Back

Replies (1)

More like this

Recommendations from Medial

Aakash kashyap

Building JalSeva and... • 1y

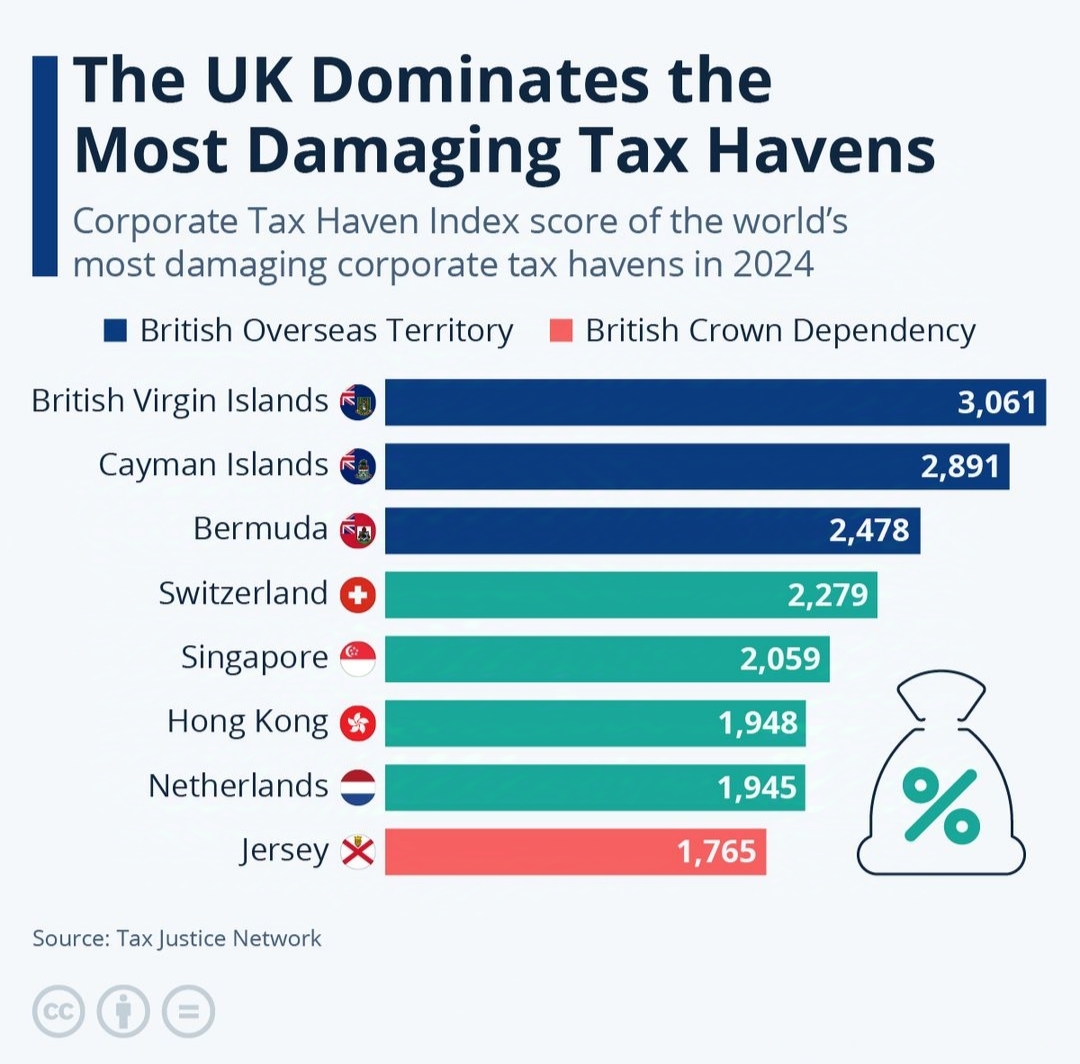

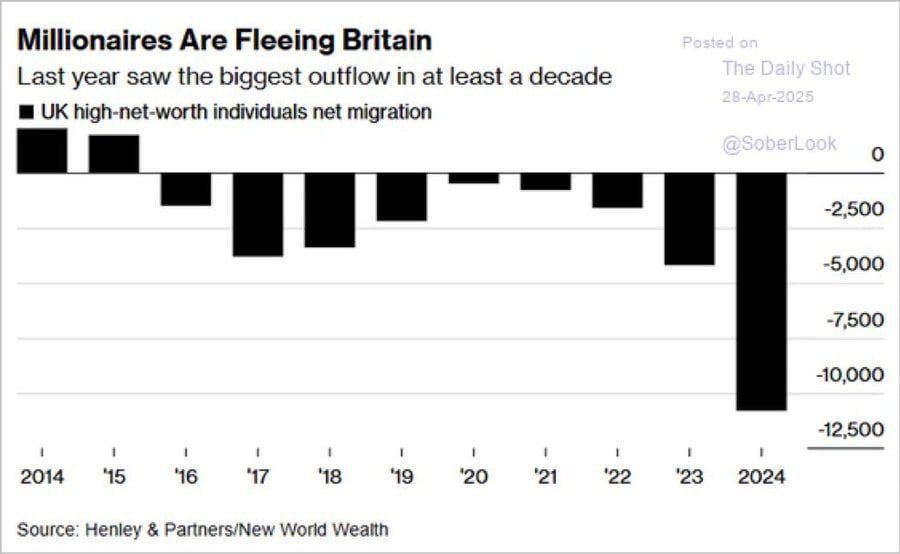

The UK's Overseas Territories Lead the Charge in Global Tax Havens – British Influence Dominates the Corporate Tax Haven Landscape in 2024 🤯 (A tax haven is a country or jurisdiction that offers low or no taxes, minimal financial transparency, an

