Back

Vishu Bheda

•

Medial • 9m

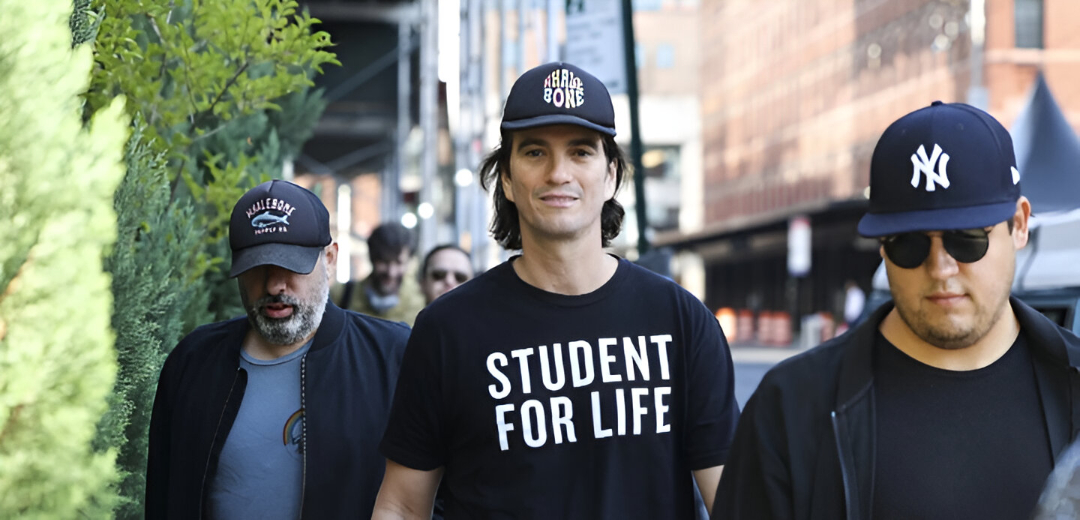

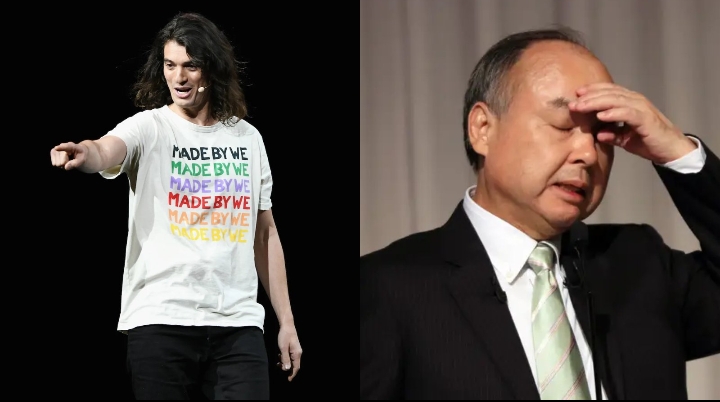

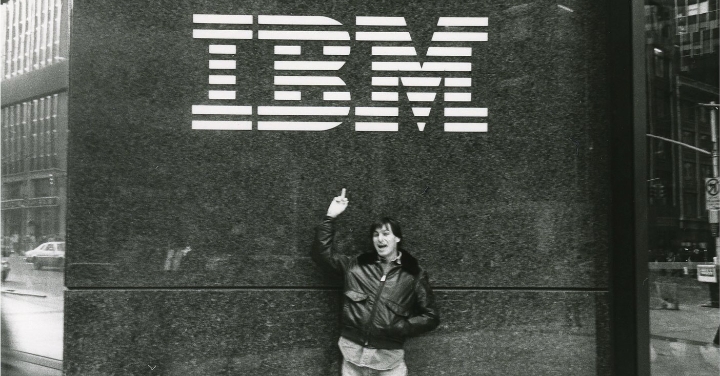

𝗘𝘃𝗲𝗿𝘆𝗼𝗻𝗲 𝗟𝗮𝘂𝗴𝗵𝗲𝗱 𝗔𝗳𝘁𝗲𝗿 𝗛𝗶𝘀 $𝟰𝟬𝗕 𝗙𝗮𝗶𝗹𝘂𝗿𝗲 — 𝗡𝗼𝘄 𝗛𝗲’𝘀 𝗕𝗮𝗰𝗸 𝗪𝗶𝘁𝗵 𝘁𝗵𝗲 𝗕𝗶𝗴𝗴𝗲𝘀𝘁 𝗩𝗖 𝗕𝗲𝘁 𝗼𝗳 𝘁𝗵𝗲 𝗗𝗲𝗰𝗮𝗱𝗲 In 2019, Adam Neumann became the face of one of tech’s most infamous disasters. WeWork’s valuation collapsed from $𝟒𝟕𝐁 to almost nothing . He was mocked, criticized, and blacklisted. Most founders would disappear forever. But not Neumann. In 2022, he launched a new startup called 𝐅𝐥𝐨𝐰 — a real estate-tech company aiming to reinvent renting. And guess what? 𝐀𝐧𝐝𝐫𝐞𝐞𝐬𝐬𝐞𝐧 𝐇𝐨𝐫𝐨𝐰𝐢𝐭𝐳 (𝐚𝟏𝟔𝐳), one of the world’s most elite VCs, invested $𝟑𝟓𝟎𝐌 in Flow — their 𝐥𝐚𝐫𝐠𝐞𝐬𝐭 𝐬𝐢𝐧𝐠𝐥𝐞 𝐜𝐡𝐞𝐜𝐤 𝐞𝐯𝐞𝐫. Now, they’ve 𝐝𝐨𝐮𝐛𝐥𝐞𝐝 𝐝𝐨𝐰𝐧. They just invested another $𝟏𝟎𝟎𝐌, increasing their stake to 25%. Here’s what makes this comeback one of tech’s wildest stories: 𝗧𝗵𝗲 𝗪𝗲𝗪𝗼𝗿𝗸 𝗙𝗮𝗹𝗹 Neumann once scaled WeWork to 𝟖𝟑𝟔 𝐥𝐨𝐜𝐚𝐭𝐢𝐨𝐧𝐬 𝐢𝐧 𝟐𝟔 𝐜𝐨𝐮𝐧𝐭𝐫𝐢𝐞𝐬. Revenue grew from $𝟕𝟓𝐌 𝐭𝐨 $𝟏.𝟖𝐁 in just four years. But things spiraled. He burned cash fast, behaved erratically (weed on jets, barefoot in NYC), and lost control. WeWork collapsed. 