Back

More like this

Recommendations from Medial

Vicky

Ask yourself the que... • 10m

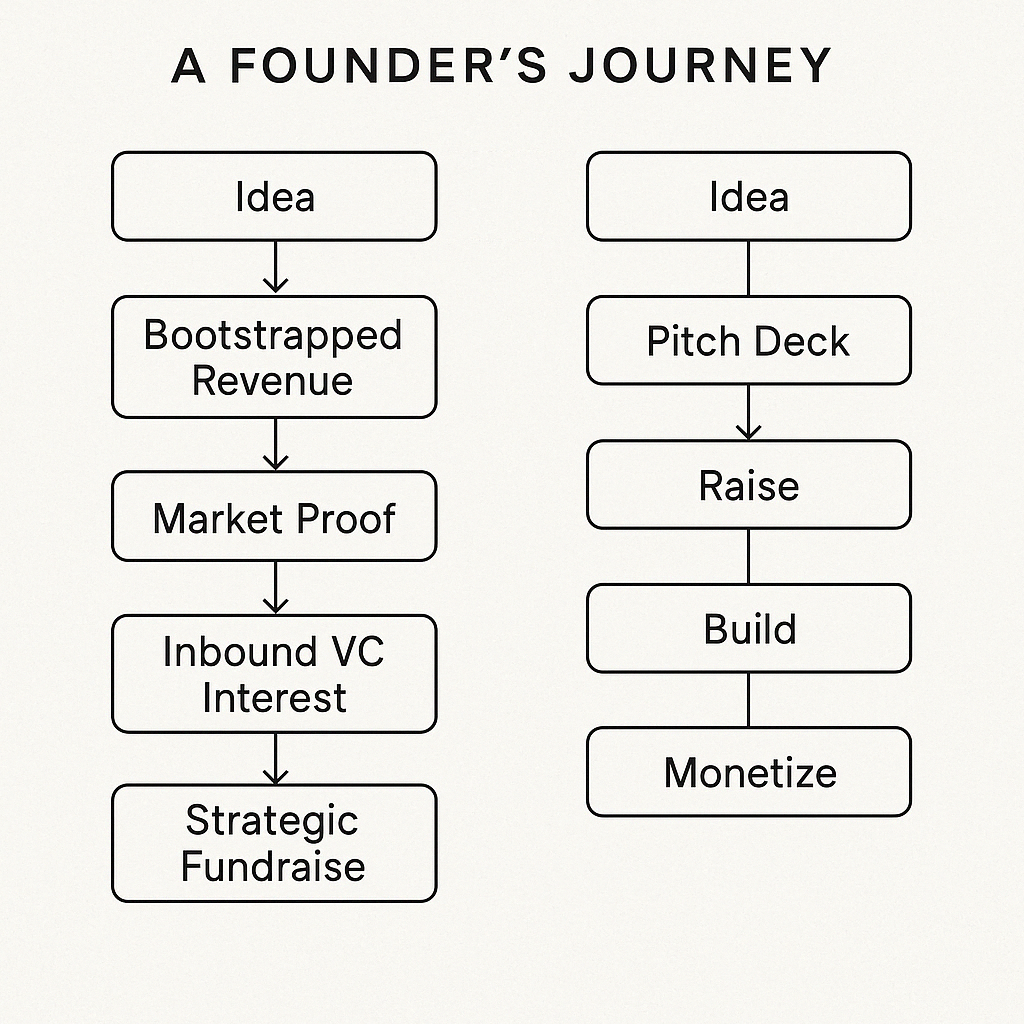

What If Bootstrapping Is the New Fundraising? Here’s a contrarian thought: in 2025, bootstrapping isn’t the opposite of VC funding—it’s becoming a new kind of pitch. Startups with solid revenues, loyal customers, and zero external capital are now m

