Back

Anonymous 2

Hey I am on Medial • 10m

Dividends are taxed immediately when distributed, while capital gains are only taxed when realized. In most countries, this gives growth stocks a significant advantage through tax deferral. Your ₹100 dividend gets taxed immediately, reducing your compounding potential, whereas that same ₹100 in share appreciation can keep working for you tax-free until you decide to sell. Over decades, this difference in tax treatment can add hundreds of thousands to your portfolio. Dividend investing is basically volunteering to pay taxes earlier than necessary.

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 10m

I’ve noticed a lot of people make this mistake they invest in a company just because it offers good dividends, without looking at anything else. But that’s not really a smart approach. The dividends you get are based on how much you invest. So if yo

See MoreGangesh Rameshkumar

Figure it out • 8m

Today's term of the day: Dividends When a company makes a profit, it can choose to share a portion of the profit with its shareholders as a reward for their investment. This "reward" given by the company to it's shareholders is called a dividend Di

See MoreSiddharth K Nair

Thatmoonemojiguy 🌝 • 11m

How Parachute Outsmarted India’s Tax System & Saved Crores🤯🌝 Ever noticed that Parachute Coconut Oil never says "hair oil" on its bottle? Instead, it’s labeled as “100% Pure Edible Coconut Oil.” This isn’t just a branding choice—it’s a smart tax-s

See More

VIJAY PANJWANI

Learning is a key to... • 2m

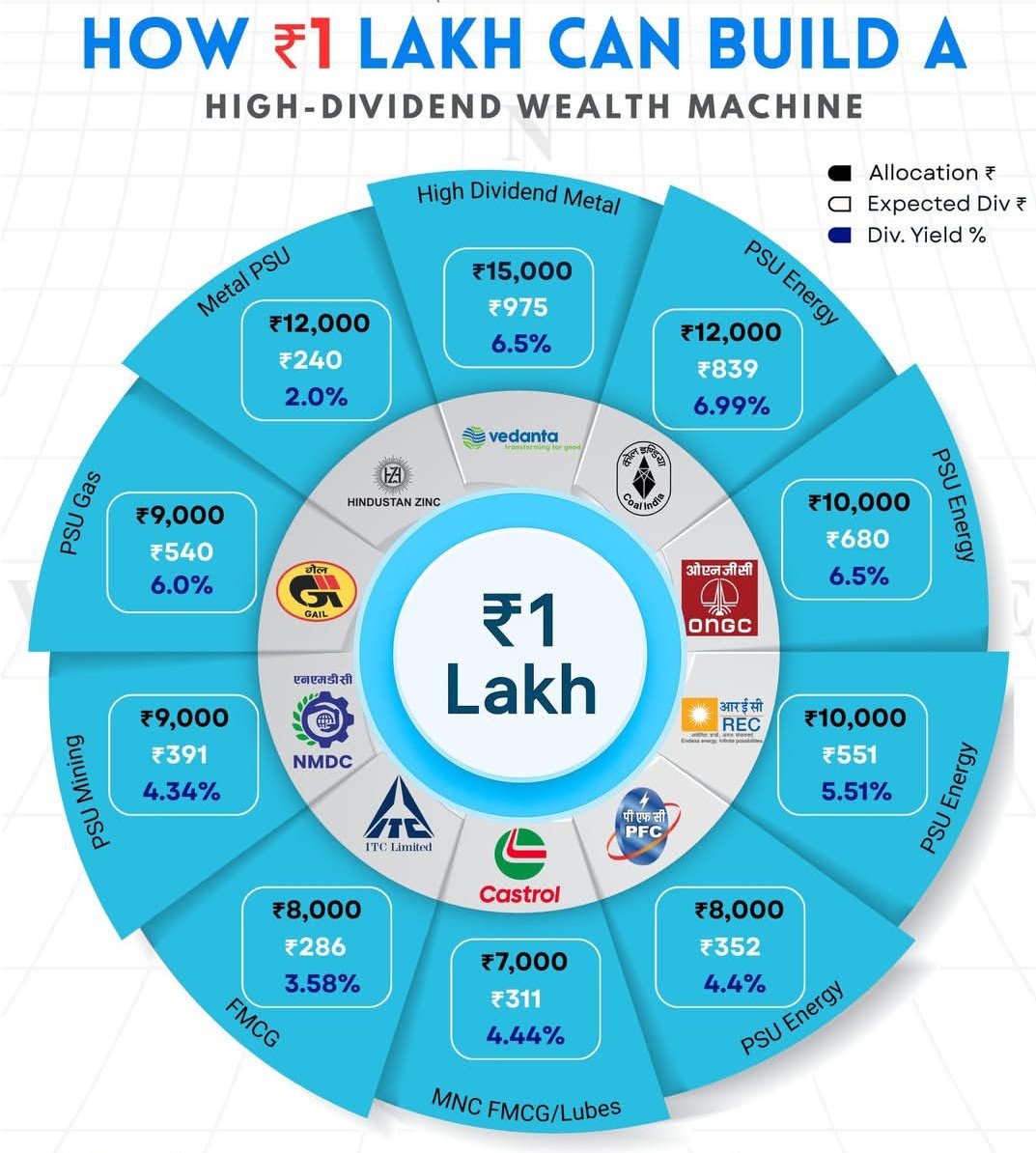

💰 ₹1 Lakh → High-Dividend Wealth Machine! So many people think you need crores to earn passive income… ❌ Not true. 📊 With smart allocation in high-dividend stocks, even ₹1 Lakh can start generating regular cash flow. ⚙️ This portfolio focuses on

