Back

Kimiko

Startups | AI | info... • 9m

Higher IGST revenue often indicates a state is a manufacturing and exporting hub (e.g., Maharashtra, Karnataka, Rajasthan). Conversely, higher SGST revenue can suggest a state with strong consumer and retail activity (e.g., Gujarat, Tamil Nadu, UP). This is because IGST is levied on inter-state supplies, while CGST and SGST are collected together on intra-state supplies.

Replies (1)

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 1 Evolution of GST across the years - 2000 - PM introduced the concept of GST and set up a committee 2006 - Announced by FM that GST to be introduced from 1st April 2010 2014 - Bill introduced in Lok Sabha 2015 - Bill passed in Lok Sa

See MorePoosarla Sai Karthik

Tech guy with a busi... • 4m

Petrol analysis: Pricing Patterns: Petrol varies from ₹82.46 (Andaman) to ₹109.46 (Andhra), driven by state VAT, not crude ($60/barrel). Taxes (50-60% of price) dominate. Consumer Behavior: High prices in Andhra/Kerala suggest reduced travel, boost

See MorePoosarla Sai Karthik

Tech guy with a busi... • 4m

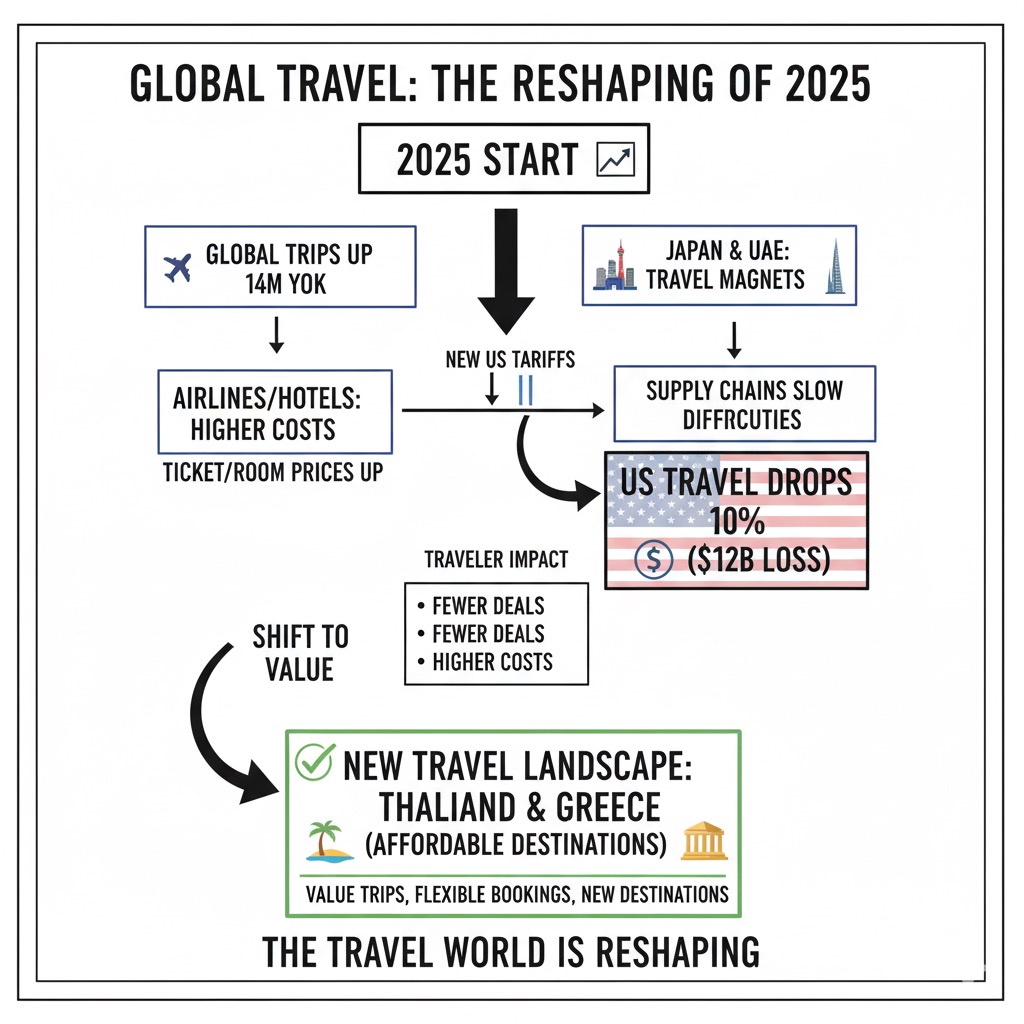

Global travel isn’t dying. It’s just moving. 1. 2025 started strong. Global trips were up by 14M YOY (year over year). People were traveling again after the pandemic, and places like Japan and the UAE became major travel hotspots. 2. Then came new

See More

sindiri vinay kumar

Dream it achieve it • 9m

Concept Summary: states are treated like stocks — each state has its own "stock" on an exchange. Investors buy shares in a city. The invested funds go directly into infrastructure, public services, or urban development projects. Shareholders rece

See MoreKetu Kashyap

Disruptor | Visionar... • 8m

In India's rural and low-tier cities, unorganized peer-to-peer land sales and agri-leasing (for cash/grains) thrive. Land prices range ₹1.5L–₹40L/acre, offering investment potential amid govt infrastructure push. India's P2P land market spans 25.12–

See MorePoosarla Sai Karthik

Tech guy with a busi... • 6m

India is planning to change the GST system from four slabs to just two. The 12% slab will come down to 5%, the 28% slab will drop to 18%, and luxury or sin goods could be taxed at a new 40% rate. This is one of the biggest tax changes since GST start

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)