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 10m

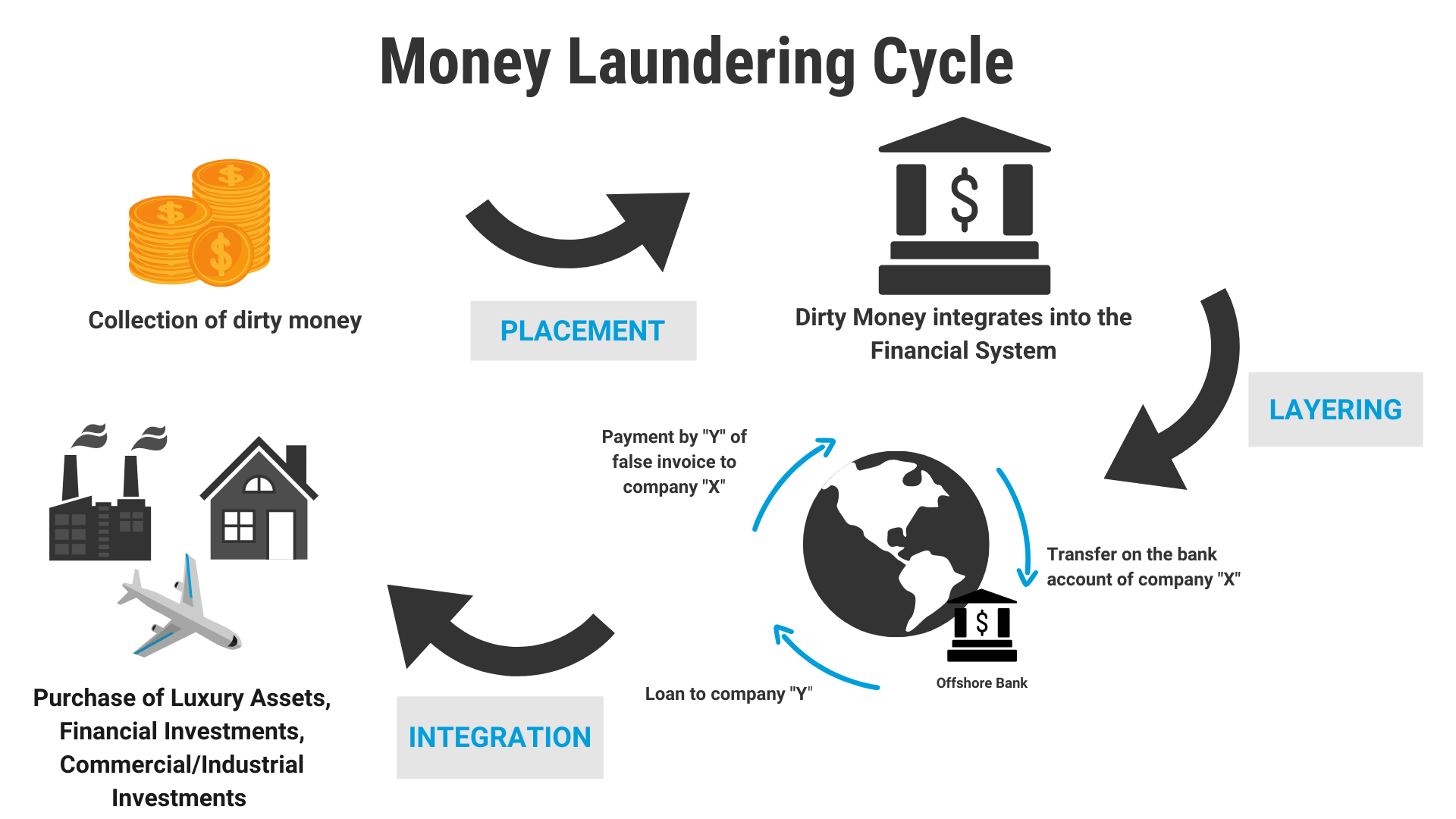

30+ Strategies How Billionaires Avoid Taxes. 🚀 1. Double Irish with a Dutch Sandwich 2. Tax Haven Residency 3. Offshore Shell Companies 4. Trust Funds 5. Carried Interest Loophole 6. Capital Gains Tax Rate 7. Intellectual Property Rights Shifts 8.