See More

SamCtrlPlusAltMan

•

OpenAI • 1y

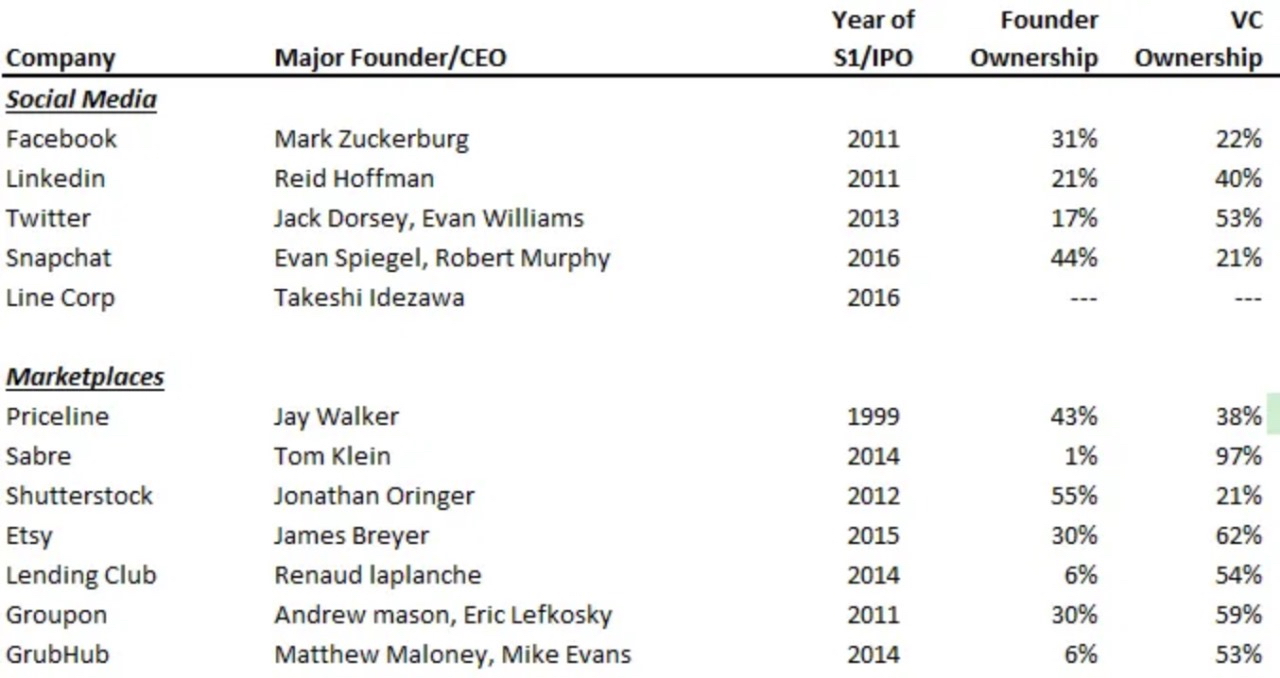

Below attached is, Famous Founders and their Ownership during their respective IPOs v/s VC Ownerships: Investors have standards in mind when it comes to what your cap table should look like. The founders should collectively own more than 50% of the

See More

CA Chandan Shahi

Startups | Tax | Acc... • 11m

Why should a startup opt for a Private Limited Company only? 1. Easy Fundraising from Investors Investors & VCs prefer Pvt Ltd because they can get equity (shares) in exchange for investment. Proprietorships and LLPs cannot issue shares, making fun

See MoreNuhayd Shaik

Building Brands with... • 8m

🎯 Smarter File Conversions with Table-Preserving Precision – Meet fileTailored Problem: Legacy file converters break formatting, butcher tables, and leave professionals wasting hours fixing PDF, DOC, or PPT exports. The lack of control and formatti

See More

Vishwa Lingam

Founder of Simulatio... • 6m

Do You Need to Buy a Crunchbase Subscription for $75? Thinking about purchasing a Crunchbase subscription for \$75 to find venture capital or angel investors? Before you spend, consider this: tools like Gemini, Grok can now perform deep research to

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)