Back

Shuvam Kar

Building better Indi... • 7m

The basic purpose of bringing and promoting digital payment is to stop tax evasion. Cash gets hidden, unaccounted and that's the reason why digital payment systems are brought to bring the transparency. They are getting notice because their bank account showing deposit of more than 20L/40L which is the threshold limit for taking gst registration. So, if upi was not there then they would have suppressed their turnover, income and there by escaped tax.

More like this

Recommendations from Medial

CA Dipika Pathak

Partner at D P S A &... • 1y

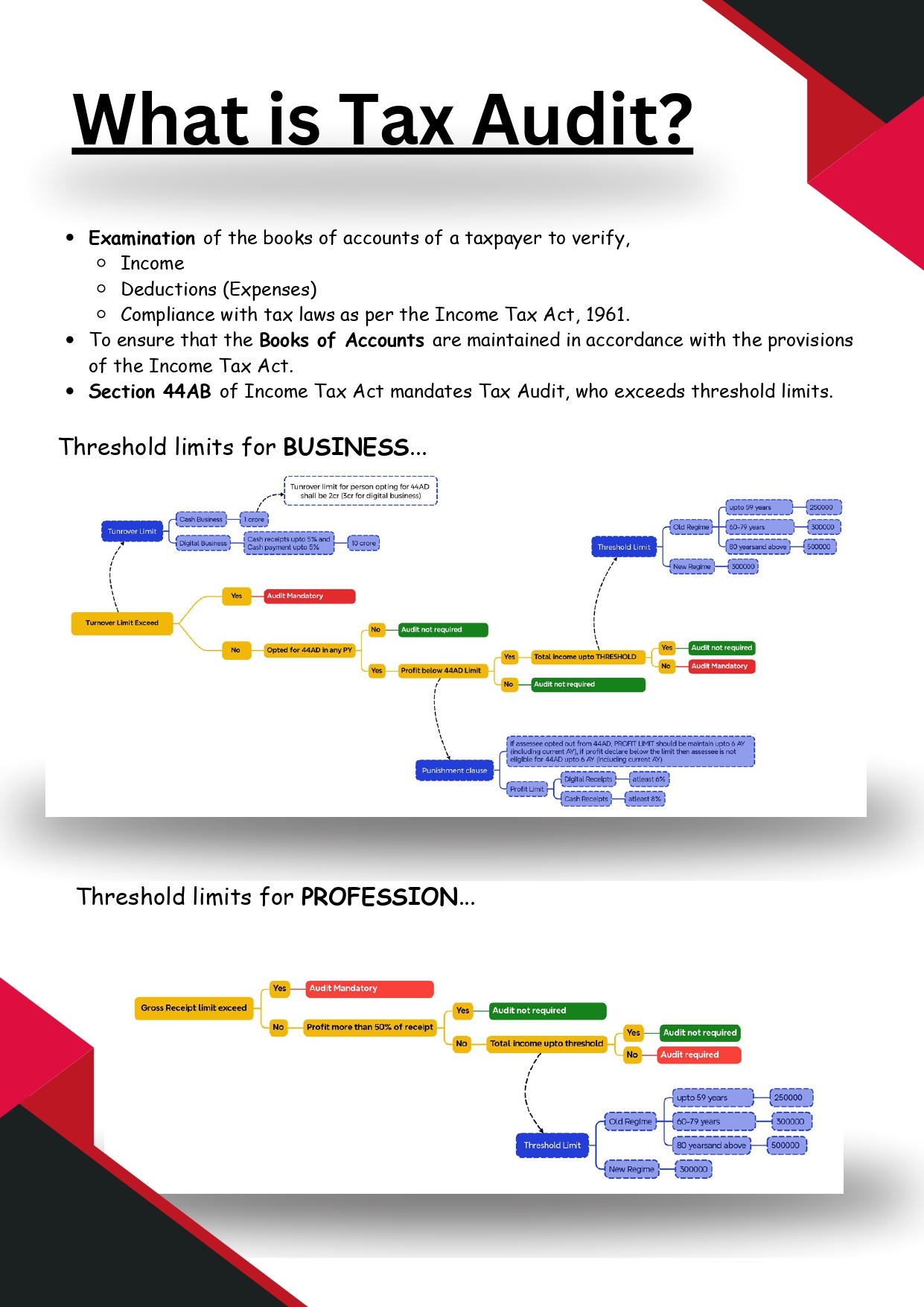

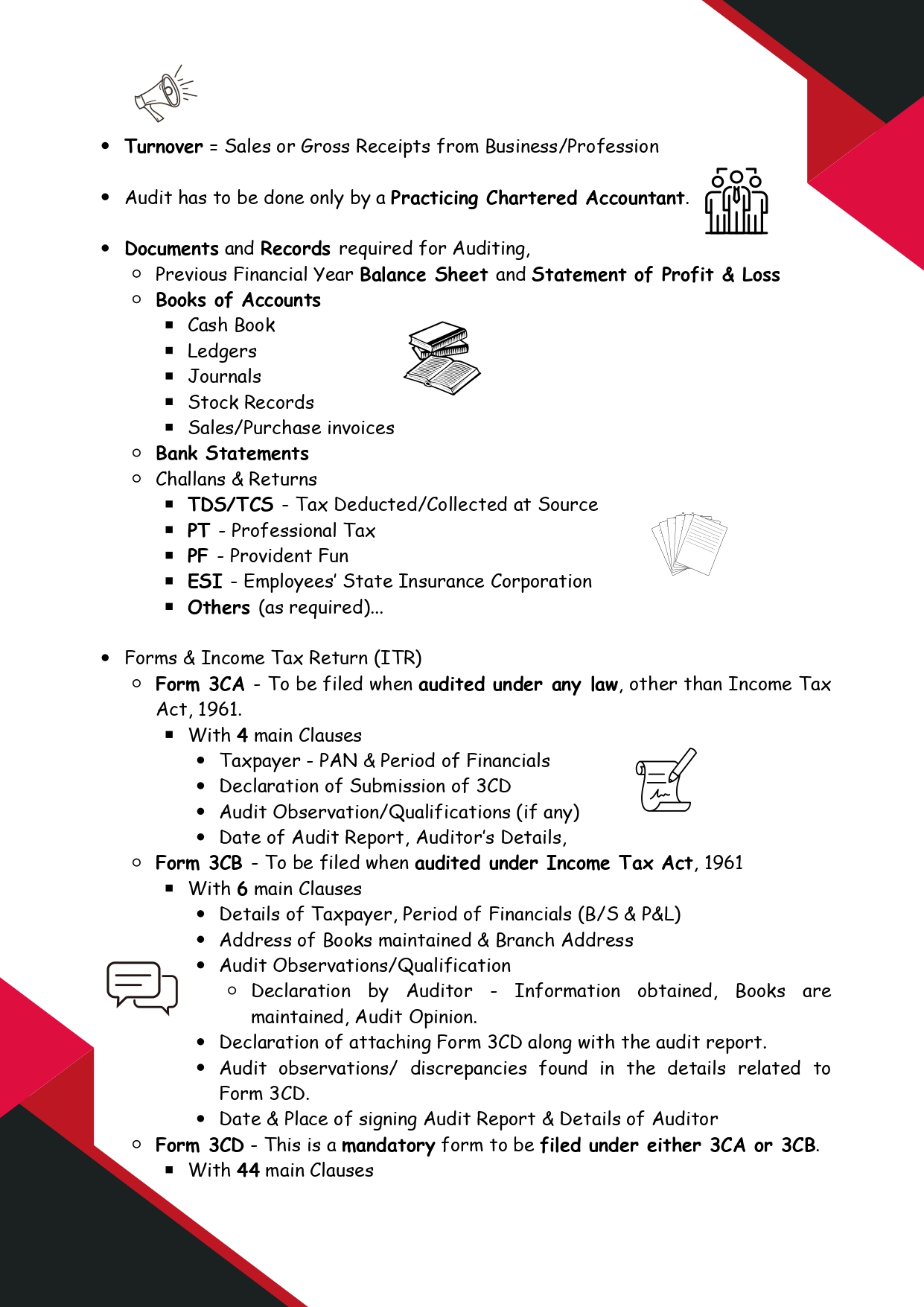

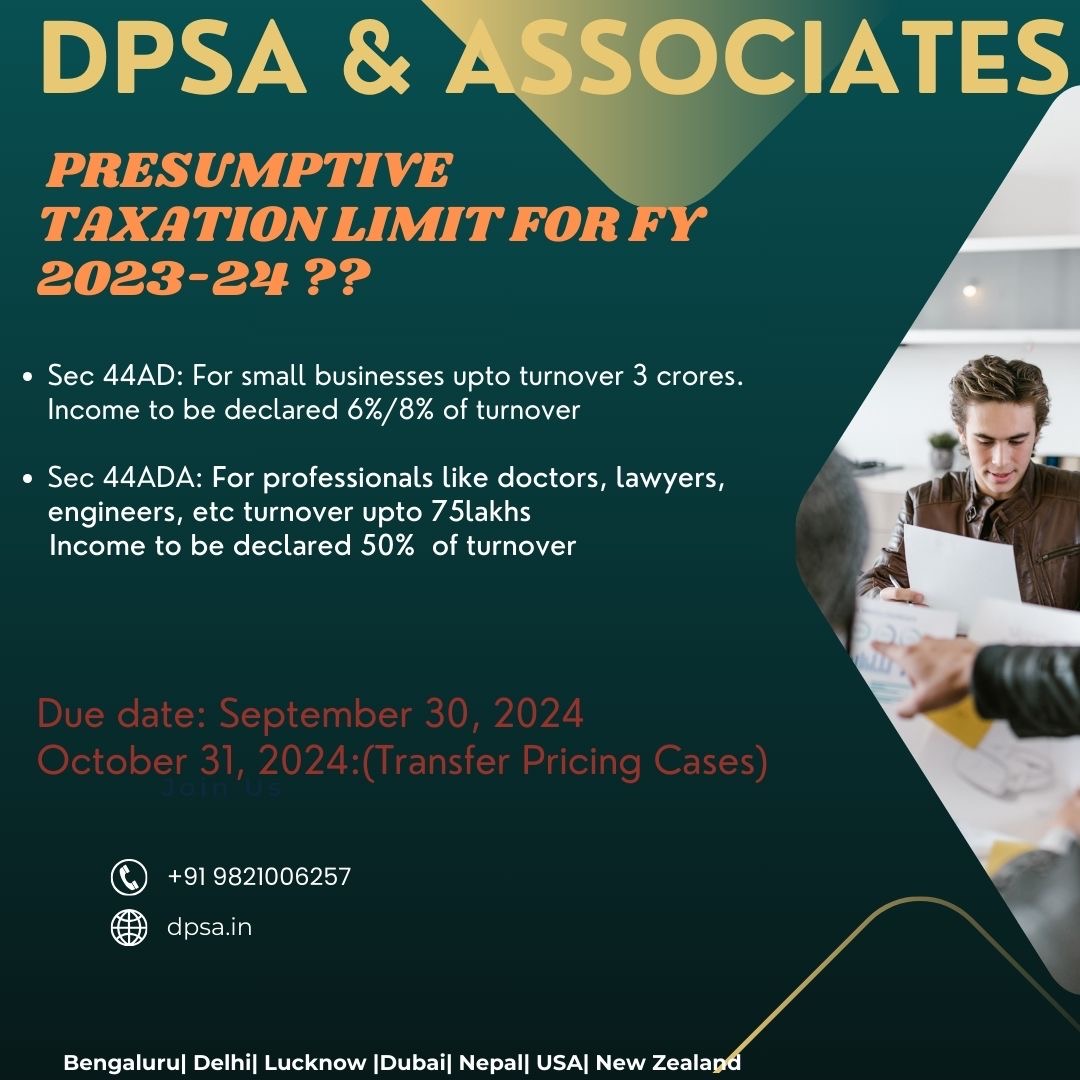

Dear business🔊 please note your tax audit applicability ➡️Every business, including private limited companies, individuals, and partnership firms (excluding those opting for the presumptive taxation scheme), is subject to a tax audit ifTotal sale

See More

Sai Vishnu

Income Tax & GST Con... • 11m

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

Kamlesh Gurjar

ll प्रत्येकं त्रुटिः... • 11m

Top 10 Trending Businesses in India for 2025 with Starting Investments: EdTech Platforms - Online learning boom. Start: ₹5L-₹20L Renewable Energy - Solar/wind power. Start: ₹10L-₹50L HealthTech - Telemedicine & wellness. Start: ₹10L-₹30L E-com