𝗪𝗵𝘆 𝗩𝗖𝘀 𝗦𝘁𝗶𝗹𝗹 𝗕𝗲𝘁 𝗼𝗻 𝗛𝗶𝗺 It seems crazy to back someone who lost $40B. But elite investors don’t just bet on business models — they bet on 𝐟𝐨𝐮𝐧𝐝𝐞𝐫 𝐃𝐍𝐀. And Neumann has something rare: A magnetic vision World-class fundraising skills The ability to rally top talent Before failure, he built one of the fastest-scaling startups in history. That’s not luck. That’s skill. 𝐖𝐡𝐚𝐭’𝐬 𝐃𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐭 𝐖𝐢𝐭𝐡 𝐅𝐥𝐨𝐰? Neumann learned from WeWork’s mistakes. Flow is smarter: Owns property (no risky leases) Focuses on community-based living Mixes real estate, tech, and design Grows 𝐦𝐞𝐚𝐬𝐮𝐫𝐞𝐝𝐥𝐲, not recklessly He’s solving a $𝟓𝟎 𝐭𝐫𝐢𝐥𝐥𝐢𝐨𝐧 problem: outdated rental housing. 𝗧𝗵𝗲 𝗛𝗶𝗱𝗱𝗲𝗻 𝗟𝗲𝘀𝘀𝗼𝗻 Neumann turned his worst failure into fuel. He didn’t run or make excuses. He took the L, learned the lesson — and came back stronger. That’s why billion-dollar investors still believe. 𝐈𝐧 𝐭𝐡𝐞 𝐬𝐭𝐚𝐫𝐭𝐮𝐩 𝐰𝐨𝐫𝐥𝐝, 𝐭𝐡𝐞 𝐫𝐞𝐚𝐥 𝐞𝐝𝐠𝐞 𝐢𝐬𝐧'𝐭 𝐩𝐞𝐫𝐟𝐞𝐜𝐭𝐢𝐨𝐧. 𝐈𝐭'𝐬 𝐫𝐞𝐬𝐢𝐥𝐢𝐞𝐧𝐜𝐞.

Replies (6)

More like this

Recommendations from Medial

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)