Back

Inactive

AprameyaAI • 1y

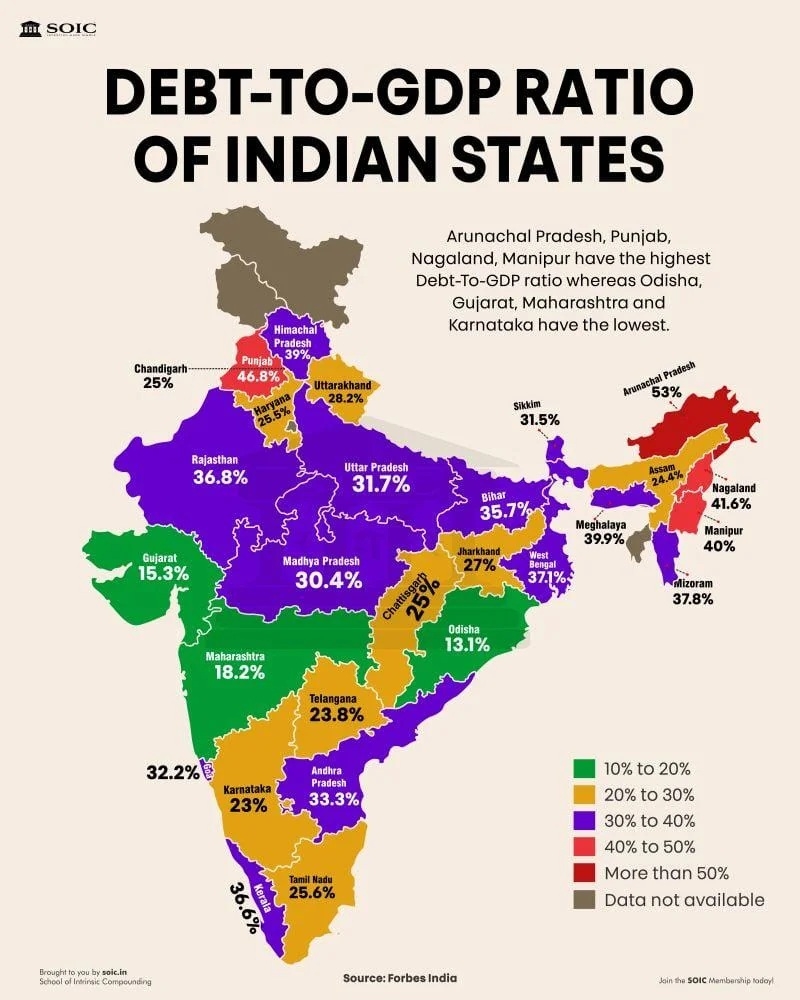

How to evade tax with simple locations ? Gujarat's Bus Tax Evasion Scheme 💀: A 1,000-Character Exposé In a startling revelation, Gujarat's private bus industry is exploiting a tax loophole: • Over 1,400 buses registered in Arunachal Pradesh and Nagaland • Operators save ₹4.5 lakh annually per bus • Tax disparity: ₹40,000/month in Gujarat vs. ₹2,000 in NE states The Scheme: 1. Open temporary offices in NE states 2. Register buses there to avoid Gujarat's high taxes 3. Operate primarily in Gujarat with out-of-state plates Key Players: • Major companies like P Travels and N Travels involved • Driven by post-COVID financial pressures and rising fuel costs Implications: • Massive revenue loss for Gujarat government • Unfair advantage over law-abiding operators • Potential safety concerns with lax regulations Questions Raised: 1. How long has this been happening? 2. What's the total tax revenue loss? 3. Are there plans to close this loophole? - follow Dev oza for more

Replies (4)

