Back

Jayant Mundhra

•

Dexter Capital Advisors • 1y

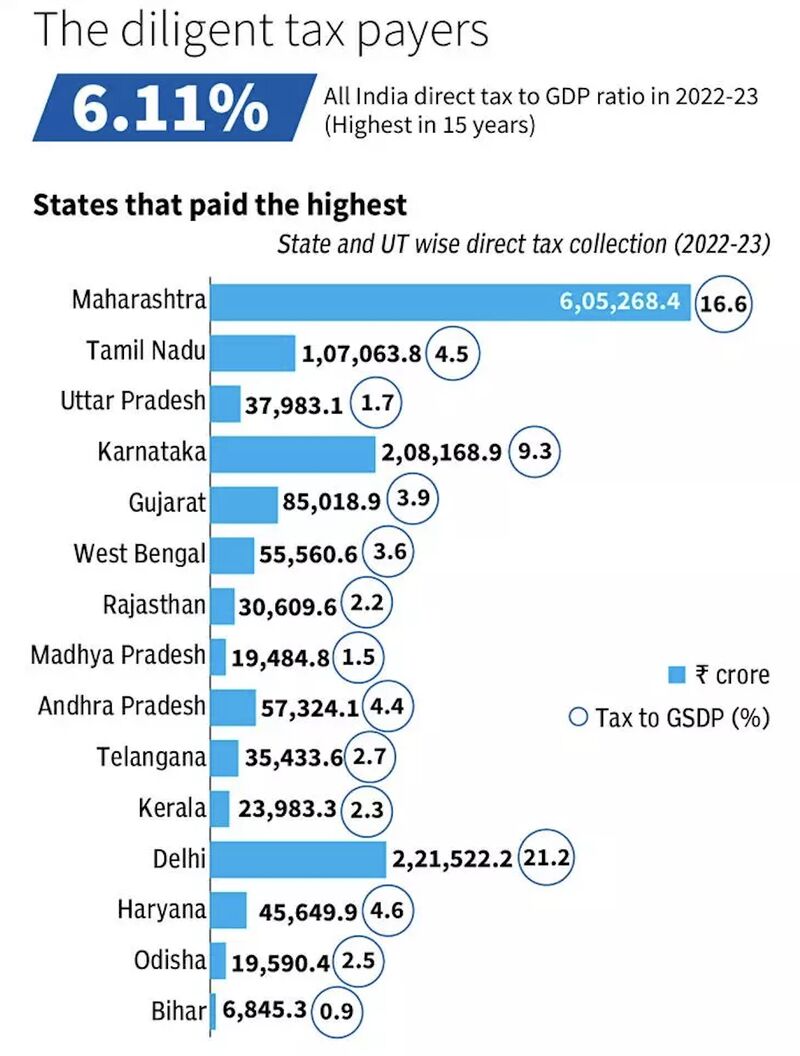

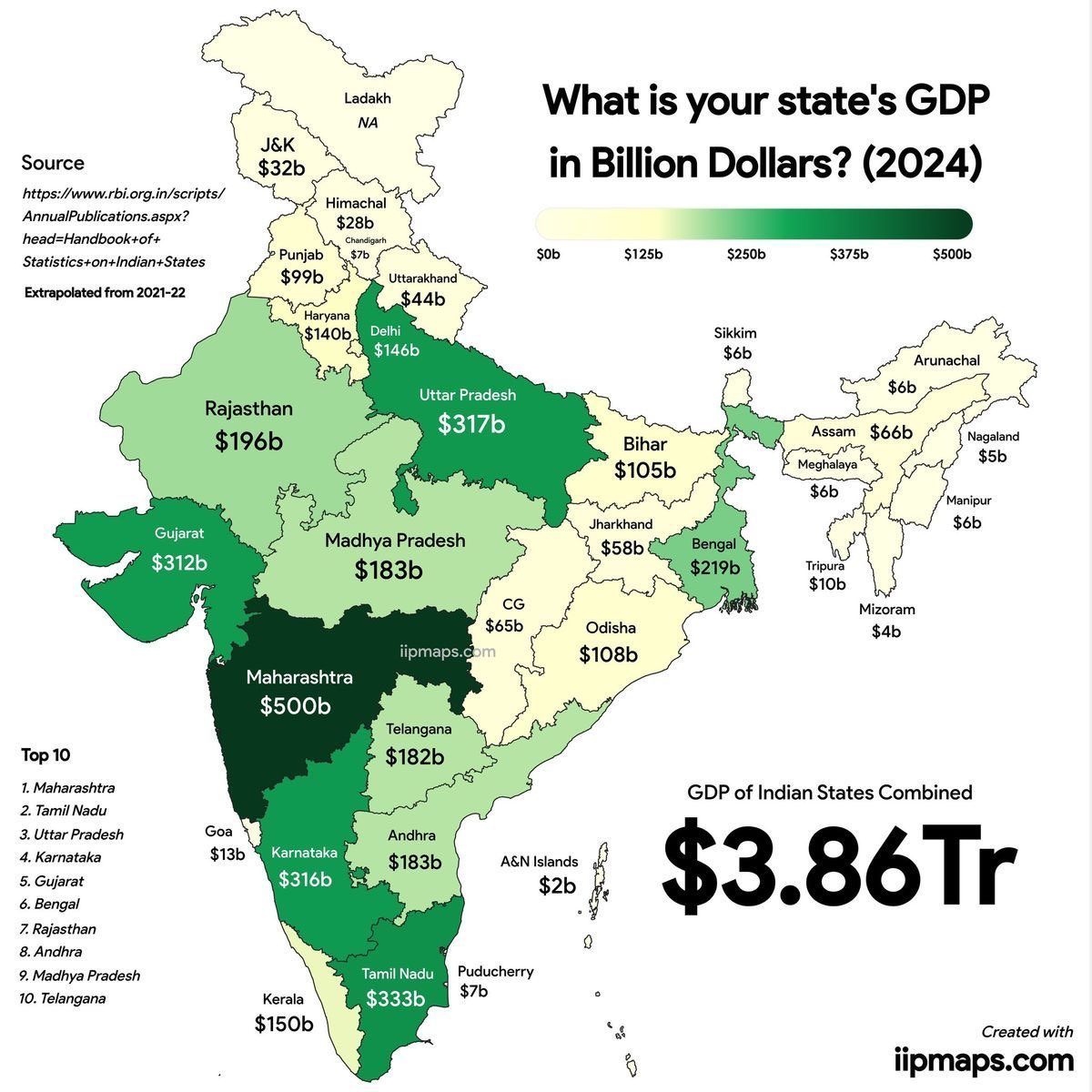

I know that Delhi, Maharashtra and Karnataka account for much of India’s income tax collections. But, the fact that Delhi’s direct tax to GDP ratio is as much as 21%, while for Bihar it’s 0.9% - That is staggering! 🤯🤯 Came across this fantastic Hindu Businessline report, which analysed the direct tax contribution to GDP for 15 states and UTs. And what I learned left me nuts! .. So, Delhi’s direct tax to GDP stands out as the highest at 21.2%. -> And at the second and third spot at Maharashtra and Karnataka at 16.6% and 9.3% respectively -> Now, if you notice, the gap between Maharashtra and Karnataka is humongous, indicating how much of the state’s GDP/economy is led by activities where people don’t earn enough, or earn what’s non-taxable But, what’s strange is how this %age falls for 4th and 5th rankers, which makes Karnataka’s figures look like fantastic 😅😅 .. Let me explain. At the fourth spot, we have Haryana, which has a direct tax-to-GDP ratio of just 4.6% - Half of Karnataka’s! Then you have Tamil Nadu at 4.5% and Gujarat at just 3.9%. And this should explain why we lag behind as a country. .. The best and biggest of our state economies, like TN and Gujarat, also have a majority of people employed in activities which don’t earn them much. While getting people jobs is a big problem that these states have solved masterfully, ensuring an income that reduces the income tax burden on a select few Indians is something that continues to persist. And well, that’s something that must be a national priority. .. Why do I say that? Look at other states - You have West Bengal at 3.6%, Telangana at 2.7%, Kerala at 2.3%, Rajasthan at 2.2%, and UP at 1.7%. And then you have Bihar at a pathetic 0.9%! 😅😅 Need I say more? ..

