Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 10m

30+ Strategies How Billionaires Avoid Taxes. 🚀 1. Double Irish with a Dutch Sandwich 2. Tax Haven Residency 3. Offshore Shell Companies 4. Trust Funds 5. Carried Interest Loophole 6. Capital Gains Tax Rate 7. Intellectual Property Rights Shifts 8. Tax Loss Harvesting 9. SALT Deduction Cap Workarounds 10. Real Estate Depreciation Deduction 11. 1031 Exchange (Property Swap) 12. Charitable Remainder Trusts 13. Qualified Small Business Stock Exclusion 14. Life Insurance Borrowing 15. Executive Stock Options 16. Inversion Mergers 17. Step-Up in Basis Loophole 18. GILTI Tax Avoidance 19. Corporate Debt Shifting 20. Dynasty Trusts 21. Income Shifting 22. Panama Papers 23. Lux Leaks 24. The Paradise Papers 25. IRS Settlement Deals 26. Swiss Bank Accounts 27. Art and Collectibles Investment 28. Foreign Tax Credits Manipulation 29. Foundation Investment Vehicles 30. Tax-Free Bond Investments 31. Offshore Life Insurance Policies

Replies (2)

More like this

Recommendations from Medial

Sanskar

Keen Learner and Exp... • 1y

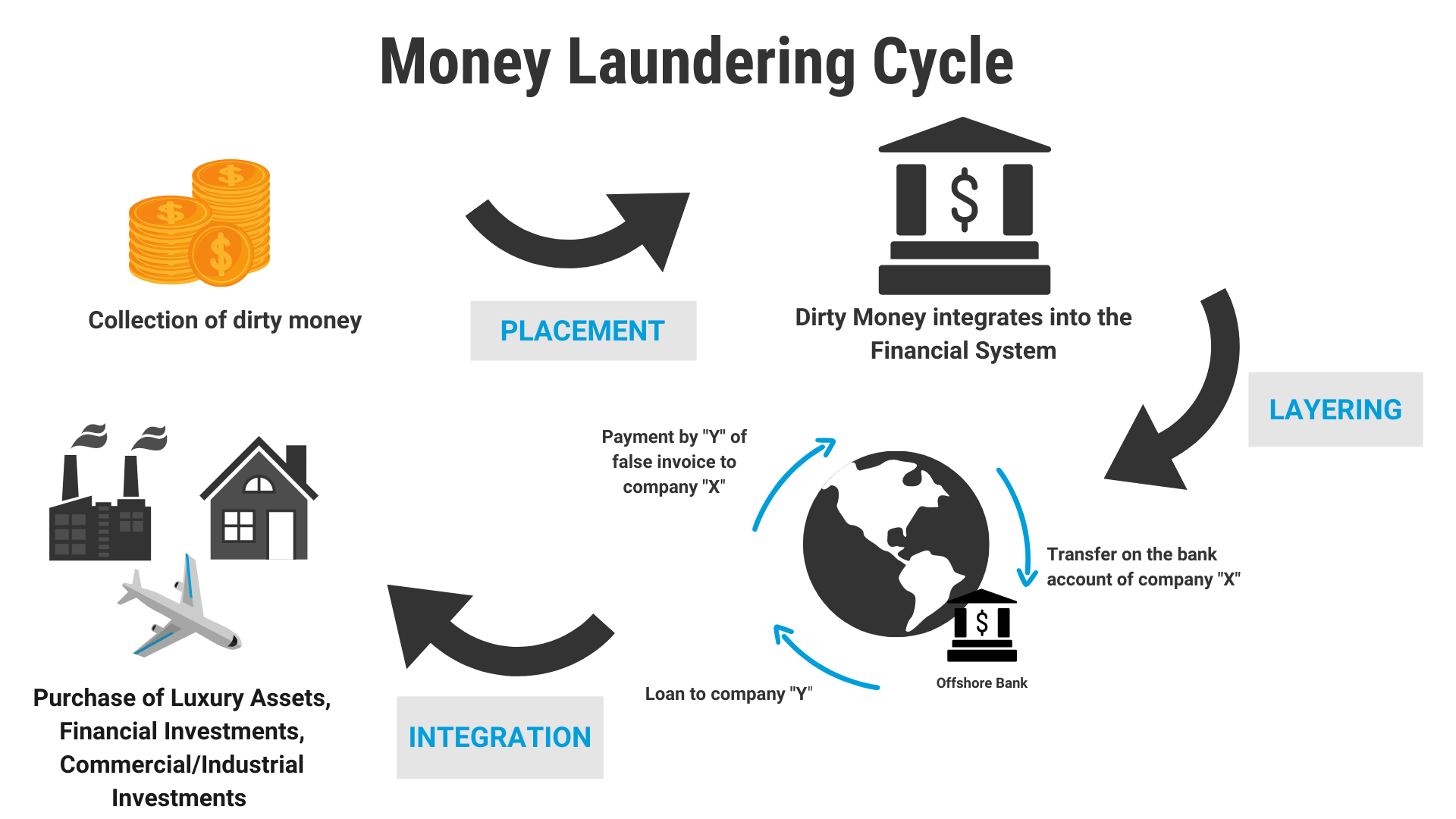

In 2016, a German journalist Bastian Obermayer has published 11.5M documents online. These documents contained details about financial tax evasion and money laundering of the VIPs and VVIPs. This list contained the names of 11 world leaders, politic

See More

Bharat Yadav

Betterment, Harmony ... • 1y

Key Financial Considerations for Medical Professionals 1 . Debt Management: Strategize student loan repayment, credit cards, and personal loans. 2. Retirement Planning: Maximize tax-advantaged accounts (401(k), IRA). 3. Investments: Diversify portfol

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)