Back

Kimiko

Startups | AI | info... • 9m

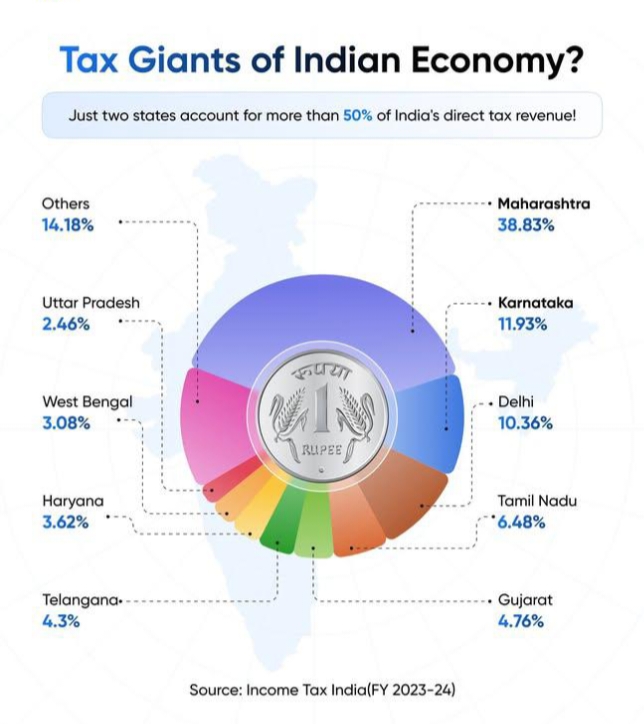

Over half of India’s direct tax revenue — from individuals, corporates, and businesses and more— comes from just two states. This revenue is the backbone funding our infrastructure, healthcare, and education. Comment below and tell us: which state do you belong to?

More like this

Recommendations from Medial

Poosarla Sai Karthik

Tech guy with a busi... • 4m

Petrol analysis: Pricing Patterns: Petrol varies from ₹82.46 (Andaman) to ₹109.46 (Andhra), driven by state VAT, not crude ($60/barrel). Taxes (50-60% of price) dominate. Consumer Behavior: High prices in Andhra/Kerala suggest reduced travel, boost

See MoreDr Bappa Dittya Saha

We're gonna extinct ... • 5m

The Great Shift in Indian Healthcare: Corporates Rising, Clinics Struggling India’s healthcare is undergoing a silent transformation. Over the last five years: 🏥 Corporate hospitals, backed by billions in private equity and venture capital, have

See More

Jayant Mundhra

•

Dexter Capital Advisors • 1y

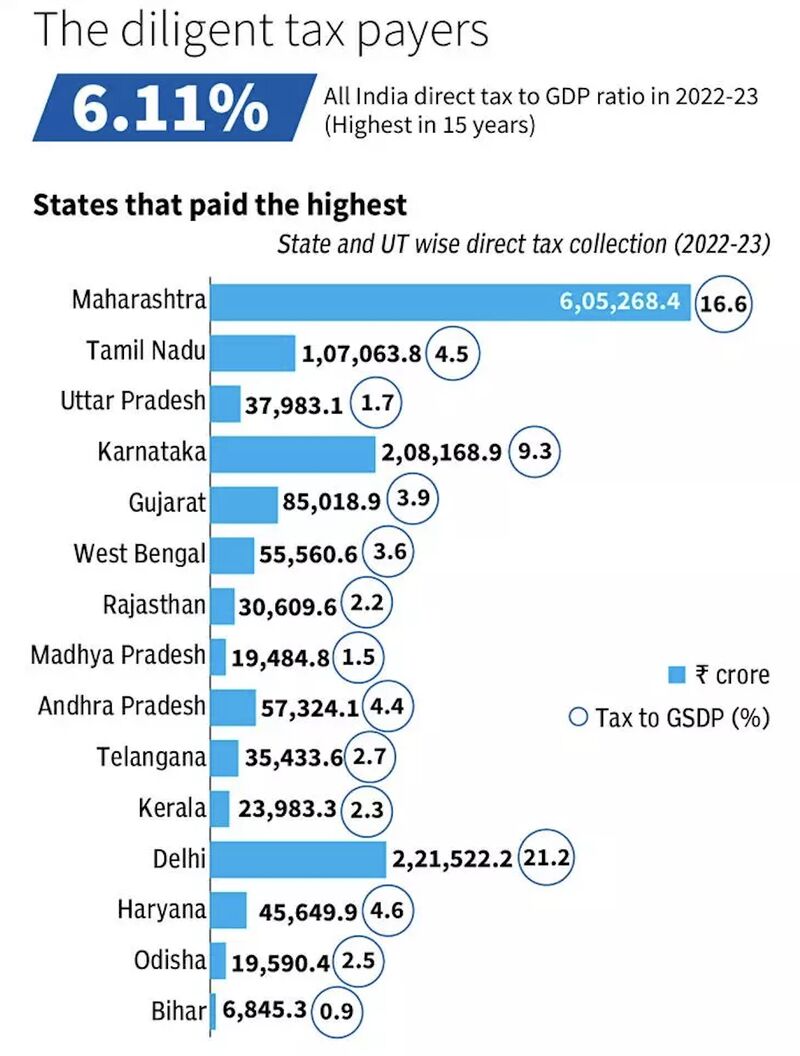

I know that Delhi, Maharashtra and Karnataka account for much of India’s income tax collections. But, the fact that Delhi’s direct tax to GDP ratio is as much as 21%, while for Bihar it’s 0.9% - That is staggering! 🤯🤯 Came across this fantastic H

See More

Prem Siddhapura

Unicorn is coming so... • 1y

**Tax Revenue Hits Record Highs** 📈 The government’s net direct tax collection, post-refunds, surged 15.4% to ₹12.3 lakh crore between April and November 10, 2024. Gross collections also saw a robust 21.2% increase, reaching ₹15.02 lakh crore. 💰

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)