See MoreRohan Saha

Founder - Burn Inves... • 11m

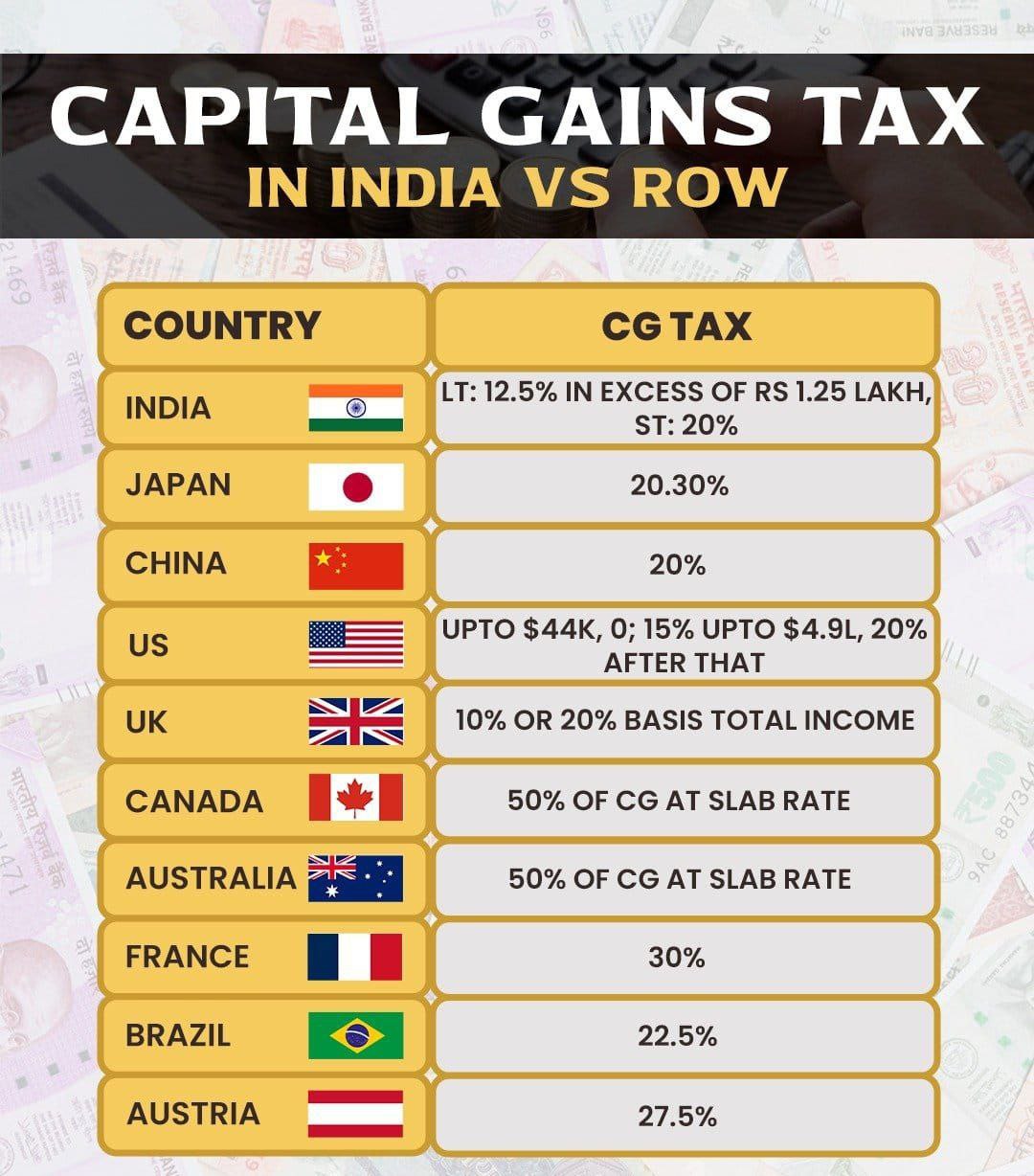

When comparing capital gains tax across different countries, India's main competitors are China and Brazil. Interestingly, both China and Brazil impose higher capital gains taxes than India. However, it's important to note that India also levies a Se

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)