Back

Chandni Das

Hey It's me Chandni • 1y

I agree with your points especially these two :- We should feel that, Tax is our responsibility not a burden and money should not be given to those states who can't use it responsibly.

More like this

Recommendations from Medial

Sanskar

Keen Learner and Exp... • 1y

There exists a market whose value is estimated to range between 20% to 30% of India's GDP. Yes, I am talking about the Black market (it refers to illegal trade and transactions that occur mainly to Avoid taxes or to trade illegal goods.) But do you

See MoreKimiko

Startups | AI | info... • 9m

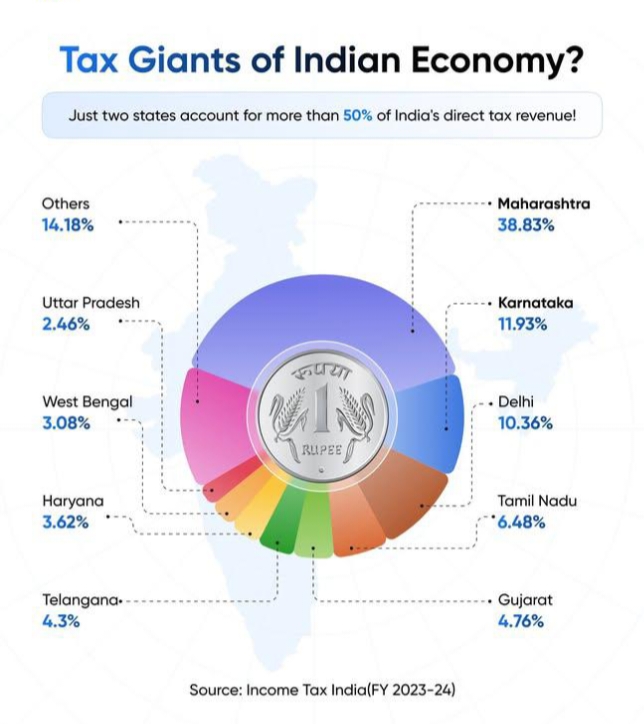

Over half of India’s direct tax revenue — from individuals, corporates, and businesses and more— comes from just two states. This revenue is the backbone funding our infrastructure, healthcare, and education. Comment below and tell us: which state do

See More

Shravankumar

Hey I am on Medial • 27d

Publishing content online is easy. Taking responsibility for it is not. With OTP-based verification and government-verified identity linkage, platforms can ensure accountability without compromising privacy. Digital platforms have scaled. Digital res

See MoreSairaj Kadam

Student & Financial ... • 1y

After a long time. Back to Reality: The Budget's Hidden Cost "Hidden Costs of the New Tax Regime" Everyone's talking about the lower tax slabs in the new income tax regime. But has anyone considered the long-term implications? By drastically redu

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)