Back

SHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

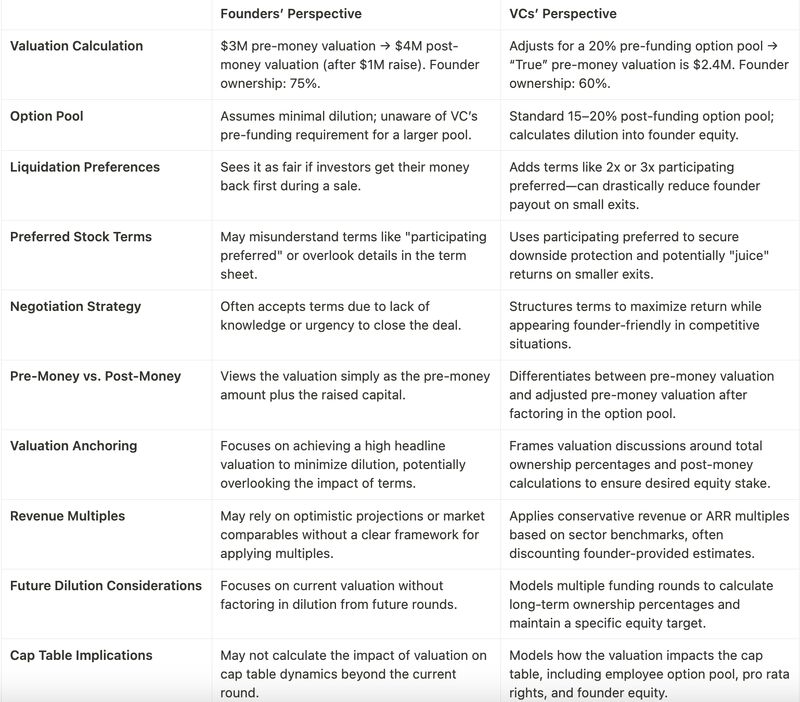

📖 DAILY BOOK SUMMARIES 📖 🚀 20 Lessons From 👉 🔥 The Entrepreneurial Bible to VC 🔥 ✨ Andrew Romans ✨ 1. Understanding Venture Capital • Learn how VCs operate, their goals, and funding structures.l • Types of investors: angels, seed funds, institutional VCs 2. Raising Capital • Prepare a strong pitch deck and clear financials • Build relationships with investors before asking for funding 3. VC Deal Structure • Understand terms like equity, convertible notes, and preferred shares • Know the importance of valuation, dilution, and liquidation preferences 4. Negotiating with VCs • Focus on favorable terms, not just valuation. • Be aware of founder control and voting rights 5. Managing Investor Relations • Keep communication open with investors. • Regular updates build trust and long-term relationships 6. The Due Diligence Process • Be ready to show solid data on market opportunity, team, and business model • Due diligence can make or break deals 7. Exit Strategies • Understand potential exits like acquisitions or IPOs • Plan exit routes early with investors to align goals 8. Common Pitfalls • Avoid over-reliance on VC money and maintain focus on profitability • Don’t ignore legal aspects like IP protection and contracts 9. Sourcing Investors • Identify the right type of investors based on your business stage (seed, Series A, etc.). • Network strategically to get warm introductions to VCs 10. Cap Tables • Understand the cap table (capitalization table) and how it affects ownership stakes • Monitor equity dilution through multiple funding rounds 11. Building Leverage • Create competitive tension by engaging multiple investors simultaneously • Don’t settle for the first offer—leverage interest from various VCs to negotiate better terms 12. Term Sheets • Study term sheets carefully to understand rights and obligations, including board seats, anti-dilution clauses, and vesting schedules • Recognize the difference between "friendly" and "investor-favorable" terms 13. VC Value Beyond Money • Choose VCs who can provide value beyond funding—mentorship, industry connections, and strategic advice • Look for investors who have experience in your market or domain 14. Fundraising Timing • Time your fundraising efforts based on market conditions and your company’s milestones • Avoid raising capital during downturns unless absolutely necessary 15. Building a Scalable Business • Focus on creating scalable business models that can attract larger investments • VCs seek companies with high growth potential, not just steady profits 16. Investor Alignment Ensure alignment between your vision and your investors’ expectations. Misaligned goals between founders and investors can lead to conflicts, especially during tough times. 🔗 You can download the whole book from comment section and read freely 🔗

Replies (6)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 10m

Raising VC Money? Tips No One Tells You : 1) Don’t Chase VCs, Attract Them - Build something so good they can’t ignore you. 2) Traction > Decks - Fancy pitch decks don’t matter if your numbers don’t add up. 3) Investors Follow Other Investors - G

See MoreMehul Fanawala

•

The Clueless Company • 1y

Is it better to bootstrap or seek VC funding for your startup? The endless debate: Bootstrap vs. VC funding. - Bootstrapping builds resilience and deep customer focus. You prioritize solving real problems over chasing valuations. - VC funding can

See MoreVivek Joshi

Director & CEO @ Exc... • 9m

For early-stage startups, generating revenue and driving growth trump chasing venture capital (VC) funding. In 2023-2025, VC funding trends underscore this shift. Global VC investment plummeted from $381B in 2022 to $221B in 2023, with 2024 seeing on

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

Venture Capital (VC) is a vital funding source for high-growth startups, typically those too risky for traditional bank loans. VCs pool capital from Limited Partners (LPs) to invest in promising early-stage companies with significant scaling potentia

See More

Thakur Ambuj Singh

Entrepreneur & Creat... • 11m

VCs don’t always invest in profitable startups—because not every great business fits the venture model. But that doesn’t mean your startup can’t thrive! Explore alternative funding options and scale on your terms. #StartupFunding #VCReality #BuildSma

See More

Manik Gruver

•

Macwise Capital • 8m

You spend months understanding your customer's pain, but VCs skip your problem slide in 30 seconds for XYZ reasons. Since VCs rush through problem statements, how can founders ensure that VCs understand the depth of problem? #39 # Started #VC #Fundr

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)