Back

Vamshi Yadav

•

SucSEED Ventures • 11m

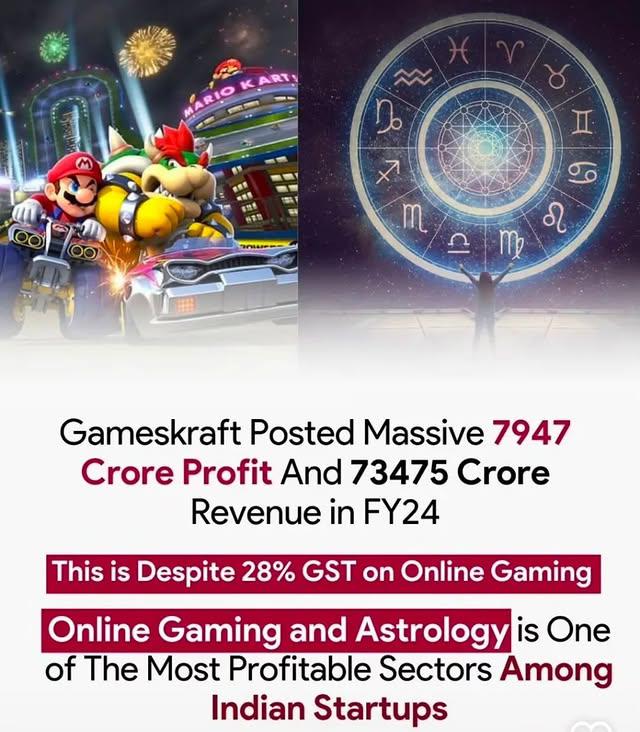

Between 2022 and 2024, the Indian government banned 1,298 online gaming platforms due to concerns regarding addiction, financial hazards, and non-payment of taxes. The Ministry of Electronics and Information Technology (MeitY) imposed stricter controls, mandating online gaming platforms to delete illegal online gambling content and objectionable material. Besides, the Finance Ministry gave the Directorate General of GST Intelligence (DGGI) authority to intensify the battle against tax evasion in the gaming industry. [Source: YourStory] With the value of India's gaming market standing at $3.1 billion and its growth trend, today's question becomes: → Is the government properly safeguarding users, or is it a restrictive measure that can end innovation? → While blocking illegal gambling sites makes sense, could the crackdown also impact legitimate gaming companies struggling with unclear tax and compliance rules? → Will aggressive enforcement drive investments and talent into gaming-friendly nations? Or is it opening windows of opportunity to homegrown regulation-compliant platforms? → Is it blocking websites or implementing stronger consumer protections such as spending limits, age-gating, and financial controls? Countries like the UK and Germany regulate gaming through compliance and licensing and not prohibition. India's policy decisions will determine whether we are a global gaming hub or a fractured marketplace with unclear regulatory guidance. What's your take? Should India close its doors or review its gaming legislation?

More like this

Recommendations from Medial

CA Dipika Pathak

Partner at D P S A &... • 1y

Tax and Accounting Compliance within the Online Gaming Sphere!! How it Started in CGST ACT ➡SCHEDULE III of the CGST Act contains “Activities or Transactions which shall be treated neither as a Supply of Goods nor a Supply of Services” #Old Para 6

See MoreCA Dipika Pathak

Partner at D P S A &... • 1y

Continue-Tax and Accounting Compliance within the Online Gaming Sphere!! Value of supply of online gaming including online money gaming Value =Total paid or payable to or deposited with the supplier by way of money or money's worth, including virtu

See More

SHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

Insights For You So guy's we all know that Indian gaming industry is booming day by day in India but only few people's are there who is really doing something in gaming industry. According to supreme court gambling is not allowed only skilled ba

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)