Back

Vishu Bheda

•

Medial • 1y

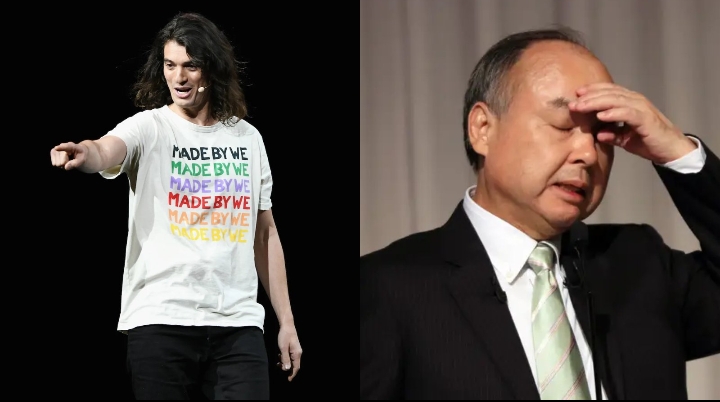

After spending just 12 minutes in their office... SoftBank's CEO wrote them a $4.4B check. Less than 30 minutes later, he invested another $2B. Here's the sales pitch WeWork's founder used to convince the world's smartest investors to ignore basic math : In 2017, WeWork was booming, but they were burning cash fast. Then came Masayoshi Son, SoftBank's legendary founder, who turned $20M into $100B with Alibaba. Known for gut-driven investments, Son decided to back WeWork after just 12 minutes of meeting its charismatic CEO, Adam Neumann. No pitch deck, no due diligence—just vibes. In a car ride, Son committed $4.4B, later adding another $2B. Why? He thought WeWork was a tech company, not a real estate one. But here’s the problem: WeWork's model was flawed. They leased offices on 15-year contracts but rented them out month-to-month. Fixed costs, variable revenue—one downturn could destroy them. Despite this, by 2019, WeWork hit a $47B valuation—worth more than Airbnb or SpaceX. But the hype masked reality: WeWork was just subletting offices, not revolutionizing workspaces. The turning point? Their IPO filing in 2019 revealed: $1.9B loss in 2018 Questionable deals benefiting Neumann A messy corporate structure Investors panicked. The IPO was canceled, valuation dropped to $8B, and SoftBank had to bail them out. Neumann was ousted. By 2023, WeWork filed for bankruptcy, drowning in $19B debt. The WeWork saga taught a hard lesson: flashy pitches don’t replace solid business fundamentals. Today, investors demand clear profitability and sound economics—no more billion-dollar bets on vibes. And that’s probably for the best. Follow me for more such amazing business case studies!

Replies (10)

More like this

Recommendations from Medial

Havish Gupta

Figuring Out • 1y

Adam Neumann, have announced a new venture called WorkFlow which is basically WeWork's competition. Basic difference between Workflow and Wework is that WeWork signed long-term leases with landlords, then relied on short-term leases for revenue. On

See MoreHavish Gupta

Figuring Out • 10m

In 2018, WeWork tried to raise $20 billion from SoftBank's Vision Fund. The deal was almost finalized, but major investors in the fund, including Saudi Arabia opposed it, causing the deal to collapse. Now, in 2025, OpenAI has raised a $40 billion rou

See More

Sanskar

Keen Learner and Exp... • 1y

Masayoshi Son (CEO of soft bank) also known as the Bill Gates of japan or you can say "The Crazy Genius" - Why? Because he is behind almost everything you can think of. The one who has raised 45 billion in 45 minutes and the one who has raised 100 Bi

See MoreAshish Singh

Finding my self 😶�... • 10m

📈Short story of wework WeWork started in 2010 when Adam Neumann and Miguel McKelvey saw a chance to rethink office space. After the 2008 recession, empty buildings were plentiful, and freelancers needed affordable places to work. They leased floors

See More

Vansh Khandelwal

Full Stack Web Devel... • 9m

WeWork, which aimed to revolutionize collaborative workspaces. However, its aggressive expansion led to a significant mismatch between supply and demand, resulting in financial strain. The company’s heavy investment in long-term leases became unsusta

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)