More like this

Recommendations from Medial

Karthikeyan

Bridging ideas and e... • 8m

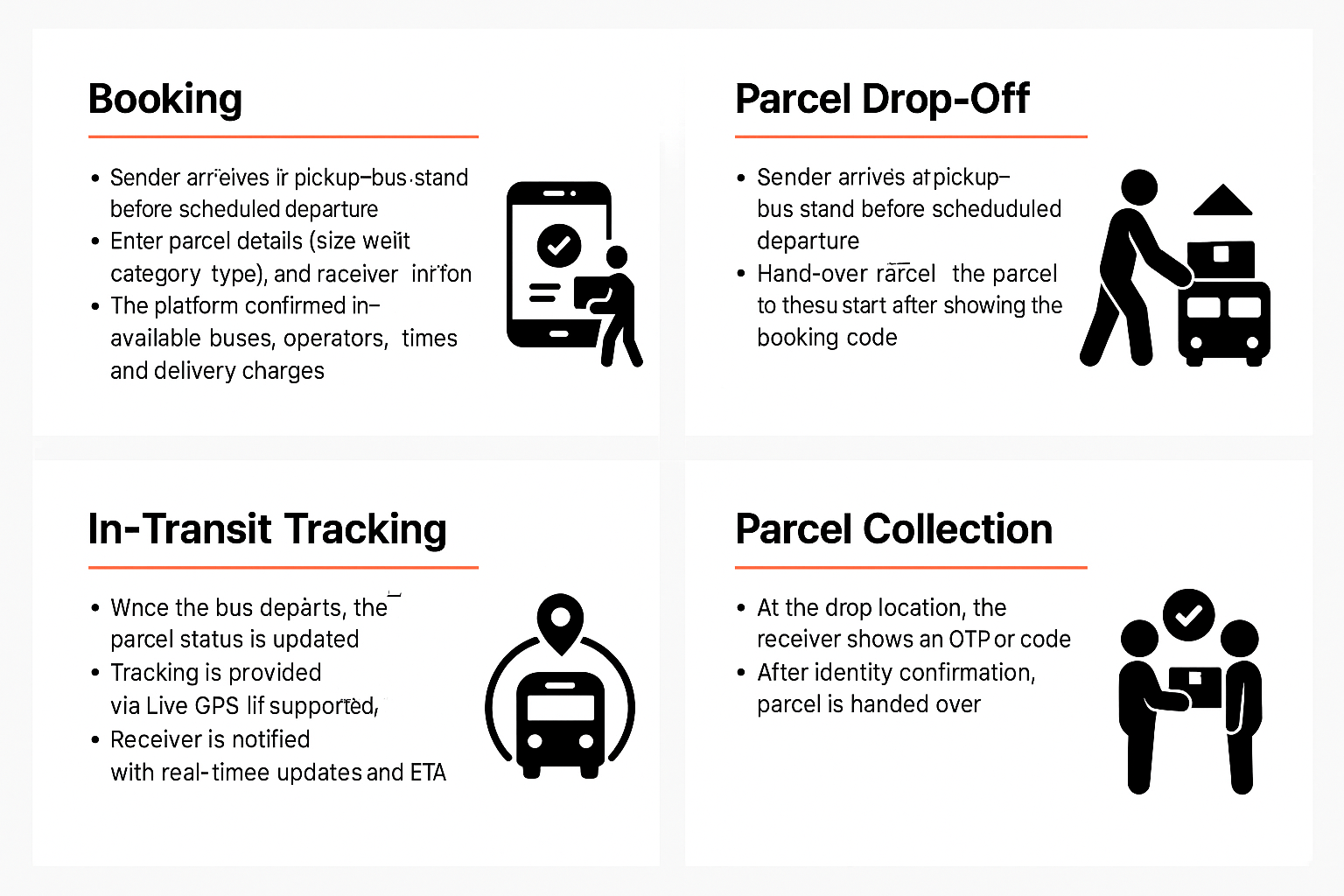

Bus-Based Parcel Delivery – Organizing Parcel Movement via Private Buses Overview Across many regions in India, individuals and businesses often rely on private buses to send parcels between towns and cities. While this method is fast and cost-effect