Replies (6)

More like this

Recommendations from Medial

Shubham Khandelwal

Software Engineer • 1y

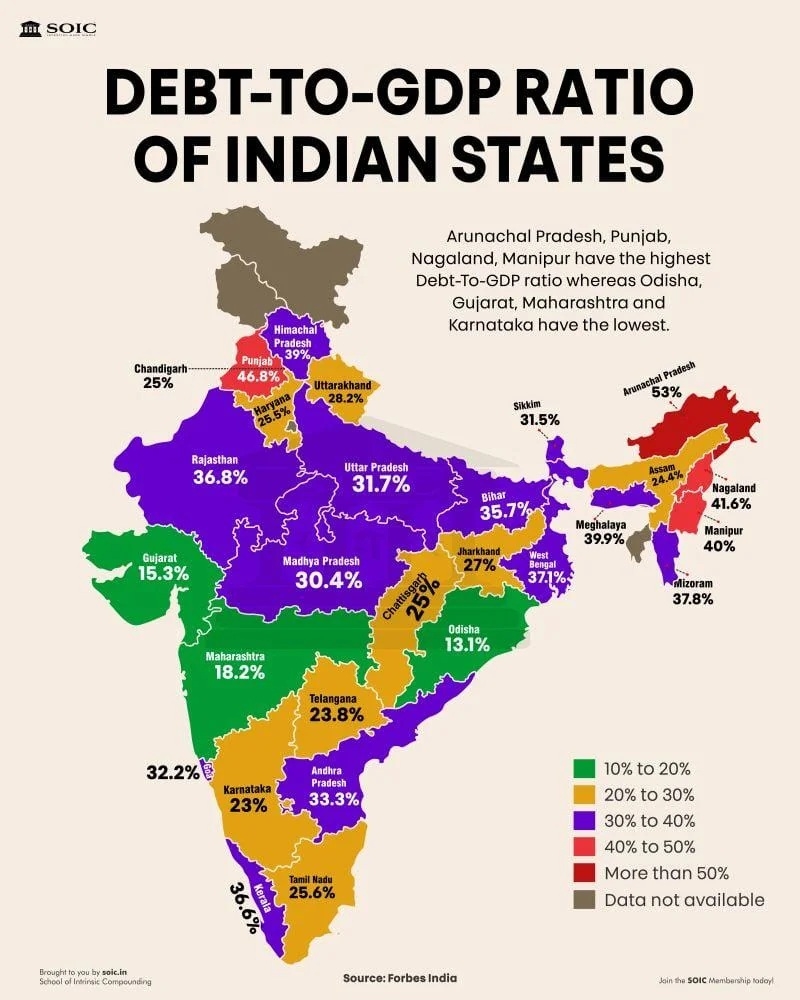

Debt to GDP Ratio of Indian States. Arunachal Pradesh, Punjab, Nagaland, Manipur have the Debt to GDP Ratio whereas Odisha, Gujarat, Maharashtra and Karnataka have the lowest Debt to GDP Ratio. Freebies in Poll Promises by Political Parties is the

See More

Mahendra Lochhab

Content creator • 1y

India is one of the leading producers and suppliers of millet, producing about 12.46 million metric tonnes from an area of 8.87 million. The main millet-growing states in India are Rajasthan, Maharashtra, Karnataka, Andhra Pradesh, and Madhya Pradesh

See MoreKimiko

Startups | AI | info... • 9m

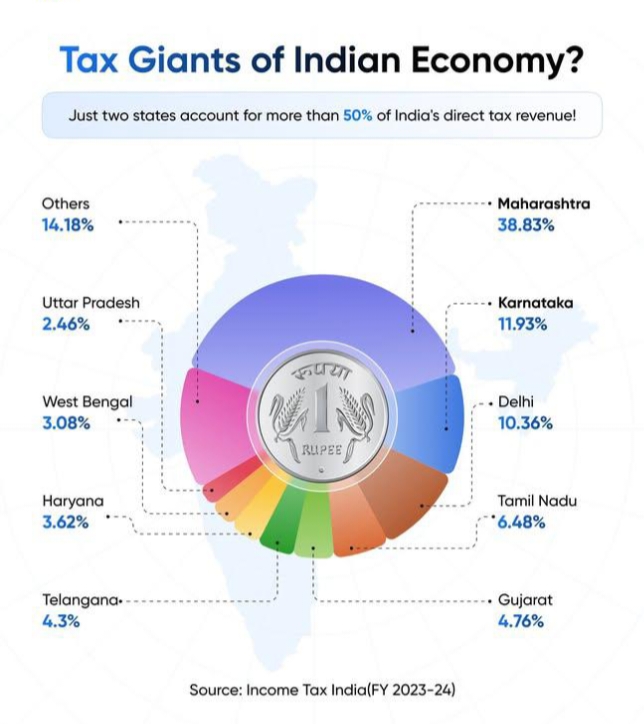

Over half of India’s direct tax revenue — from individuals, corporates, and businesses and more— comes from just two states. This revenue is the backbone funding our infrastructure, healthcare, and education. Comment below and tell us: which state do

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)