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

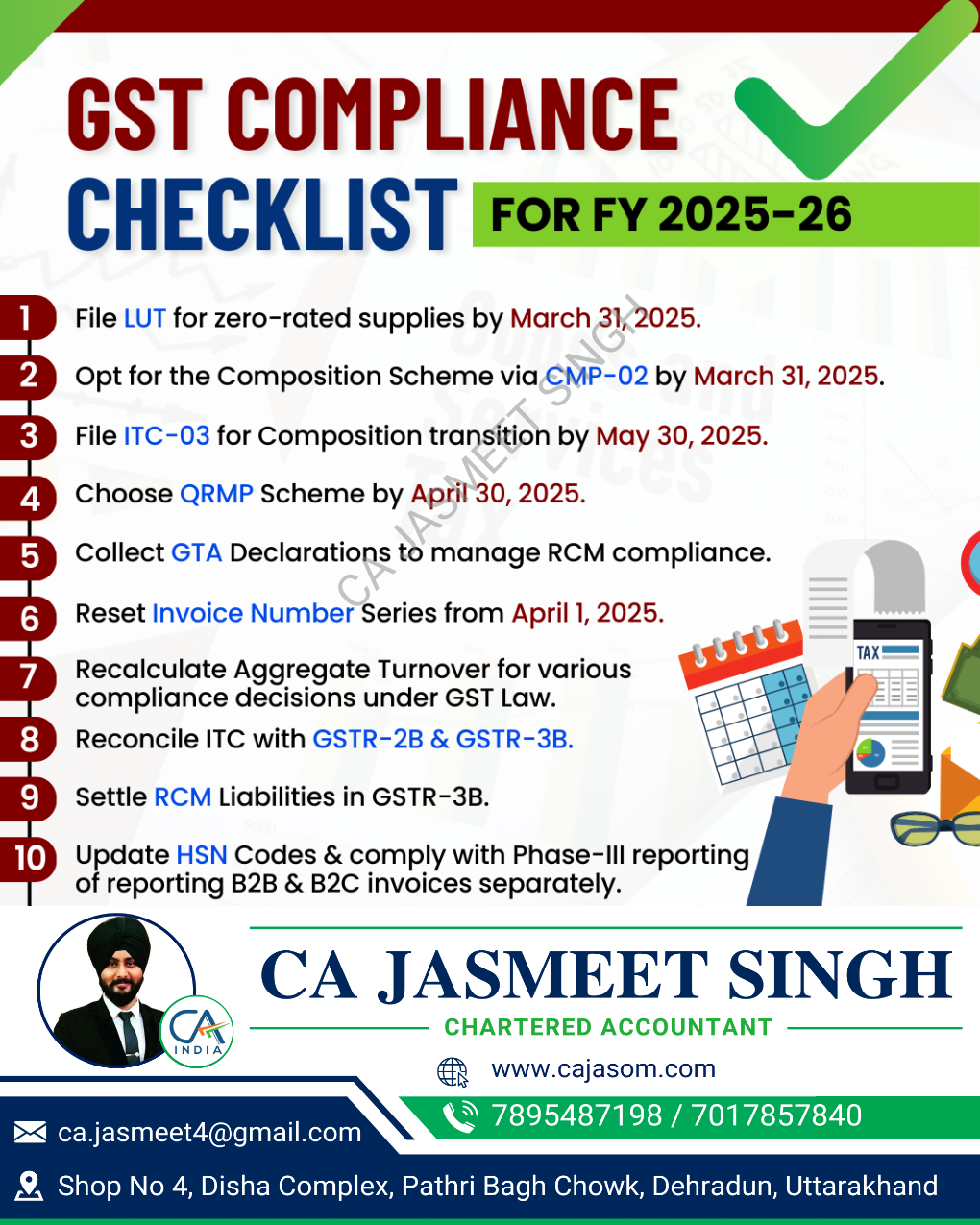

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

Ashish Singh

Finding my self 😶�... • 1y

Some of the most successful Y Combinator-backed startups from India include: • Razorpay: A fintech company valued at $7.5 billion, offering payment solutions for businesses4. •. Meesho: A social commerce platform that simplifies online selling for

See More

Vamshi Yadav

•

SucSEED Ventures • 11m

Between 2022 and 2024, the Indian government banned 1,298 online gaming platforms due to concerns regarding addiction, financial hazards, and non-payment of taxes. The Ministry of Electronics and Information Technology (MeitY) imposed stricter contro