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

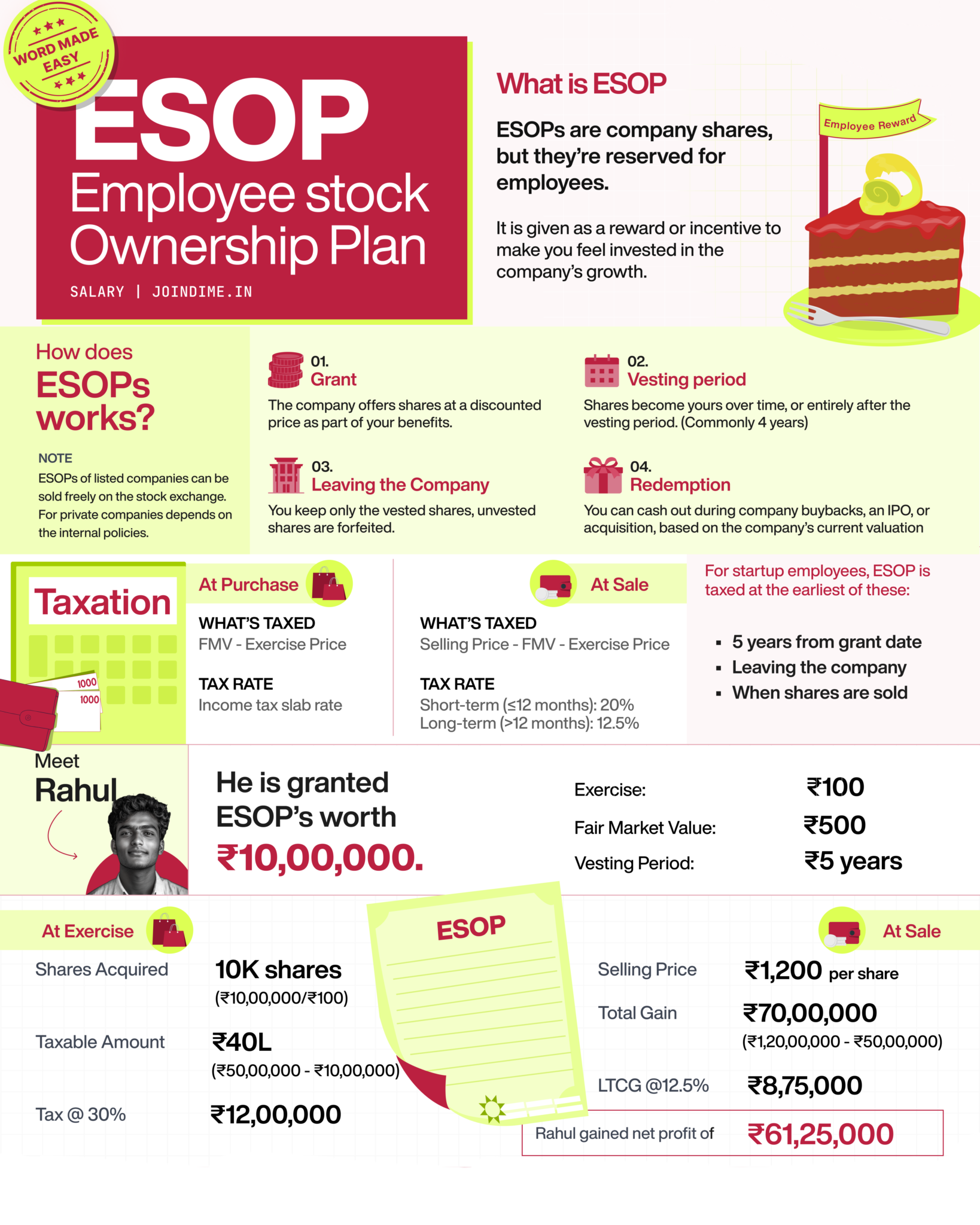

What is an ESOP (Employee Stock Ownership Plan)? ----- Explained. (Employee Perspective) Imagine your company gives you a chance to own a piece of the business. That’s what an ESOP is company shares reserved for employees like you. You don’t get

See More

Mohd Rihan

Student| Passionate ... • 1y

Everyone should know 19 financial terms before any investment... Stock: A security that represents the ownership of a fraction of the issuing corporation. IPO: The first sale of the company's share to the public allowing it to raise capital by listin

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)