Back

Inactive

AprameyaAI • 1y

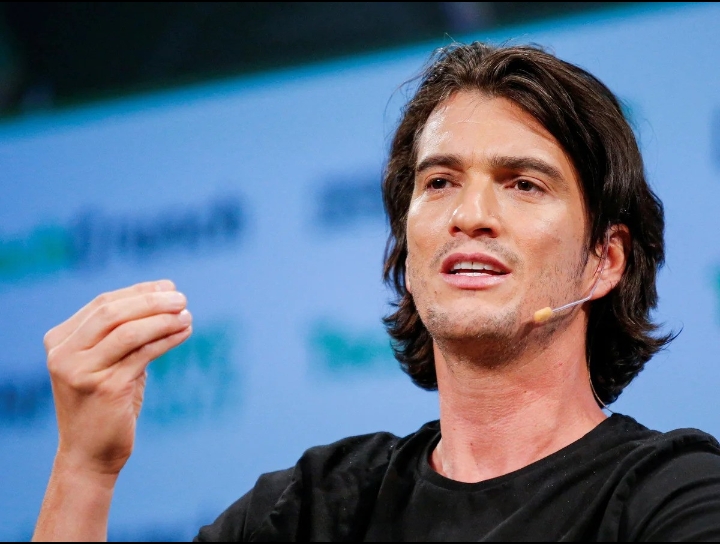

WeWork's Rise and Fall 2010: Adam Neumann co-founds WeWork Concept: Trendy coworking spaces 2014-2018: Rapid expansion • Raises billions in funding • Valuation hits $47 billion • Opens locations globally 2019: IPO attempt reveals issues • Massive losses exposed • Neumann's conflicts of interest uncovered • Corporate governance problems highlighted September 2019: Neumann forced out as CE October 2019: SoftBank bailout • $9.5 billion rescue package • Valuation plummets to $8 billion 2020-2021: Pandemic struggles • Empty offices • Lawsuits from investors 2021: SPAC merger • Goes public at $9 billion valuation 2022-2023: Continued challenges • Persistent losses • Multiple CEO changes • Stock price decline Lessons: 1. Sustainable growth trumps rapid expansion 2. Proper governance is crucial 3. Beware of charismatic leaders without checks 4. Profitability matters, not just vision A tale of hype, mismanagement, and the dangers of prioritizing growth over fundamentals Fllw fr more

Replies (4)

More like this

Recommendations from Medial

Kishan Kabra

Founder & CEO • 1y

What's the reason behind of OYO valuation crash? They were struggling to get approval from SEBI for IPO back in 2021, Finally got a approval but they withdrew their application and looking to raise from private investors at $2.3 Billion which was $9

See MoreAccount Deleted

Hey I am on Medial • 1y

Interesting News From OYO 🤔🤯 • India’s Oyo, once valued at $10B, seeks new funding at 70% discount. • Oyo, an Indian startup, seeks new funding at a $3 billion valuation, down from $10 billion. • Negotiating with investors like Malaysia's Khazan

See More

Ashish Singh

Finding my self 😶�... • 1y

🤯 India's fastest unicorn Mensa Brands, founded by Ananth Narayanan in 2021, became India's fastest unicorn, achieving a $1.2 billion valuation in just six months.🫡 The company scales digital-first consumer brands across categories like fashion, b

See More

HigherLevelGames

Learning | Earning • 1y

Game Changing Growths of India [ PART 1 ] In 2014, an e-commerce website called Bundl was rebranded as "SWIGGY" to enter the food delivery market and in August 2014. In 2015, Swiggy recieved $2 million investment from Accel and SAIF Partners with a

See More

gray man

I'm just a normal gu... • 10m

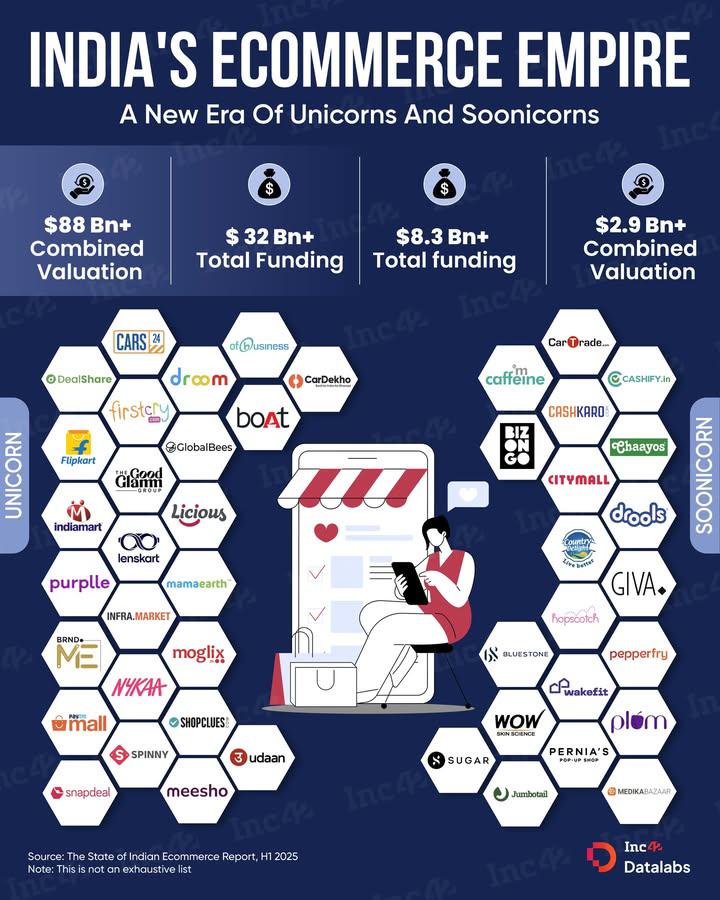

India's ecommerce sector is undergoing a dynamic transformation, fueled by innovation, rapid scaling, and robust funding. With a collective valuation exceeding $88 billion and more than $32 billion in total funding, leading unicorns like Flipkart,

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)