See More

Government Schemes Updates

We provide updates o... • 6m

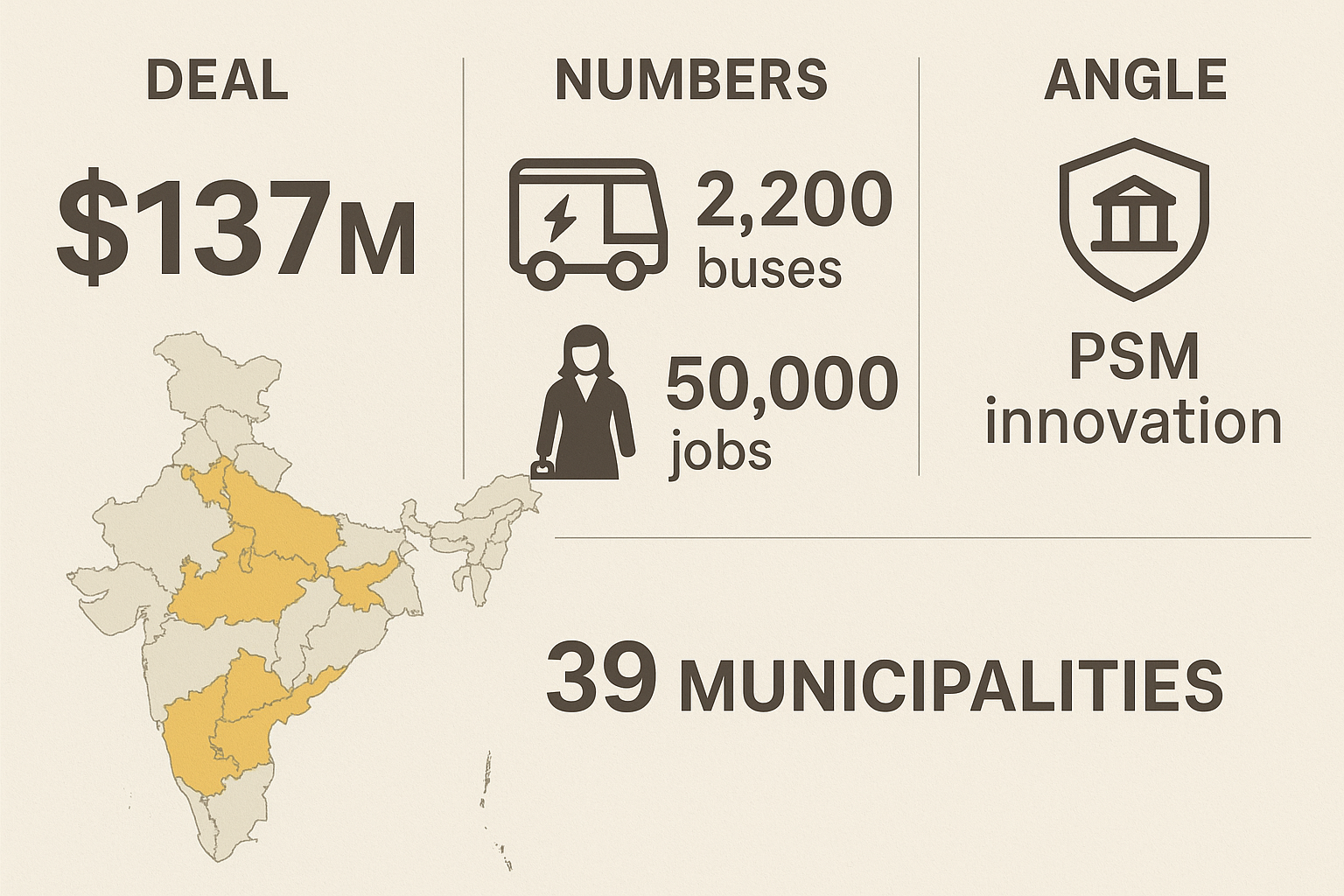

🚍 Andhra Pradesh Stree Shakti Scheme – Free Bus Travel for Women 🚍 The Andhra Pradesh Government is set to roll out an empowering initiative called the Stree Shakti Scheme, starting 15th August 2025. This major step is part of the TDP-led governmen

See MoreShubham Khandelwal

Software Engineer • 1y

Debt to GDP Ratio of Indian States. Arunachal Pradesh, Punjab, Nagaland, Manipur have the Debt to GDP Ratio whereas Odisha, Gujarat, Maharashtra and Karnataka have the lowest Debt to GDP Ratio. Freebies in Poll Promises by Political Parties is the

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)