Back

Vishu Bheda

•

Medial • 1y

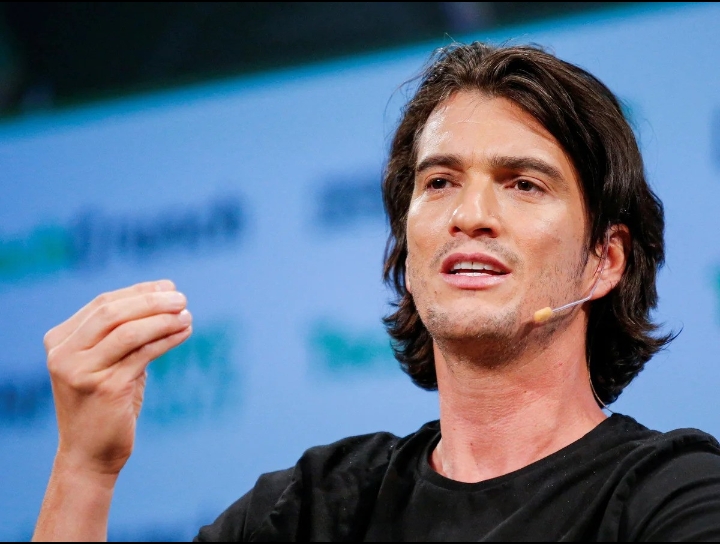

In 2018, he threw a $2 million party to show off his startup’s success. Private jets. Celebrities. Live music. But just a year later, his over-the-top lifestyle cost his company $47 billion. Here’s how one CEO’s bad decisions destroyed a billion-dollar business: In 2010, Adam Neumann started WeWork with a big idea: turn offices into creative, community-driven spaces. The company grew fast, expanding to 400+ locations with a $47B valuation. But behind the growth was chaos. Neumann lived lavishly, using private jets and throwing $2M parties, while the company lost money. In 2019, their IPO filing revealed serious mismanagement, like Neumann selling the trademark “We” to his own company for $5.9M. The valuation crashed below $10B, the IPO was canceled, and thousands of employees were laid off. The lesson? Big ideas need solid systems. Without structure and accountability, even great businesses can fail. If you like this then follow me Mr Z for more valuable content!

Replies (27)

More like this

Recommendations from Medial

Vikas Acharya

Building Reviv | Ent... • 11m

Meesho plans $1 billion IPO at $10 billion valuation Meta-backed e-commerce company Meesho is planning to list on stock exchanges around Diwali this year, aiming to raise around $1 billion in an initial public offering (IPO) at a valuation of $10 bi

See More

Kishan Kabra

Founder & CEO • 1y

What's the reason behind of OYO valuation crash? They were struggling to get approval from SEBI for IPO back in 2021, Finally got a approval but they withdrew their application and looking to raise from private investors at $2.3 Billion which was $9

See MoreAccount Deleted

Hey I am on Medial • 11m

Meesho Is Planning For $10 Billion IPO! • Meesho is planning to file its IPO papers in the second half of 2025, with a potential listing in 2026. • The company is planning to raise $1 billion at a $10 billion valuation and appointed Morgan Stanley,

See More

Rohan Saha

Founder - Burn Inves... • 8m

Lenskart has now registered itself as a public company. Earlier, it was known as Lenskart Solutions Private Limited, but the name has been changed to Lenskart Solutions Limited. The IPO announcement could come any time now. A few months ago there wer

See MoreAshish Singh

Finding my self 😶�... • 1y

🤯Groww, India's largest retail stockbroker, is preparing for an initial public offering (IPO) within the next 10 to 12 months, targeting a valuation between $6 billion and $8 billion. This would mark a significant milestone as it would be the first

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)