See MorePoosarla Sai Karthik

Tech guy with a busi... • 7m

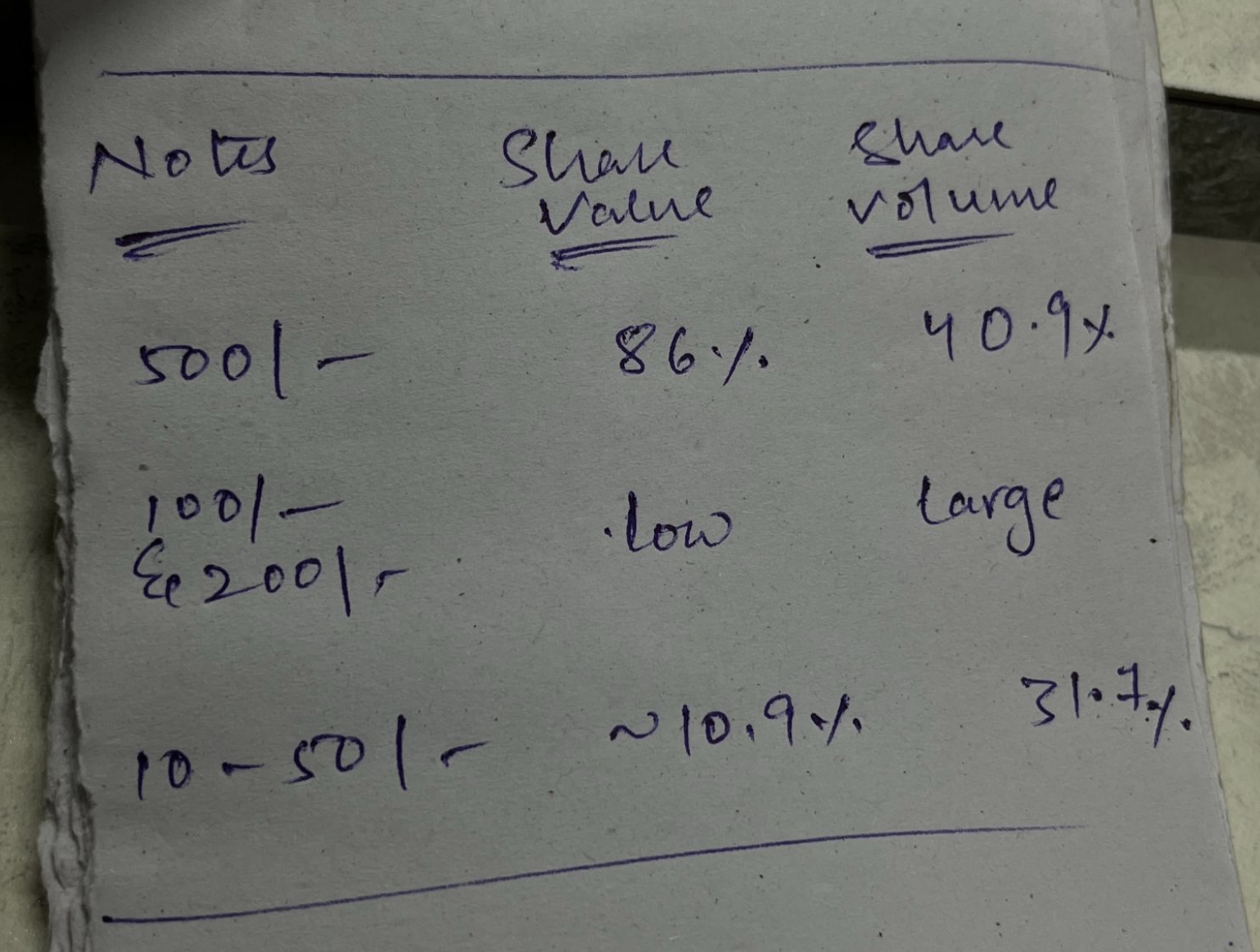

As of 2025, ₹500 notes dominate India’s cash system, making up 86 percent of the total value and 40.9 percent of all notes by volume. But while they’re everywhere, they’re not always practical. For everyday use, smaller denominations like ₹100 and ₹2

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)