much in so many businesses?? They do not get exit early, their companies are running in loss and they have to use money in their business too? How are they having money to invest in other businesses? What is actually h

See More

Anonymous

Hey I am on Medial • 1y

In an attempt to encourage more investments in the Indian startup ecosystem, Union Finance Minister Nirmala Sitharaman announced that the angel tax will be abolished for all classes of investors. The angel tax, introduced in 2012 to prevent money la

See More

Sameer Patel

Work and keep learni... • 1y

PAN Card The PAN (Permanent Account Number) card is a ten-digit alphanumeric identifier issued by the Income Tax Department of India. It's crucial for various financial transactions such as opening a bank account, filing income tax returns, and buyin

See MoreSai Vishnu

Income Tax & GST Con... • 11m

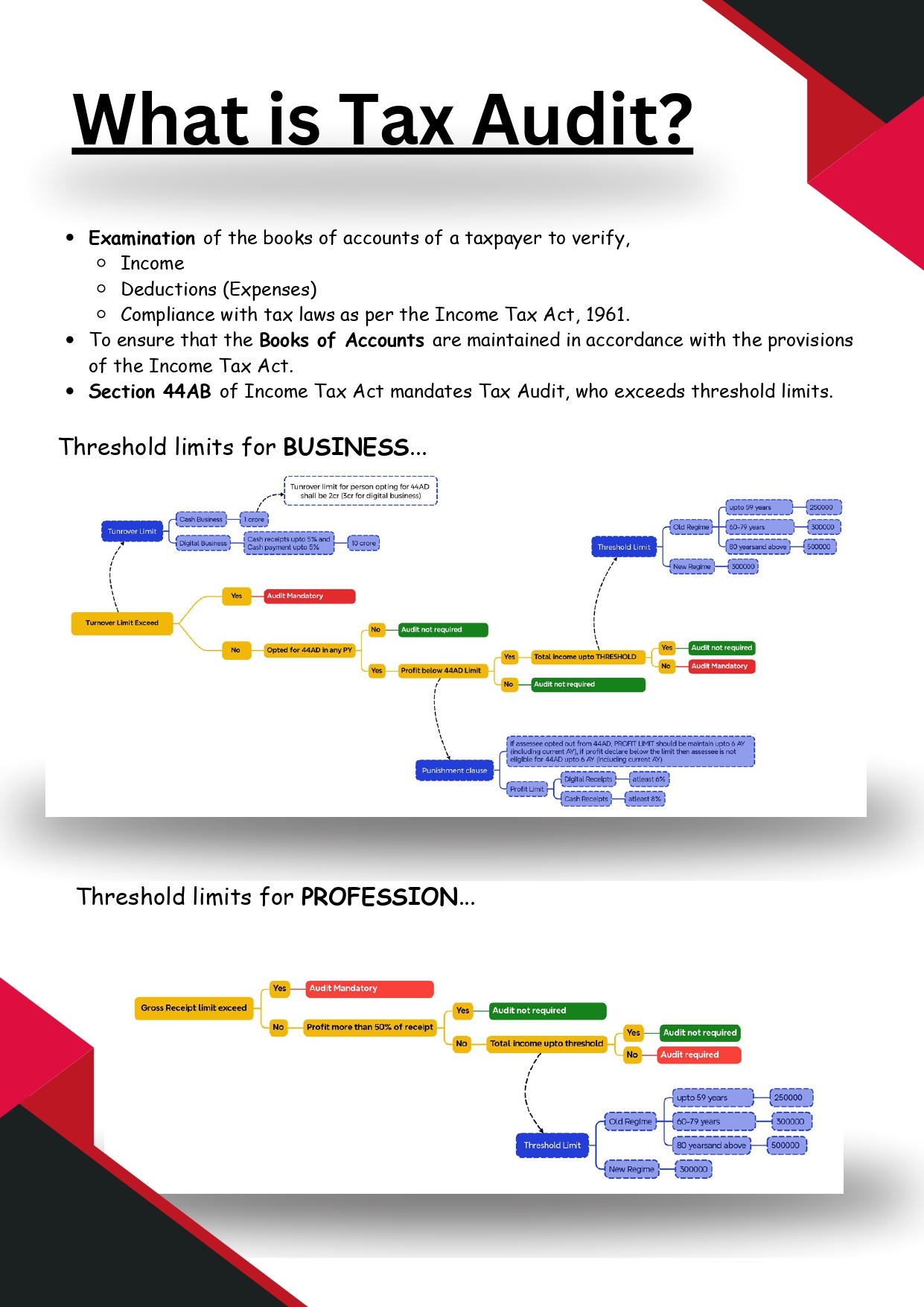

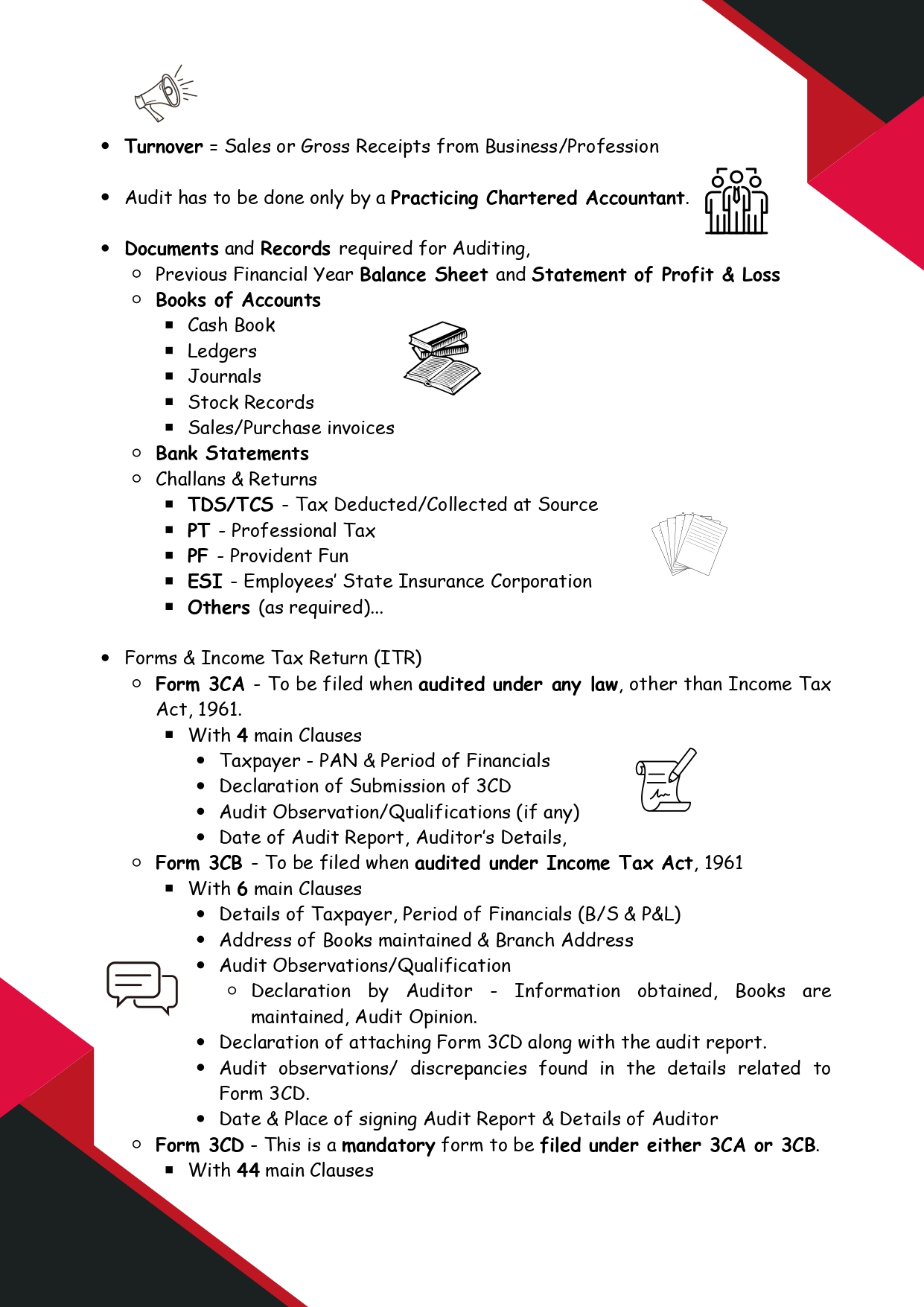

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)